We've Helped Customers Create Their 944 Form Using Our Generator

What Is Form 944?

Form 944, Employer’s Annual Federal Tax Return, is used by small employers to file and pay taxes once a year rather than the more common frequency, every quarter. Your small business may qualify if your total annual liability for social security, Medicare, and withheld federal income taxes is $1,000 or less.

Federal tax law requires that employers withhold and pay taxes on behalf of their employees. These taxes include federal income tax, social security tax, and Medicare tax– referred to collectively as employment taxes. When you withhold and pay taxes on behalf of your employees, the amount is credited against their tax liability in their individual tax accounts with the Internal Revenue Service (IRS).

Federal tax law also requires employers to pay the employer share of social security and Medicare taxes. The employer share is not withheld from employees’ paychecks, but is rather paid directly by the employer.

Do I Need To File Form 944?

You must file annual Form 944 instead of quarterly Forms 941, 941-SS, or 941-PR if the IRS has notified you in writing to file Form 944, even if your tax liability for the year exceeds $1,000 Once your tax liability exceeds this amount, the IRS will notify you that you are no longer eligible to file Form 944 in future years. However, until you receive this notice from the IRS, continue to file Form 944 annually.

Can I Request To File Form 944?

If you haven’t received the notice to file Form 944 for the year, but your employment tax liability is $1,000 or less and you would like to file Form 944, you can contact the IRS to request to file Form 944. The IRS phone number to call is 800-829-4933 (or 267-941-1000 if you’re outside the United States). You must call between January 1 and April 1 of the year in which you’re hoping to file Form 944 or send a written request that is postmarked between January 1 and March 15. If you don’t receive a written notice back from the IRS confirming your request to change to Form 944, you should still file the quarterly Forms 941, 941-SS, or 941-PR for the year.

Can I Request To File Form 941?

Similarly, if you want to file the quarterly Forms 941, 941-SS, or 941-PR, and you have been informed you are required to file Form 944, you will need to contact the IRS to request to file the quarterly forms. You can use the same phone number from above or send a written request to:

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0038

Or

Department of Treasury

Internal Revenue Service

Cincinnati, OH 45999-0038

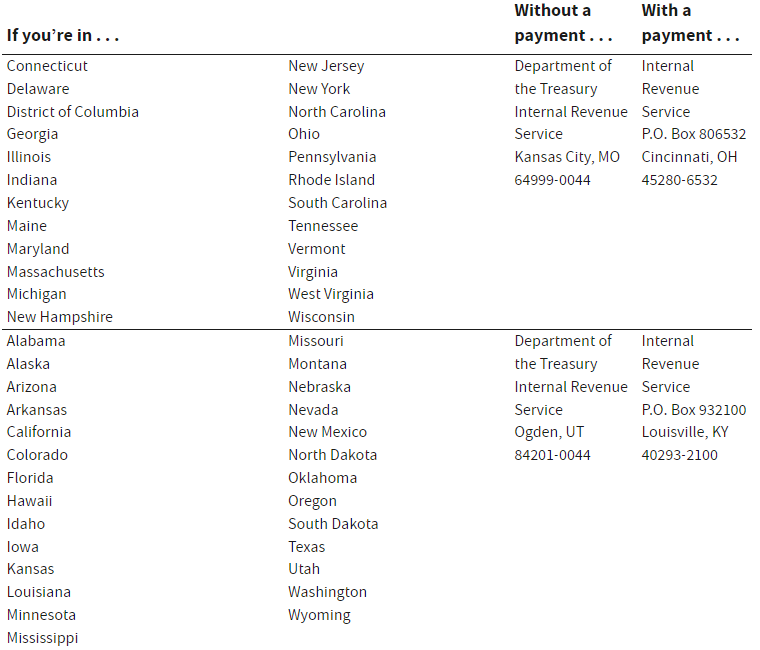

If your return without a payment is due to the Ogden address, mail your request to Ogden. If your return without a payment is due to the Kansas City address, mail your request to Cincinnati. After your request has been made, the IRS will inform you in writing whether your request was approved to file the other form.

What Is Form 944 Used For And When Must It Be Filed?

Form 944 is used by small employers to report their annual employment tax obligations to the Internal Revenue Service. The form is due once a year, by January 31 of the year following the calendar year in question. If you made timely deposits of all your tax payments, you have an additional 10 calendar days to file Form 944.

Where Do I File Form 944?

You can file online or mail in Form 944. The IRS highly encourages you to file online.

Where To Mail Form 944

If you mail in Form 944, where you file depends on whether you include a payment with the form and the state in which your business is located.

How To File Form 944 Online

The IRS recommends you file Form 944 online. It is secure, saves you time, and you will receive acknowledgment for your submission within 24 hours. If you want to submit the form yourself, you must have an IRS approved software. There is a list of IRS approved software providers, here. Otherwise, you could have a tax professional file Form 944 for you. A list of IRS approved e-file providers is found here.

Do I Need To Make A Payment With My Form 944?

You can make a tax payment with your Form 944 only if one of the following applies:

- Your net employment taxes for the year are less than $2,500 and you are filing your Form 944 timely.

- Your net employment taxes for the year are $2,500 or more and you already deposited the taxes you owed for the first, second, and third quarters; the fourth quarter taxes you owe are less than $2,500; and you are filing your Form 944 timely.

- You are a monthly depositor making a payment in accordance with the Accuracy of Deposits Rule– the only case where you can make a payment with Form 944 that is greater than $2,500.

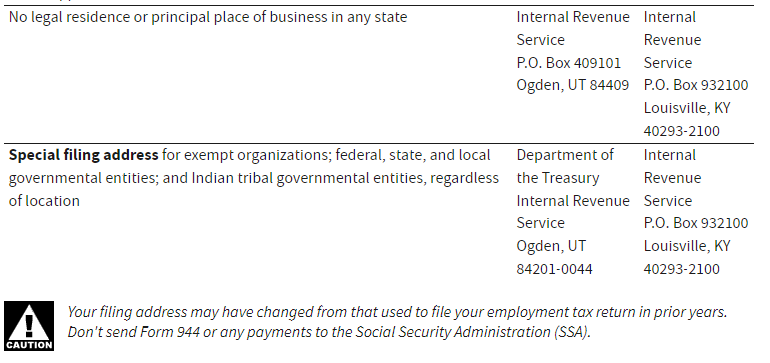

If you are eligible to make a payment with your Form 944 due to one of the three situations above, you can use Form 944-V, Payment Voucher. Otherwise, you must make federal tax deposits by electronic fund transfers (EFT).

How Do I Make Federal Tax Deposits?

Federal tax deposits must be made via EFT. You can either use the Electronic Federal Tax Payment System (EFTPS) or arrange for your tax professional or financial institution to make electronic deposits on your behalf. The Department of Treasury provides the EFTPS free of charge.

When Do I Make Federal Tax Deposits?

Federal tax deposits are due by 8PM Eastern time the day before the deposit due date. If you fail to make the payment by that time, you can initiate a same-day wire transfer. You will have to arrange the payment with your financial institution, and fees may apply.

If the payment is due on a day that is not a business day– such as a weekend or legal holiday– it will be deemed to have been paid timely if it is made by the close of the next business day.

How Do I Avoid Penalties and Interest?

You can avoid penalties and interest by depositing your taxes when they are due, filing your Form 944 on time, and accurately reporting all details on tax forms furnished to the IRS and your employees. Penalties and interest charges arise from both filing your 944 late or paying your employment tax deposits late.

What Documents Do I Need To Complete Form 944?

To complete a Form 944, you’ll need several details out of your business’s payroll system. You’ll have to know the total wages you have paid throughout the calendar year, tips reported to you by employees, federal income tax withheld from all employees’ paychecks, and employer and employee shares of social security and Medicare taxes. You’ll also need basic information about your business such as the EIN and legal name.

Should you need to create paystubs for your employees, be sure to check out the online paystub maker. There are dozens of paystub templates for you to choose from.

What Is Reported On Form 944?

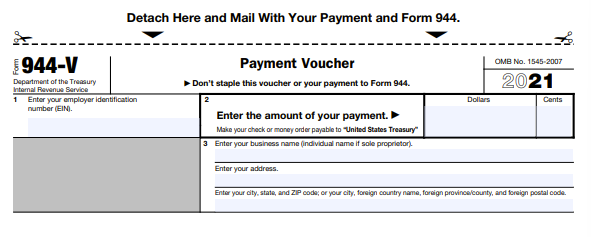

There is an information box in the top left corner of Form 944 that helps the IRS identify your business. For the IRS to accept the form, you must complete the information box, all three pages of the form, and sign on page 3. Failure to complete all the steps will result in processing delays.

Information Box

The top section of the Form 944 is where you will enter your employer identification number (EIN), name, trade name, and address. Name is the legal business name, while a trade name is your “doing business as” (DBA) name, if any.

Part 1: Answer these questions for this year.

You can use the information from your payroll software to answer questions in part one. Line 1 asks for your business’s wages, tips, and other compensation. Line 2 is where you’ll enter the federal income tax withheld from wages, tips, and other compensation. If you have no wages, tips, or compensation that are subject to social security and Medicare tax, check the box in line 3 and skip to line 5. If you do have wages subject to social security and Medicare tax, you will need to enter the wages for each type in Column 1 and multiply by the applicable rate to calculate the tax in Column 2 of these lines:

- 4a Taxable Social Security Wages

- 4a(i) Qualified Sick Leave Wages

- 4a(ii) Qualified Family Leave Wages

- 4b Taxable Social Security Tips

- 4c Taxable Medicare Wages & Tips

- 4d Taxable Wages & Tips Subject to Additional Medicare Tax Withholding

Line 4e is the sum of all the social security and Medicare taxes in the second column. Line 5 is your total taxes before adjustments. It adds the income taxes withheld from line 2 and the social security and Medicare taxes from line 4e. Line 6 is for current year adjustments, and line 7 is the total taxes after removing those adjustments.

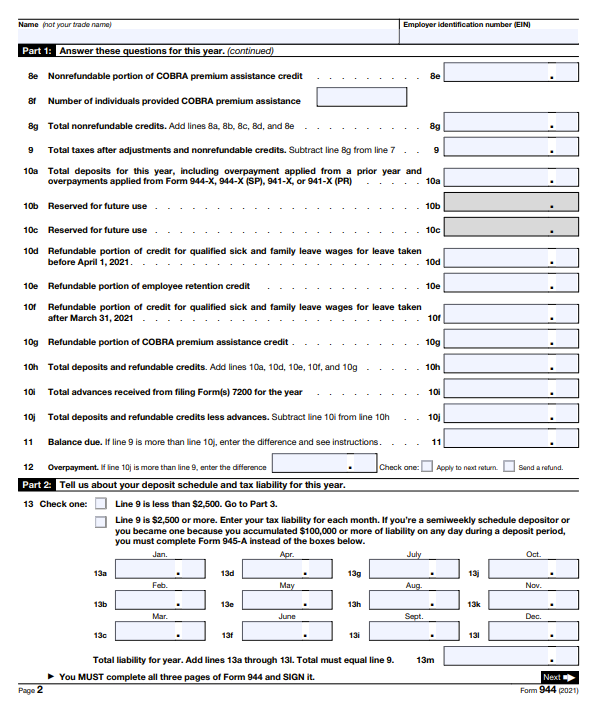

Line 8a is where you enter your qualified small business payroll tax credit for increasing research activities. The tax credit can be used to offset the employer portion of the social security tax. Other current nonrefundable tax credits are listed in lines 8b to 8f, and lines 8a to 8f are added together for the total nonrefundable credits in line 8g. Line 9 subtracts line 8g from line 7 to arrive at the total taxes after adjustments and nonrefundable credits.

Enter your business’s total deposits for this year, including overpayments applied from a prior year or Forms 944-X, 944-X(SP), 941-X, or 941-X(PR) in line 10a. Lines 10b through 10g are for refundable tax credits. Line 10h is the total of deposits from line 10a and all refundable credits in lines 10b through 10g. Enter your total advances received from filing Form(s) 7200 for the year in line 10i. Line 10j is the total deposits and refundable credits less advances.

If line 9 is greater than line 10j, you have a balance due to the IRS and the amount will be entered in line 11. If line 10j is more than line 9, you have overpaid your taxes and the amount will be entered in line 12. You can check a box to either apply the amount to your next return or have it returned to you in the form of a refund.

Part 2: Tell us about your deposit schedule and tax liability for this year

Part two is where you enter details about your tax liability for the year. Check the correct box in line 13 to answer whether your total taxes after adjustments and nonrefundable credits in line 9 is less than or greater than $2,500. If it’s less than $2,500, you can skip to Part 3. If it’s $2,500 or more, you will need to enter your tax liability for each month. Each month has a corresponding box, from January in 13a to December in 13l. The months should be totalled for your total annual tax liability in line 13m.

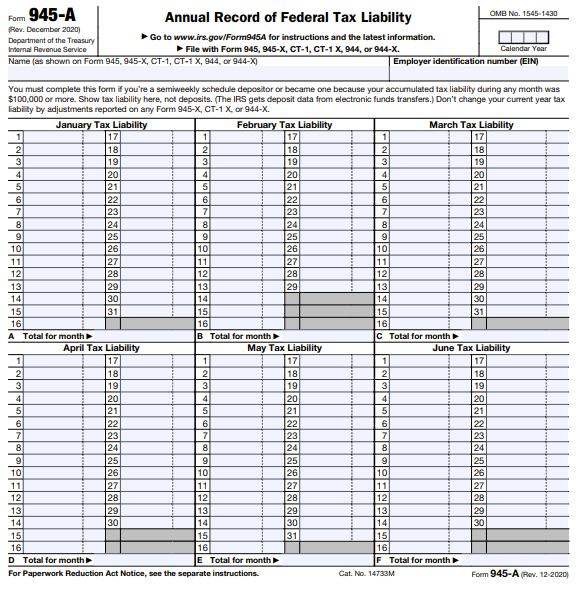

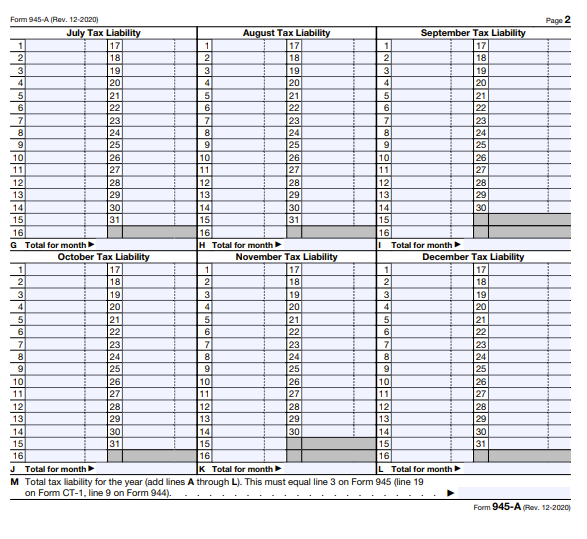

If you are a semiweekly depositor or became one because you accumulated $100,000 or more of tax liability on any day during a deposit period, you must complete Form 945-A instead of the monthly boxes in Part 2 of Form 944. The Form 945-A includes a corresponding space for each day of each month of the year. You can enter your tax liability in these boxes. Each month has a total box at the bottom, and your total tax liability for the year is entered in line M on page 2 of the Form 945-A.

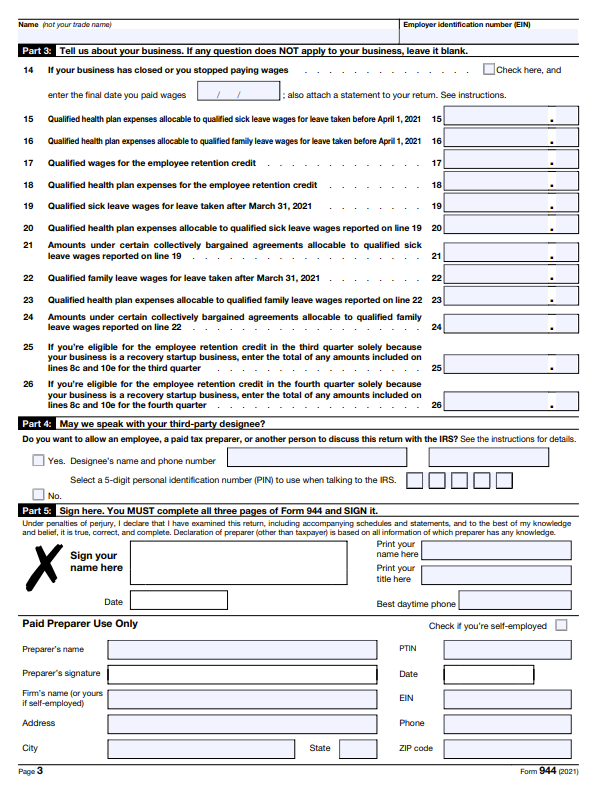

Part 3: Tell us about your business

Part three has questions that may or may not apply to your business. If it does not apply, you can leave the boxes blank. If your business has closed, check the box in line 14, enter the final date you paid wages, and attach a statement to the Form 944. The rest of the boxes relate to special treatment around qualified health plan expenses, qualified sick leave wages, and qualified wages for the employee retention credit.

Part 4: May we speak with your third-party designee?

If you have an employee or third-party tax preparer who is authorized to discuss the Form 944 with the IRS, check the “yes” box and enter the designee’s name and phone number. You can also enter a five digit PIN for the designee to use when they discuss the form with the IRS.

Part 5: Sign here

You must sign your name and date the Form 944 for it to be accepted by the IRS. Be sure to print your name and title and enter your best daytime phone number on the right hand side.