What is Form 8995?

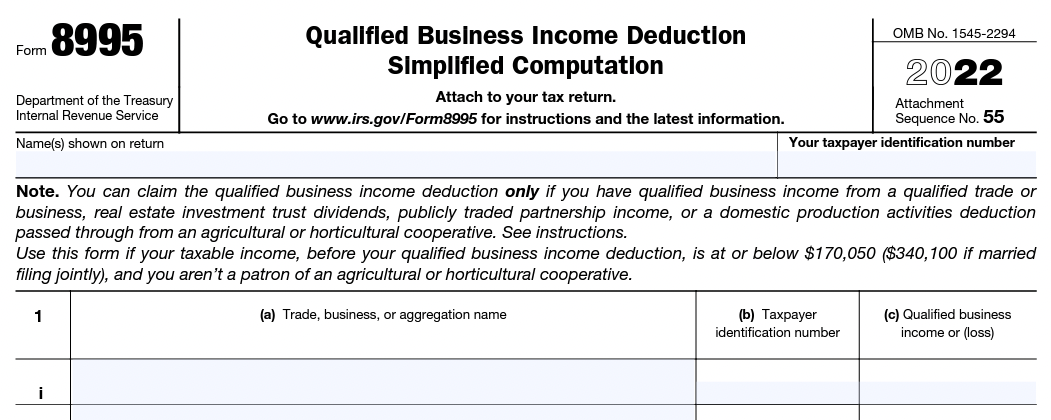

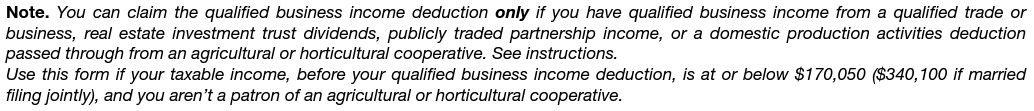

Form 8995 is the IRS’s tax form used to calculate the amount of the Section 199A Qualified Business Income (QBI) Deduction that can be claimed on an individual, trust, or estate tax return.

The Qualified Business Income (QBI) deduction is a tax benefit introduced by the Tax Cuts and Jobs Act for individuals, trusts, and estates who have income from a qualified trade or business. The QBI deduction allows these taxpayers to take a federal tax deduction of up to 20% of their qualified business income, which can result in a significant reduction in their taxable income. It is designed to benefit small business owners and freelancers.

Form 8995 takes into account a number of factors, including the taxpayer's taxable income, the type of business, qualified business income or loss, and other factors that may affect the amount of the QBI deduction. The form is straightforward and user-friendly, making it easy for taxpayers to understand and complete.

In summary, Form 8995 is an important tool for individuals, trusts, and estates who have income from a qualified trade or business and want to take advantage of the QBI deduction to lower their taxable income. The potential deduction can be massive, so it is worth considering for most small business owners and freelancers.

Who needs to file Form 8995?

Form 8995 is required to be filed by individuals, trusts, and estates who have income from a qualified trade or business and wish to claim the Qualified Business Income (QBI) deduction.

This includes self-employed individuals, small business owners, freelancers, partners in a partnership, S corporation shareholders, and beneficiaries of an estate or trust who have qualified business income. If you have income from a qualified trade or business and expect to claim the QBI deduction, you will need to complete Form 8995 and attach it to your federal tax return.

The Qualified Business Income (QBI) deduction is a tax benefit that allows individuals, trusts, and estates to deduct a portion of their income from a qualified trade or business. The deduction is designed to help reduce the tax burden on small business owners and individuals with business income.

Should you need to produce pay stubs for your employees, be sure to check out this online check stub maker today. There are dozens of printable pay stubs examples for you to pick.

It is important to note that not all businesses are eligible for the QBI deduction, and there are certain limitations and restrictions on the amount of the deduction that can be claimed. For example, the QBI deduction may be limited for certain high-income taxpayers or for businesses in certain industries. For 2022, taxpayers filing Form 1040 must have taxable income of $170,050 or less for single taxpayers ($340,100 or less for married filing joint) before claiming the QBI deduction. Read the IRS’s Form 8995 Instructions for more information.

Who is not required to file Form 8995?

Not all taxpayers are required to file Form 8995. The following individuals, trusts, and estates are generally not required to file this form:

-

Those who do not have income from a qualified trade or business: Only individuals, trusts, and estates with income from a qualified trade or business are eligible to claim the Qualified Business Income (QBI) deduction.

-

Those with taxable income below the threshold: The QBI deduction is subject to income limitations and is phased out for taxpayers with taxable income above certain thresholds. Taxpayers with taxable income above the applicable threshold may not be required to file Form 8995.

-

Those who are not eligible for the QBI deduction: The QBI deduction is not available for certain businesses, such as specified service trades or businesses, investment businesses, and passive activities. Taxpayers who do not have income from a qualified trade or business or whose business is not eligible for the QBI deduction will not be required to file Form 8995.

When is the deadline for Form 8995?

Form 8995 is a tax form that is required to be filed as part of an individual's, trust's, or estate's tax return. The deadline for filing Form 8995 and an individual's tax return is April 15th of each year, unless an extension has been granted.

It is important to note that this information is subject to change and taxpayers should check with the IRS or a tax professional for the most up-to-date information on the filing deadline for Form 8995.

Can the deadline for Form 8995 be extended?

Form 8995 is filed with the federal individual, trust, or estate tax return. The due date for federal tax returns of these types is generally April 15th of the year following the tax year being filed.

The deadline for filing a federal tax return can be extended under certain circumstances. To request an extension of time to file your Individual Form 1040 tax return, including Form 8995, you can file Form 4868, "Application for Automatic Extension of Time to File U.S. Individual Income Tax Return." The form must be filed by the original due date of the tax return, which is generally April 15th of each year. For trust and estate tax returns, use Form 7004 to request an extension of time to file.

An extension will provide you with an additional 6 months, generally until October 15th of the same year, to file your tax return and Form 8995. However, it is important to note that an extension of time to file is not an extension of time to pay taxes owed. If you expect to owe taxes, you should estimate the amount owed and pay it by the original due date of the tax return to avoid interest and penalties.

What is the penalty for late filing of Form 8995?

There is no penalty specifically related to the late filing of Form 8995, but if you are required to file Form 1040 and you do not file it by the original (or extended) deadline, you may be subject to a penalty for late filing.

The penalty for late filing of a tax return is generally 5% of the unpaid taxes for each month or part of a month that a return is late, up to a maximum of 25%. In addition, if you file your tax return more than 60 days after the due date (including extensions), the minimum penalty is the smaller of $435 or 100% of the tax shown on the return, whichever is less.

It is important to note that if you have a valid reason for not filing your tax return on time, such as a reasonable cause or an inability to obtain necessary information, you may be able to have the penalty waived. If this is the case, notify the IRS as soon as possible to avoid difficulties with filing.

It is always best to file your tax return, including Form 8995, by the due date to avoid potential penalties and interest charges. If you need more time to file, you can request an extension of time to file, but you will still be responsible for paying any taxes owed by the original due date.

What happens if I don't file Form 8995?

There is no official penalty for neglecting to file form 8995 and claim the Qualified Business Income Deduction. Federal tax penalties are generally calculated as a percentage of taxes owed but not paid. Because Form 8995 is used to calculate a deduction, this calculation is not possible.

However, failing to file Form 8995 has downsides that could be even more severe than a tax penalty. The QBI deduction is up to 20% of qualified business income earned during the tax year. For example, if you have $100,000 of qualified business income and you’re able to take the full QBI deduction, you’d receive a $20,000 tax deduction. Because a 20% tax deduction is significant for most taxpayers, it is generally recommended that anyone who qualifies for the QBI deduction should file Form 8995 in order to claim it.

The good news is that if you don’t file Form 8995 and realize you should have, there is still hope: you can file an amended tax return. Individual taxpayers can file Form 1040-X, trusts can file an Amended Form 1041 (by checking the “Amended Return” box), and estates can file another Form 706 (by entering “Supplemental Information” across the top of page 1 and attaching a copy of pages 1-4 of the original Form 706).

How do I calculate my qualified business income deduction on Form 8995?

The calculation of the qualified business income deduction on Form 8995 involves several steps, including determining your taxable income, calculating your qualified business income, and determining your deduction limit.

-

Determine your taxable income: Your taxable income is your total income from all sources, minus any adjustments, deductions, and exemptions. For individual taxpayers, it’s listed on Line 15 of Form 1040.

-

Calculate your qualified business income: Your qualified business income is the amount of income you receive from qualified trades or businesses, less any deductions allocable to that income.

-

Determine your deduction limit: The qualified business income deduction is limited to the lesser of 20% of your taxable income, or 20% of your qualified business income.

Once you have determined your taxable income, calculated your qualified business income, and determined your deduction limit, you can fill out Form 8995 and claim your qualified business income deduction.

What is the maximum qualified business income deduction that I can claim on Form 8995?

The maximum qualified business income (QBI) deduction that you can claim on Form 8995 is limited to 20% of your taxable income, or 20% of your qualified business income, whichever is lower.

There are also additional limits and restrictions that may apply depending on the type of business you have, your taxable income, and other factors.

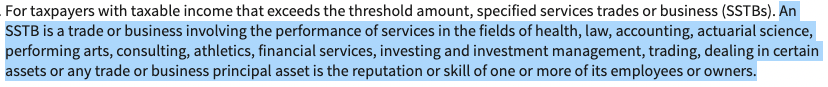

For example, if your business is a specified service trade or business (SSTB), which includes professions such as doctors, lawyers, consultants, investment managers, and others (see below), the amount of your QBI deduction is subject to additional limitations based on your taxable income. If your taxable income exceeds certain thresholds, the QBI deduction for an SSTB may be limited or phased out altogether.

What supporting documents do I need to file with Form 8995?

Form 8995 must be filed as part of an individual's, trust's, or estate's tax annual federal tax return. In addition to Form 8995, you may need to provide supporting documentation to the IRS when you file your tax return. The specific supporting documents that are required will depend on the details of your individual tax situation.

Some common supporting documents that may be required when filing Form 8995 include:

-

Proof of business income: Documentation such as tax returns, bank statements, or invoices that demonstrate the income you received from your qualified trade or business.

-

Evidence of expenses: Receipts, invoices, or other documentation that support the expenses you incurred in connection with your qualified trade or business.

-

Business tax forms: Forms such as Schedule C (for sole proprietorships), Schedule E (for rental income), or Form 1120 (for corporations) that provide additional information about your business activities and income.

-

Evidence of depreciation: Records that demonstrate the depreciation of assets used in your business, such as vehicles, equipment, or buildings.

How do I file for Form 8995?

Form 8995 must be filed as part of an individual's, trust's, or estate's tax return. You can file both Form 8995 and your tax return electronically or by mail.

Here is a general overview of the steps to file Form 8995:

-

Gather necessary information: Collect all of the necessary information, including your income and expenses, to complete Form 8995.

-

Obtain a copy of the form: You can obtain a copy of Form 8995 from the IRS website or from a tax professional.

-

Complete the form: Fill in all of the required information on Form 8995, including your taxable income and your qualified business income deduction.

-

File the form: You can file your tax return with Form 8995 attached electronically using IRS e-file or by mailing a paper copy to the appropriate IRS processing center.

-

Attach supporting documentation: If required, include any supporting documentation, such as proof of business income and expenses, with your tax return.

It is always best to consult with a tax professional to ensure that you complete and file your tax return, including Form 8995, correctly. A tax professional can also help you determine if you are eligible for the qualified business income deduction and estimate the amount of the deduction you may be able to claim.

Can I file Form 8995 electronically?

Yes, you can file Form 8995 electronically as part of your tax return using the IRS e-file system. E-filing is a convenient and secure way to file your tax return, including Form 8995, and can help reduce the risk of errors and speed up the processing time.

To e-file your tax return, including Form 8995, you can use IRS e-file through a tax professional or a software program. Before you e-file, you should gather all of the necessary information and complete Form 8995.

When you e-file your tax return, the software will guide you through the process and submit your return, including Form 8995, to the IRS for you. The IRS will then process your return and, if necessary, issue any refund or bill for additional taxes owed.

E-filing is a convenient and efficient way to file your tax return, including Form 8995.

Where should I mail Form 8995 to?

If you decide to mail to a physical address, Form 8995 should be mailed to the appropriate Internal Revenue Service (IRS) processing center, along with your tax return. Here are the various IRS processing centers as of January 2023:

| If you live in... | And you are not enclosing a payment, use this address | and you are enclosing a payment, use this address |

| Arkansas ,Connecticut, Delaware, District of Columbia, Illinois, Indiana, Iowa, Kentucky, Maine, Maryland, Massachusetts, Minnesota, Missouri, New Hampshire, New Jersey, New York, Oklahoma, Rhode Island, Vermont, Virginia, West Virginia, Wisconsin | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0002 | Internal Revenue Service P.O. Box 931000 Louisville, KY 40293-1000 |

| Pennsylvania | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0002 | Internal Revenue Service P. O. Box 802501 Cincinnati, OH 45280-2501 |

| Florida, Louisiana, Mississippi, Texas | Department of the Treasury Internal Revenue Service Austin, TX 73301-0002 | Internal Revenue Service P.O. Box 1214 Charlotte, NC 28201-1214 |

| Alabama, Georgia, North Carolina, South Carolina, Tennessee | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0002 | Internal Revenue Service P O Box 1214, Charlotte, NC 28201-1214 |

| Arizona, New Mexico

| Department of the Treasury Internal Revenue Service Austin, TX 73301-0002 | Internal Revenue Service P.O. Box 802501, Cincinnati, OH 45280-2501 |

| Alaska, California, Colorado, Hawaii, Idaho, Kansas, Michigan, Montana, Nebraska, Nevada, Ohio, Oregon, North Dakota, South Dakota, Utah, Washington, Wyoming | Department of the Treasury Internal Revenue Service Ogden, UT 84201-0002 | Internal Revenue Service P.O. Box 80250, Cincinnati, OH 45280-2501 |

Always be sure to check the IRS website for the most recent and updated mailing addresses and any special instructions regarding mailing your return. It's also important to note that if you owe taxes and you're mailing your return, you should send your payment (via check, not cash) along with your tax return to the appropriate address.

It is important to note that if you file your tax return electronically using the IRS e-file system, you do not need to mail a paper copy of your return or Form 8995. The e-filing process will automatically submit your tax return and Form 8995 to the IRS for you.

To ensure that your tax return is processed as quickly and accurately as possible, it is recommended that you follow the instructions for mailing your tax return carefully and include all required forms and supporting documentation.