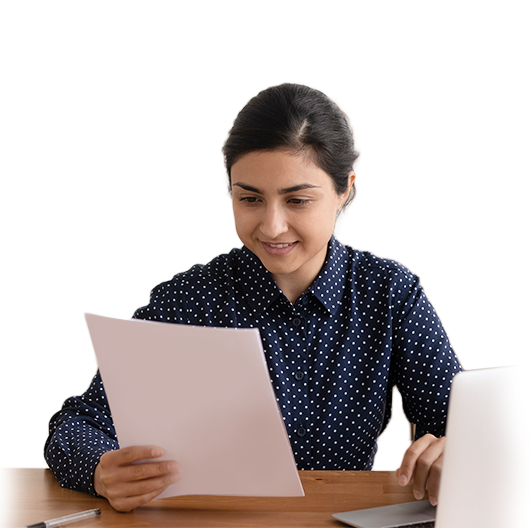

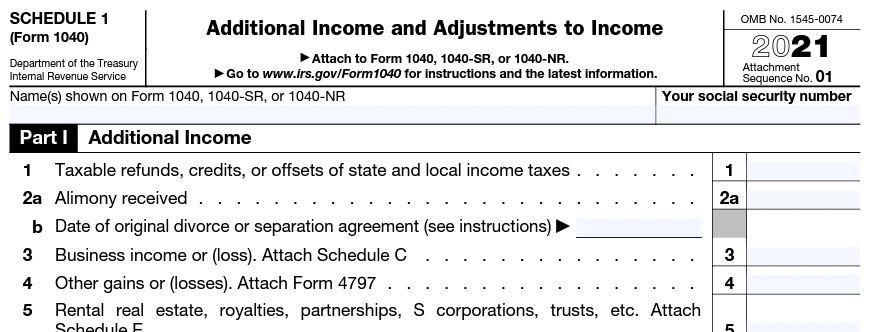

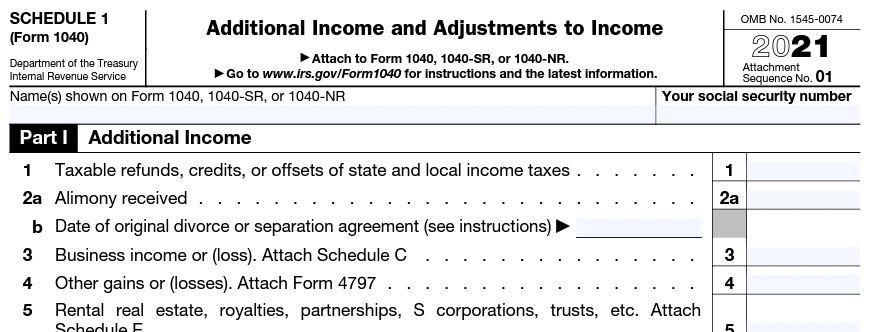

What is Form 1040 Schedule 1?

Form 1040, Schedule 1, Additional Income and Adjustments to Income, is a tax form used by the United States Internal Revenue Service (IRS) to report additional income that must be included on an individual's federal tax return. It is used to report various types of income that are not reported on the main Form 1040, such as:

-

Taxable refunds, credits, etc from the prior year

-

Alimony received

-

Gambling or lottery income

-

Cancellation of debt (debt forgiveness)

-

Prize or award money

-

Jury duty pay

-

Taxable HSA distributions

-

Income from activities not engaged in for profit (hobbies)

…And other types of income. Be sure to look through Schedule 1 and the Form 1040 Instructions (page 83) to learn more.

Schedule 1 is used to report these types of income so that the IRS can determine the taxpayer's total taxable income and calculate the amount of federal income tax owed. The information reported on Schedule 1 is used, along with other sources of income, to calculate the taxpayer's adjusted gross income (AGI), which is the starting point for determining the taxpayer's federal tax liability.

Who needs to file Form 1040 Schedule 1?

Form 1040 Schedule 1 is used to report additional sources of income that are not reported on the main Form 1040. Some common examples of income that are reported on Schedule 1 include:

-

Self-employment income: If you are self-employed and have earned income from your business, that income will be reported on Schedule C, which will then appear on Schedule 1.

-

Capital gains or losses: If you have sold investments such as stocks, bonds, or real estate, gains or losses from those sales will be reported on Schedule D, which will then appear on Schedule 1.

-

Rental income: If you own rental property and receive rental income, that income will be reported on Schedule E, which will then appear on Schedule 1.

-

Unemployment compensation: If you received unemployment benefits during the tax year, that income will be reported on Schedule 1.

-

Prize or award money: If you won a prize or award, the value of that prize or award will be reported on Schedule 1.

-

Alimony received: If you received alimony as part of a divorce settlement, that income will be reported on Schedule 1.

-

Gambling: If you received gambling winnings, such as winnings from a casino, lottery, or horse racing, that income will be reported on Schedule 1 as well. This includes winnings from both domestic and foreign sources. In addition, if you have gambling losses, you can generally use them to offset some or all of your gambling winnings by reporting your gambling losses on Schedule A (Itemized Deductions). However, you can only deduct gambling losses up to the amount of your gambling winnings.

Not all sources of income need to be reported on Schedule 1. For example, wages, salaries, and tips are reported directly on Form 1040, rather than on a supporting schedule.

In addition to reporting additional sources of income, Schedule 1 is also used to report certain adjustments to income, such as student loan interest, educator expenses, and contributions to a health savings account (HSA). Be sure to examine the form and instructions to ensure you’re reporting your income and adjustments correctly.

Who is not required to file Form 1040 Schedule 1?

Not all taxpayers are required to file Form 1040 Schedule 1. You are not required to file Schedule 1 if you do not have any of the types of income listed on the form that are not already reported on the main Form 1040. For example, if you only receive wages, salaries, and tips and have no other sources of income, such as self-employment income or capital gains, you will not need to file Schedule 1.

Often when you do file Schedule 1, you’ll still need to report certain types of income on other forms or schedules. For example, if you have foreign income, you may need to report it on Form 8938 (Statement of Specified Foreign Financial Assets).

Similarly, business income (Schedule 1, Line 3) will also need to be reported on Form 1040, Schedule C, and rental income (Schedule 1, Line 5) will also need to be reported on Form 1040, Schedule E.

When is the deadline for Form 1040 Schedule 1?

Because Schedule 1 is filed along with your Form 1040, the deadline is typically April 15th of each year. However, if April 15th falls on a weekend or holiday, the deadline may be extended to the next business day.

Even if you are not required to file Schedule 1, you must still file your federal tax return by the deadline. If you need more time to file your return, you can request an extension by filing Form 4868 (Application for Automatic Extension of Time to File U.S. Individual Income Tax Return).

However, keep in mind that an extension of time to file your return is not an extension of time to pay any taxes owed. If you owe taxes, you should estimate the amount owed and pay it by the original deadline in order to avoid interest and penalties.

Can the deadline for Form 1040 Schedule 1 be extended?

If you choose to file an extension for your Form 1040, then the deadline for filing Schedule 1 will automatically be extended too. The original deadline for filing Schedule 1, along with your federal tax return, is generally April 15th of each year. If April 15th falls on a weekend or holiday, the deadline may be extended to the next business day.

If you need more time to file your federal tax return, including Schedule 1, you can request an extension of time to file by submitting Form 4868 to the IRS by the April 15th deadline. This will give you an additional six months to file both your Form 1040 and the accompanying Schedule 1, until October 15th of the year following the tax year you’re filing for.

What is the penalty for late filing of Form 1040 Schedule 1?

While there is no penalty specifically for the late filing of Schedule 1, there is a penalty for the late filing of your Form 1040, which Schedule 1 will be attached to. That penalty is calculated as follows:

-

The penalty is 5% of the unpaid taxes owed for each month (or part of a month) that the return is late, up to a maximum of 25% of the unpaid taxes owed.

-

For example, if you owe $1,000 in taxes and your return is 3 months late, the late filing penalty would be 5% of $1,000, or $50, for each of the 3 months, for a total penalty of $150. If your return is 5 months late, the penalty would be 5% of $1,000, or $50, for each of the 5 months, for a total penalty of $250, or 25% of the unpaid taxes.

In addition to the late filing penalty, you may also be charged interest on any taxes owed that are not paid by the original deadline. The interest rate is set by the IRS and is based on the federal short-term rate, plus a percentage that changes quarterly. The interest rate is subject to change quarterly and is compounded daily - learn more on the IRS website.

If you have a valid reason for not being able to file your return by the deadline, such as a natural disaster or serious illness, you may be able to get relief from the penalties. To request relief, you should contact the IRS and provide a written explanation of your circumstances.

What happens if I don't file Form 1040 Schedule 1?

If you don't file Form 1040 Schedule 1 by the original or extended due date, there can be several consequences, including:

-

You may owe additional taxes: If you have additional sources of income that are not reported on the main Form 1040, such as gambling income, cancellation of debt, or taxable HSA distributions, the IRS may not be aware of this income and you may owe additional taxes on that income.

-

You may face penalties: If you don't file Schedule 1 by the deadline, you may be subject to a penalty for late filing. The penalty for late filing is 5% of the unpaid taxes for each month (or part of a month) that the return is late, up to a maximum of 25% of the unpaid taxes owed.

-

You may be charged interest: In addition to the late filing penalty, you may also be charged penalties and interest on any taxes owed that are not paid by the original deadline. The interest rate on unpaid taxes is set by the IRS and is based on the federal short-term rate, plus a percentage.

-

You may face difficulty in claiming credits or deductions: If you don't file Schedule 1, you may miss out on the opportunity to claim certain credits or deductions that are related to the types of income reported on the form.

-

You may trigger an audit: Failure to file Schedule 1 may increase your risk of being audited by the IRS.

What supporting documents do I need to file with Form 1040 Schedule 1?

While you generally do not need to file supporting documentation alongside Schedule 1, you should still keep documentation of income and related expenses in your records. The specific supporting documents you should keep on hand will depend on the sources of income you are reporting on the form. However, here are some common types of supporting documents that may be required:

-

W-2 forms: If you received wages, salaries, or tips, you will receive a W-2 form from your employer(s) that reports this income.

-

1099 forms: If you received income from self-employment, rental property, capital gains, unemployment compensation, or other sources, you may receive a 1099 form that reports this income.

-

Brokerage statements: If you sold investments, such as stocks or bonds, you will need to provide a statement from your brokerage that shows the sales price, cost basis, and any related expenses.

-

Receipts or records of expenses: If you are reporting rental income, you may need to provide receipts or records of expenses related to your rental property, such as repairs, utilities, and property taxes.

-

Receipts or records of gambling winnings and losses: If you are reporting gambling winnings, you may need to maintain receipts or records of your winnings and any related expenses, such as transportation or lodging.

It's important to keep accurate records of all your income and expenses and to retain any supporting documentation in case the IRS requests additional information or proof of income/expenses. Should you need to produce proof of income, you can always try out the online pay stub maker. If you have any questions about the supporting documents required for Form 1040 Schedule 1, you should consult with a tax professional or refer to the Form 1040 Instructions on the IRS website.

How do I file for Form 1040 Schedule 1?

Form 1040 Schedule 1 can be filed in one of several ways:

-

Electronically: You can file Schedule 1 along with Form 1040 electronically using tax preparation software, such as TurboTax or H&R Block, or through the IRS e-file system. Electronic filing is the fastest and most accurate method of filing and can result in a quicker refund.

-

By mail: You can file Schedule 1 along with Form 1040 by mailing a paper copy of the form, along with any supporting documents and a check for any taxes owed, to the appropriate IRS office. The mailing address will depend on your state of residence and the type of form you are filing.

-

Use a tax professional: a tax professional can handle the tax planning, preparation and filing process for you. They’ll help ensure you get the most accurate results possible.

Regardless of how you file Form 1040 Schedule 1, it's important to double-check your return for accuracy and completeness before submitting it to the IRS.

Where should I mail Form 1040 Schedule 1 to?

The mailing address for Form 1040, Schedule 1 will depend on your state of residence and the type of form you are filing. The mailing addresses for Form 1040 and its schedules are listed on the IRS website, and you can find the correct address for your situation by using the IRS "Where to File" tool.

Here are the various IRS processing centers as of March 2023:

| If you live in... | And you are not enclosing a payment, use this address | and you are enclosing a payment, use this address |

| Arkansas ,Connecticut, Delaware, District of Columbia, Illinois, Indiana, Iowa, Kentucky, Maine, Maryland, Massachusetts, Minnesota, Missouri, New Hampshire, New Jersey, New York, Oklahoma, Rhode Island, Vermont, Virginia, West Virginia, Wisconsin | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0002 | Internal Revenue Service P.O. Box 931000 Louisville, KY 40293-1000 |

| Pennsylvania | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0002 | Internal Revenue Service P. O. Box 802501 Cincinnati, OH 45280-2501 |

| Florida, Louisiana, Mississippi, Texas | Department of the Treasury Internal Revenue Service Austin, TX 73301-0002 | Internal Revenue Service P.O. Box 1214 Charlotte, NC 28201-1214 |

| Alabama, Georgia, North Carolina, South Carolina, Tennessee | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0002 | Internal Revenue Service P O Box 1214, Charlotte, NC 28201-1214 |

| Arizona, New Mexico

| Department of the Treasury Internal Revenue Service Austin, TX 73301-0002 | Internal Revenue Service P.O. Box 802501, Cincinnati, OH 45280-2501 |

| Alaska, California, Colorado, Hawaii, Idaho, Kansas, Michigan, Montana, Nebraska, Nevada, Ohio, Oregon, North Dakota, South Dakota, Utah, Washington, Wyoming | Department of the Treasury Internal Revenue Service Ogden, UT 84201-0002 | Internal Revenue Service P.O. Box 80250, Cincinnati, OH 45280-2501 |

Always be sure to check the IRS website for the most recently updated mailing addresses, as well as for any special instructions related to mailing your return. It's also important to note that if you owe taxes and you're mailing your return, you should send your payment (via check, not cash) along with your tax return to the appropriate address.

The mailing addresses listed above are for taxpayers who are mailing a paper copy of their return. If you are filing your return electronically, you do not need to mail a paper copy of your return to the IRS.

Can I file Form 1040 Schedule 1 electronically?

Yes, you can file Form 1040, Schedule 1 electronically using tax preparation software or through the IRS e-file system. You can also hire a tax professional to prepare and file Form 1040 on your behalf, and they will have access to e-filing software. Electronic filing is the fastest and most accurate method of filing and can result in a quicker refund.

When you file your return electronically, the software or e-file system will check your return for accuracy and completeness, and will alert you to any errors or missing information. Once your return is complete and accurate, it can be transmitted directly to the IRS.

When you file your return electronically, you will need to have a valid email address in order to receive filing confirmation. We also recommend printing a copy of your return to keep in your records, if possible. It is also recommended that you keep a copy of your prior year's tax return and any other supporting documents, such as W-2 forms and 1099 forms, on hand. If you do decide to print paper returns or save PDF copies for your records, we also recommend starring out your social security number (ex: ***-**-**** or ***-**-1234) in order to keep your identity safe.