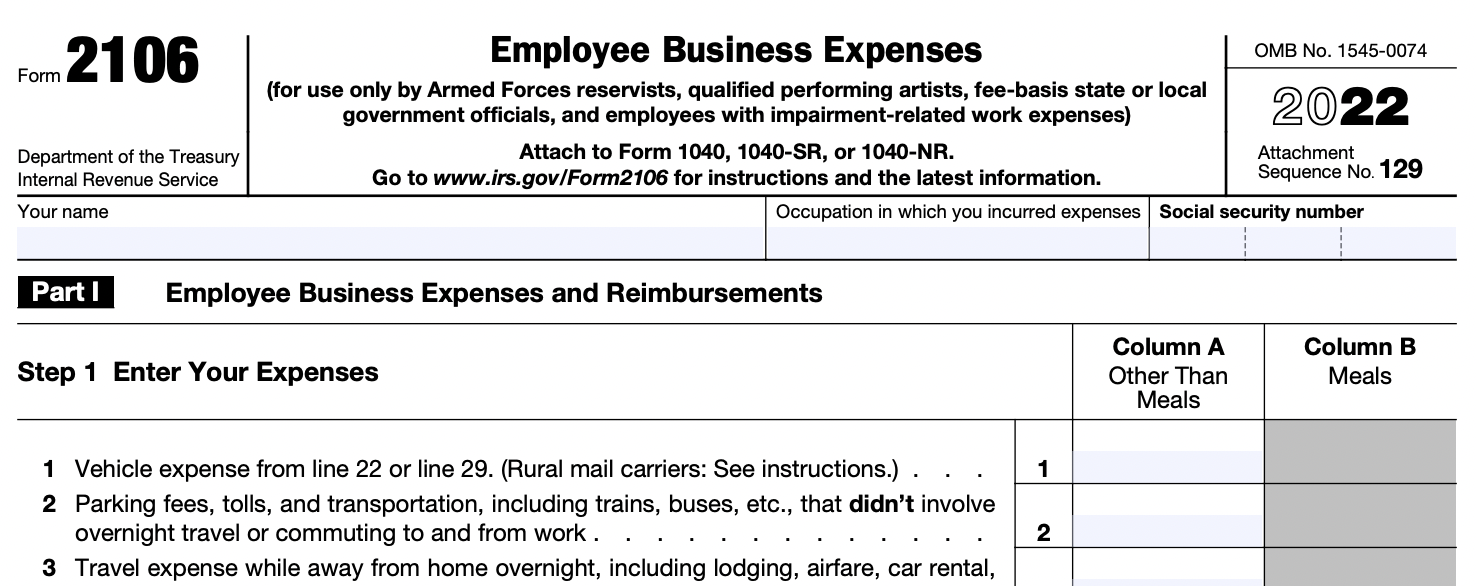

What is Form 2106?

Form 2106, Employee Business Expenses, is a tax form used by taxpayers who are claiming work-related expenses as an itemized deduction on their federal income tax return. The expenses claimed must be related to a taxpayer's job, the taxpayer must be an employee (not a contractor), and they must be expenses that have not been reimbursed by their employer.

Form 2106 is used to calculate the amount of allowable expenses that can be claimed on Schedule A (Form 1040), which is used to calculate a taxpayer’s itemized deductions. Expenses that can be claimed on Form 2106 can include travel, meals, entertainment, transportation, and other job-related expenses.

The amount of expenses that can be claimed on Form 2106 is subject to certain limitations and restrictions, and taxpayers should consult the Form 2106 instructions and/or a tax professional to ensure that they are claiming the correct maximum amount of allowable expenses.

Who needs to file Form 2106?

Taxpayers who incurred work-related expenses that were not reimbursed by their employer may want to consider filing Form 2106. However, not all taxpayers are eligible to claim these expenses, and those who are eligible may be subject to certain limitations and restrictions.

Here are some specific details about who may need to file Form 2106:

-

Eligibility: To be eligible to claim work-related expenses, the expenses must be both ordinary and necessary for the taxpayer's job, and the taxpayer must not have been reimbursed by their employer for the expenses. Additionally, the expenses must be directly related to the taxpayer's job and must be incurred in the course of performing their job.

-

Itemizing deductions: Taxpayers who choose to itemize their deductions on Schedule A (Form 1040) should consider using Form 2106 to calculate the amount of allowable employee expenses they can deduct. Work-related expenses are one of several categories of expenses that can be itemized on Schedule A, and taxpayers should only claim their itemized deductions if they exceed the standard deduction amount for their filing status and tax year.

-

Types of expenses: The types of expenses that can be claimed on Form 2106 include vehicle expenses, travel, meals, entertainment, transportation, and other job-related expenses. However, not all expenses are fully deductible, and some expenses may be subject to limitations and restrictions.

-

Employer reimbursement: If the taxpayer's employer reimbursed them for any portion of the expenses claimed on Form 2106, then that portion of the expenses cannot be claimed as a deduction. If the employer only partially reimbursed the taxpayer, the taxpayer may be able to deduct the remaining expenses on Form 2106.

Who is not required to file Form 2106?

Taxpayers who do not incur work-related expenses, or who choose to claim the standard deduction instead of itemizing their deductions, are not required to file Form 2106.

Specifically, taxpayers who have no work-related expenses to claim, or whose work-related expenses were fully reimbursed by their employer, do not need to file Form 2106. Additionally, taxpayers who claim the standard deduction (instead of itemizing their deductions) cannot claim work-related expenses on Form 2106, as the IRS only allows either the itemized or standard deduction, but not both.

Certain types of employees may be subject to limitations or restrictions on the amount of work-related expenses that can be claimed on Form 2106. For example, employees who are subject to the "50% limitation" on meals and entertainment expenses may only be able to claim a portion of their total M&E expenses on Form 2106. Additionally, some expenses may be subject to other restrictions or phase-outs based on the taxpayer's income or other factors.

When is the deadline for Form 2106?

Form 2106 is generally filed along with the taxpayer's Form 1040 federal individual income tax return for the tax year in question. The deadline for filing Form 2106 can depend on the taxpayer's individual tax situation, but Form 1040 generally must be filed by the 15th day of the 4th month after the tax year in question (usually April 15th).

For most taxpayers, the deadline for filing federal income tax returns is April 15th of the year following the tax year in question. However, in some years, the deadline may be later due to weekends or holidays. Additionally, taxpayers who request an extension of time to file their federal income tax return will have a later deadline for filing Form 2106.

It is important to note that if a taxpayer fails to file Form 2106 (or their federal income tax return) by the deadline, they may be subject to late filing and/or late payment penalties and interest.

Taxpayers should consult the instructions for Form 2106 and/or a tax professional to determine the specific deadline for filing their Form 2106 and federal income tax return based on their individual tax situation.

Can the deadline for Form 2106 be extended?

Yes, the deadline for filing Form 2106 can be extended if the taxpayer is granted an extension of time to file their federal income tax return.

Taxpayers can request an automatic extension of time to file their federal income tax return by submitting Form 4868, "Application for Automatic Extension of Time To File U.S. Individual Income Tax Return". If the extension is granted, the taxpayer will have an additional six months from the original due date to file their federal income tax return and any associated forms, including Form 2106.

It's important to note, however, that an extension of time to file does not extend the deadline for paying any tax owed. Taxpayers who owe taxes for the tax year in question should estimate the amount owed and pay it by the original filing deadline to avoid late-payment penalties and interest.

If a taxpayer is granted an extension of time to file their federal income tax return, they should use the additional time to carefully review and prepare their Form 1040, Form 2106, and any other associated forms to ensure that they are filing an accurate and complete return.

What is the penalty for late filing of Form 2106?

The penalty for late filing of Form 2106 is built into the penalty for the late filing of the federal income tax return. The penalty is calculated based on the amount of tax owed and the number of days the return is late.

The penalty for filing a late return is generally 5% of the amount of tax owed for each month or part of a month that the return is late, up to a maximum penalty of 25% of the tax owed. If the return is more than 60 days late, the minimum penalty is the smaller of $435 or 100% of the tax owed.

It's important to note that the penalty for late filing can be significant, even if the taxpayer doesn't owe any tax. For this reason, it's important to file Form 2106 and the federal income tax return by the deadline or to request an extension of time to file if needed.

If a taxpayer has a reasonable explanation for the late filing, such as a medical emergency or natural disaster, they may be able to request relief from the penalty. However, relief from the penalty is not guaranteed and is subject to the discretion of the IRS.

What happens if I don't file Form 2106?

If you are required to file Form 2106 and you don't file it, you may be subject to penalties and interest. The specific penalties and interest will depend on the facts and circumstances of your situation, including the amount of tax owed and the length of time that the return remains unfiled.

If you are required to file Form 2106 and you don't file it, the following consequences may apply:

-

Late filing penalty: If you don't file Form 1040 and the accompanying Form 2106 by the due date, you may be subject to a late filing penalty. The penalty is 5% of the amount of tax owed for each month or part of a month that the return is late, up to a maximum of 25% of the tax owed. If the return is more than 60 days late, the minimum penalty is the smaller of $435 or 100% of the tax owed. These amounts are subject to annual change by the IRS, so be sure to check the IRS’s website for the most recent amounts.

-

Late payment penalty: If you don't file Form 1040 and Form 2106, and you owe tax, you may be subject to interest on the unpaid tax. This penalty is in addition to the failure to file penalty, mentioned above. The interest rate is set by the IRS and is compounded daily.

-

Missed tax deductions: If you don't file Form 2106, you may be missing out on potential tax deductions. Form 2106 is used to report employee business expenses, such as travel, meals, and entertainment, that may be deductible on your tax return. If you don't file the form, you may not be able to claim these deductions and may end up owing more in taxes than necessary.

-

Audits and investigations: If you don't file Form 2106, you may increase your chances of being audited by the IRS. Failure to file required forms can be a red flag for the IRS, and may result in further scrutiny of your tax return.

What supporting documents do I need to file with Form 2106?

To complete Form 2106, you will need to provide certain supporting documents that substantiate the employee business expenses you are claiming. The types of supporting documents you will need to provide may include:

-

Receipts: You will need to provide receipts for any expenses you are claiming that are $75 or more. The receipts should show the date of the expense, the amount paid, and the name and location of the business.

-

Mileage logs: If you are claiming a deduction for business mileage, you will need to provide a mileage log that shows the date, starting point, destination, and purpose of each trip, as well as the number of miles driven.

-

Travel itinerary: If you are claiming expenses for business travel, you will need to provide a travel itinerary that shows the dates of your trip, the locations you visited, and the business or work purpose of the trip.

-

Credit card statements: If you paid for expenses with a credit card and you do not have receipts, you will need to provide the credit card statements that show the date of the expense, the amount paid, and the name and location of the business.

-

Canceled checks/check copies: If you paid for expenses with a check, you will need to provide the canceled checks, check copies, and/or bank statements that show the date of the expense, the amount paid, and the name and location of the business.

It's important to keep accurate records of your business expenses and to retain your supporting documents in case of an audit.

How do I file Form 2106?

To file Form 2106, you will need to follow these steps:

-

Gather your records: Collect all the documents you need to support your employee business expenses. These may include receipts, mileage logs, credit card statements, canceled checks, and other records.

-

Complete Form 2106: Use the instructions for Form 2106 to complete the form. You will need to enter your personal information, such as your name and social security number, and provide details about your employee business expenses.

-

Calculate your deduction: Once you have completed Form 2106, you will need to calculate your total deduction. The deduction is the total amount of your employee business expenses minus any reimbursement you received from your employer. This amount will generally be calculated for you by your tax filing software or your tax professional.

-

Transfer the deduction to your tax return: Transfer the deduction amount to the appropriate line on your tax return. If you are filing Form 1040, the deduction will be carried to line 12 of Schedule 1. This will generally be done for you by your tax filing software or your tax professional.

-

Retain your records: Keep a copy of Form 2106 and all the supporting documents for your records in case of an audit.

-

File your tax return: File your tax return by the appropriate deadline. If you are filing electronically, you can submit Form 2106 along with your tax return. If you are filing a paper return, attach Form 2106 to your return.

The process of filing Form 2106 may vary depending on your individual tax situation. If you have any questions or concerns, it's recommended to consult a tax professional for guidance.

If you need to produce pay stubs for tax filing purposes, you can check out the paystub generator. There are dozens of printable paystub templates available.

Where should I mail Form 2106 to?

The mailing address for Form 2106 depends on your state of residence and whether you are enclosing a payment with your form. Form 2106 should be mailed to the appropriate Internal Revenue Service (IRS) processing center, along with your tax return. Here are the various IRS processing centers as of January 2023:

| If you live in... | And you are not enclosing a payment, use this address | and you are enclosing a payment, use this address |

| Arkansas ,Connecticut, Delaware, District of Columbia, Illinois, Indiana, Iowa, Kentucky, Maine, Maryland, Massachusetts, Minnesota, Missouri, New Hampshire, New Jersey, New York, Oklahoma, Rhode Island, Vermont, Virginia, West Virginia, Wisconsin | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0002 | Internal Revenue Service P.O. Box 931000 Louisville, KY 40293-1000 |

| Pennsylvania | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0002 | Internal Revenue Service P. O. Box 802501 Cincinnati, OH 45280-2501 |

| Florida, Louisiana, Mississippi, Texas | Department of the Treasury Internal Revenue Service Austin, TX 73301-0002 | Internal Revenue Service P.O. Box 1214 Charlotte, NC 28201-1214 |

| Alabama, Georgia, North Carolina, South Carolina, Tennessee | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0002 | Internal Revenue Service P O Box 1214, Charlotte, NC 28201-1214 |

| Arizona, New Mexico

| Department of the Treasury Internal Revenue Service Austin, TX 73301-0002 | Internal Revenue Service P.O. Box 802501, Cincinnati, OH 45280-2501 |

| Alaska, California, Colorado, Hawaii, Idaho, Kansas, Michigan, Montana, Nebraska, Nevada, Ohio, Oregon, North Dakota, South Dakota, Utah, Washington, Wyoming | Department of the Treasury Internal Revenue Service Ogden, UT 84201-0002 | Internal Revenue Service P.O. Box 80250, Cincinnati, OH 45280-2501 |

Always be sure to check the IRS website for the most recent and updated mailing addresses and any special instructions regarding mailing your return. It's also important to note that if you owe taxes and you're mailing your return, you should send your payment (via check, not cash) along with your tax return to the appropriate address.

If you are enclosing a payment with your form, the address to which you should mail your form may be different. Be sure to check the Form 1040 instructions carefully to ensure that you are sending your form to the correct address.

If you are filing your tax return electronically, you do not need to mail a paper copy of your tax return or Form 2106 to the IRS.

Can I file Form 2106 electronically?

The ability to file Form 2106 electronically may depend on the tax software you are using and the tax year for which you are filing. However, the IRS generally allows taxpayers to file Form 2106 electronically as part of their individual income tax return (form 1040).

If you are filing your tax return electronically, you can attach Form 2106 to your return using tax preparation software that supports this feature. The tax software will guide you through the process of completing and attaching Form 2106 to your tax return.

If you are using a tax preparer to file your tax return electronically, they can also include Form 2106 as part of your return. Your tax preparer will need to enter the information from your records into their software program and attach the completed form to your electronic return.