We've Helped Customers Create Their 1040 Schedule C Form Using Our Generator

What Is A Form 1040 Schedule C?

Schedule C, Profit or Loss From Business, of the Form 1040, U.S. Individual Income Tax Return, is an IRS form that is used by business owners to report income or loss from the business. You should use Schedule C if you operate a business as a sole proprietor or a single-member Limited Liability Company (LLC).

Does My Activity Qualify As a Business?

Your activity qualifies as a business for the purposes of filing a Schedule C if:

-

You engage in the activity for income or profit.

-

You are involved in the activity regularly.

Alternatively, the IRS defines a hobby as an activity that you are engaged in for sport or recreation, rather than to make a profit. Here is some additional IRS guidance to consider when labeling your activity for tax purposes.

If you need to give pay stubs to your employees as proof of their income, you can rely on the check stub maker. This site has plenty of paystubs templates that will suit your preferences.

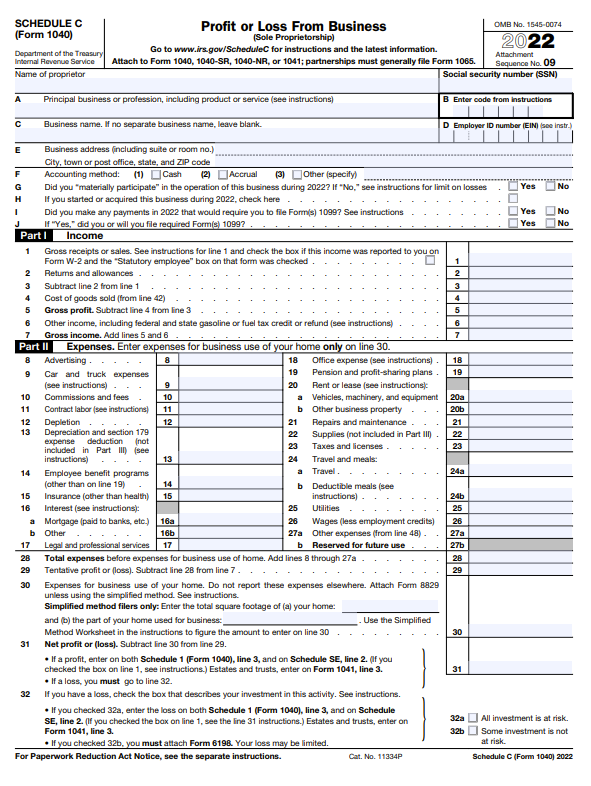

What Does a Schedule C 1040 Form Look Like?

A Schedule C has five main parts to it. Part one is for your business’s income. Part two is for its expenses. Part three is the cost of goods sold. Part four is for information on your business vehicle. You only need to complete part four if you have claimed car or truck expenses in the second part. Part five is for additional expenses not listed in part two.

When Is Form 1040 Schedule C Due?

If you are a sole proprietor or you manage a single-member LLC, you should file Schedule C when you file your personal tax return, Form 1040. The due date for Form 1040 is typically April 15. If the due date falls on a holiday or weekend in a given year, the date is pushed to the next business day.

How Do I File Form 1040 Schedule C?

Schedule C is one of many supplemental forms to your personal tax return, Form 1040. The easiest option is to file your Schedule C with your Form 1040 online. You can access Form 1040 Schedule C, here on ThePayStubs or on the IRS website. You can file your Form 1040 Schedule C online using the IRS e-file options:

-

IRS Free File or fillable forms– if your adjusted gross income is $73,000 or less

-

Free tax return preparation site– Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) if you qualify

-

Authorized e-file providers– CPAs, EAs, and other tax preparers who are approved to prepare, transmit, and process e-filed returns

-

Commercial tax preparation software– you can do it yourself from home

The IRS highly recommends you file online because it is secure and the processing is much faster. You can usually expect to receive a tax refund within 3 weeks of filing online. However, if you choose to mail in your Form 1040, and any supplemental schedules like the Schedule C, you can expect a delay of 6 to 8 weeks to process your tax return. Depending on your state, the address where you need to mail your Form 1040 and Schedule C differs. Here is a list of states and mailing addresses published by the IRS.

How To Fill Out A Form 1040 Schedule C

To fill out your Schedule C, you need to gather all of your business sales documents and receipts for the year. Keep detailed documentation throughout the year to make tax time easier.

Identifying Information About Your Business

The top section of the Schedule C asks for identifying details about your business. You will need to enter your name, social security number (SSN), a description of your business, your business name, your business address, its employer identification number (EIN), and the six-digit code that most closely describes your type of activity from the Principal Business or Professional Activity Codes.

You may not have a separate business name or employer identification number if you operate under your own name. In that case, you can leave those boxes blank. Everyone must fill out the Principal Business or Professional Activity Codes. Be aware, if your principal source of income is from farming or fishing activities, you should file Schedule F, Profit or Loss From Farming, instead.

Cash Or Accrual Method

Next, you must specify whether you use the cash or accrual method of accounting for your taxes. Under the cash method of accounting, you report income in the year you receive a payment and expense in the year you make a payment. Under the accrual method of accounting, you report income when you earn it and deduct expenses when you incur them, regardless of when the payment is made. The method you choose can make a significant difference if you make or receive many payments on credit. Generally, most sole proprietors work on a cash method because it is easier to track.

Yes Or No Questions

The following informational boxes are questions that require “yes” or “no” responses. Did you “materially participate in the operation of this business during the year? This question is used to determine if your activity is a passive activity or not. There is a limit on losses from passive activities. Additionally, there may be a limit on losses related to rental activity, even if you did materially participate in the activity. Here, the IRS provides a list of seven tests to determine if your participation in an activity is material.

If you started or acquired the business during the year, check the “yes” box on line H.

Did you make any payments in the year that would require you to file Form(s) 1099? If “yes,” did you or will you file required Form(s) 1099? These questions refer to any payments you made during the year that require you to file Form(s) 1099– information returns that provide details to the IRS relating to payments that other taxpayers will have to report as income on their tax returns. You do not owe taxes when you file an information return. The most common 1099 for a small business is the Form 1099-NEC, Nonemployee Compensation. You would issue a Form 1099-NEC to any independent contractors whom you paid more than $600 in total through the year. Most Form(s) 1099 are due to the recipient(s) by January 31 and the IRS by February 28, if mailed, or March 31, if filed online.

Part I: Income

Part one asks about your business’s income for the year. Similar to how you may have to file information returns for other taxpayers, other businesses may be required to report information to the IRS for amounts that you received as income related to your business activities.You may receive Form(s) 1099 from multiple sources, so be sure to include all income related to your business from all sources.

Line 1 is where you enter your gross receipts from sales. If the income you enter on line 1 was reported to you on Form W-2, Wage and Tax Statement and the “statutory employee” box was checked on that form, you should check the box on line 1 of Schedule C, as well. You do not owe self-employment taxes on statutory employee wages because your employer should have withheld taxes from your earnings.

Line 2 is where you enter any sales returns or allowances. Sales returns are cash or credit refunds given to customers who returned defective, damaged, or otherwise unwanted products. Sales allowances are a reduction in the sales price of a product. Line 3 subtracts your sales returns and allowances from line 2 from gross receipts and sales in line 1. Line 4 is copied from line 42 where your cost of goods sold is calculated. Line 5 is your gross profit– line 3 minus cost of goods sold from line 4.

Line 6 is where you enter income not otherwise reported in part one. Amounts you should enter on line 6 include:

-

Finance reserve income

-

Scrap sales

-

Bad debts you recovered during the year

-

Interest received

-

Credits for green energy

-

Other taxable tax credits

-

Prizes or awards given to your business

Line 7 adds gross profit from line 5 and other income from line 6 to calculate your gross income from business activities.

Part II: Expenses

The second part of Schedule C is for your business related expenses. Lines 8 through 27b list specific expenses you may or may not have incurred related to your business. If you did, you can enter the dollar amount in the box next to the description. Be sure to keep detailed receipts of any expenses you claim in part two.

-

8 - Advertising

-

9 - Car and truck expenses

-

10 - Commission and fees

-

11 - Contract labor

-

12 - Depletion

-

13 - Depreciation and section 179 expense deduction (not included in Part III)

-

14 - Employee benefit programs (other than on line 19)

-

15 - Insurance (other than health)

-

16a - Mortgage Interest

-

16b - Other Interest

-

17 - Legal and professional services

-

18 - Office expense

-

19 - Pension and profit-sharing plans

-

20a - Rent or lease of vehicles, machinery, and equipment

-

20b - Rent or lease of other business property

-

21 - Repairs and maintenance

-

22 - Supplies (not included in Part III)

-

23 - Taxes and licenses

-

24a - Travel

-

24b - Deductible meals (may only be 50% deductible)

-

25 - Utilities

-

26 - Wages (less employment credits)

-

27a - Other expenses

Line 28 is the sum of all the above expenses. This is for all expenses other than business use of home expenses. Line 29 is your tentative profit, calculated by subtracting line 28 expenses from your line 7 gross profit.

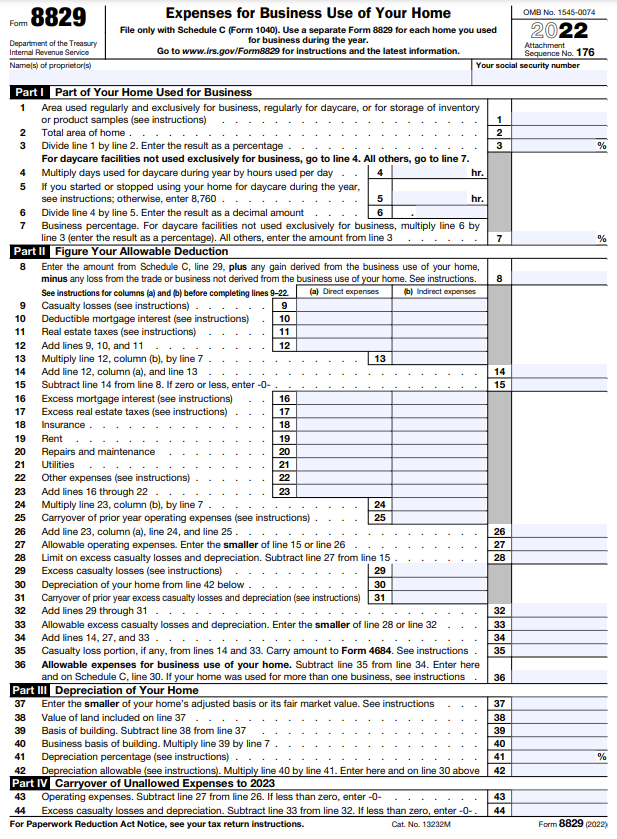

Line 30 is for expenses related to the business use of your home. You must attach Form 8829, Expenses for Business Use of Your Home, unless you are using the simplified method.

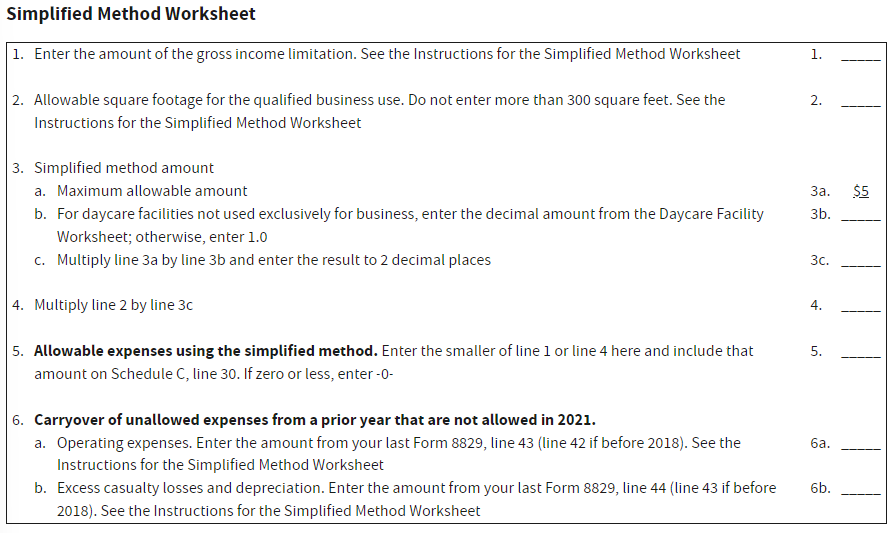

The simplified method is an alternative to tracking your actual home expenses and allocating the expenses between personal and business use. Under the simplified method, you figure your deduction by multiplying the area of your home used regularly and exclusively for business by $5. The area is measured by square footage– up to a maximum of 300 square feet. You can complete the Simplified Method Worksheet in the instructions to Schedule C to calculate your deduction. If you choose this method, line 30 of Schedule C asks for the total square footage of your home and the part of your home used for business.

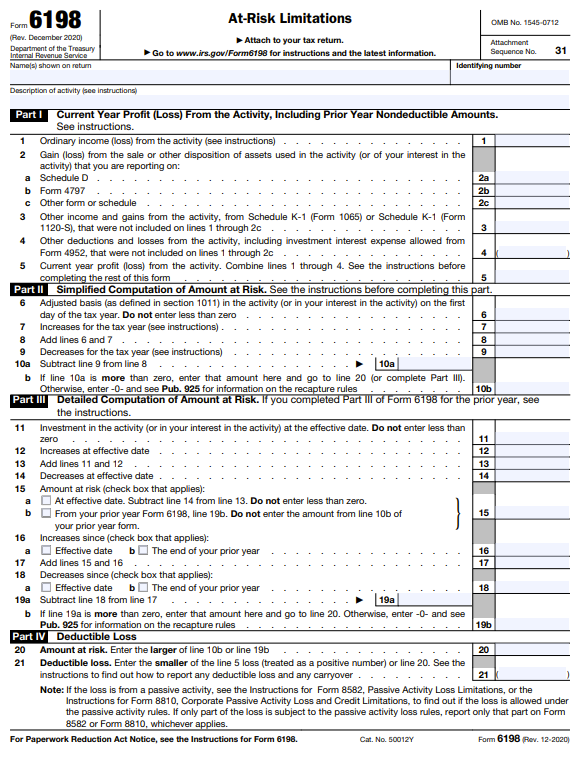

Line 31 is calculated by subtracting business use of home expenses on line 30 from tentative profit or loss on line 29. If you have a profit, enter the amount from line 31 on both Schedule 1, Additional Income and Adjustments to Income, and Schedule SE, Self-Employment Tax. If you have a loss, you should check the box in 32a if all of your investment in the business is at risk or 32b if only some of your investment is at risk. If you checked 32a, you should record the loss on Schedule 1 and Schedule SE. If you checked 32b, you must attach Form 6198, At-Risk Limitations, as some of your loss may be limited.

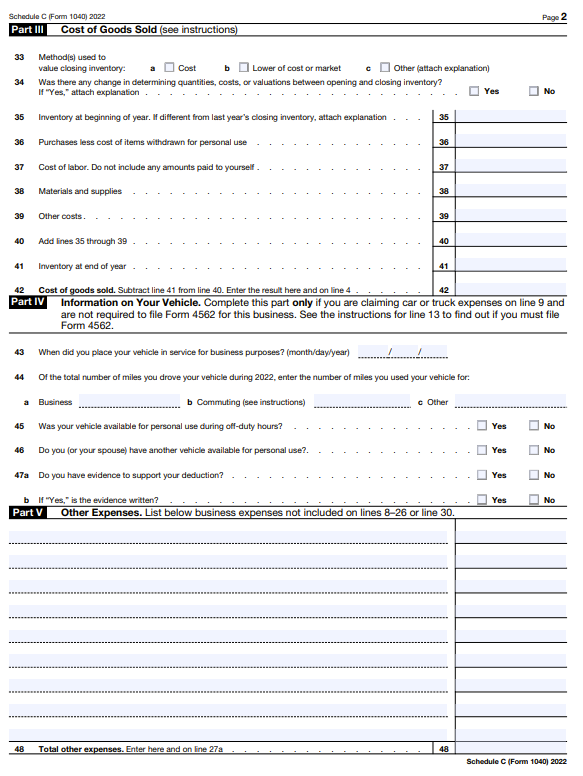

Part III: Cost of Goods Sold

Part three reports on your cost of goods sold– the amount you paid to acquire or produce the goods you sold. Line 33 asks for your method to value closing inventory. You can check the box for:

-

A - Cost

-

B - Lower of Cost or Market

-

C - Other (Attach Explanation)

If there was a change in the method you used to determine quantities, costs, or valuations between opening and closing inventory, check the “yes” box in line 34 and attach an explanation. Otherwise check “no.”

Line 35 is for your inventory at the beginning of the year. Line 36 is where you add your purchases from the current year. Line 37 is for the cost of labor to produce your goods. Line 38 is for materials and supplies, and line 39 is for other costs directly related to the production of your goods. Enter the sum of lines 35 through 39 into line 40. Line 41 is where you enter your inventory at the end of the year. Your cost of goods sold for the year is calculated by subtracting your inventory at the end of the year on line 41 from the sum that was entered in line 40.

Part IV: Information on Your Vehicle

If you claim a car or truck expense related to your business and are not required to file Form 4562, Depreciation and Amortization, you should complete part four of Schedule C. Line 43 asks for the date in which you placed the vehicle in service for business purposes. Line 44 asks for the total mileage you drove the vehicle for business, commuting, and other purposes. Lines 45 through 47b are yes or no questions that provide validity to the business use of your vehicle.

-

45 - Was your vehicle available for personal use during off-duty hours?

-

46 - Do you (or your spouse) have another vehicle available for personal use?

-

47a - Do you have evidence to support your deduction?

-

47b - If yes, is the evidence written?

Part V: Other Expenses

Part five is where you list business expenses that are not otherwise included in lines 8 through 26 or line 30. The sum from this list will be entered on line 27a.