We've Helped Customers Create Their 1040-ES Form Using Our Generator

What Is A Form 1040-ES?

Form 1040-ES, Estimated Tax For Individuals is an Internal Revenue Service (IRS) tax form used to compute and pay your estimated taxes. It is used to file quarterly income taxes by individuals who have income not subject to tax withholding.

Who Needs To File A Form 1040-ES?

If you are a freelancer or have income from other non-employment sources– such as interest, dividends, and rent– you may need to file a Form 1040-ES. Individuals, including owners, partners, and members of pass-through organizations, should make estimated tax payments if you expect to owe $1,000 or more for the tax year.

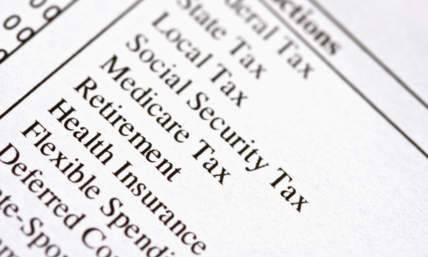

You do not have to file a Form 1040-ES or pay estimated taxes if you receive salary and wages through the course of typical employment and your employer withholds a sufficient amount of taxes from your paycheck throughout the year. Your employer will use the information you report to them on a Form W-4, Employee’s Withholding Certificate, to determine your correct federal income tax withholding. If you’ve found that you are not withholding enough when you complete your Form 1040, U.S. Individual Income Tax Return, be sure to file a new form with your employer.

If you need to get your own salary slip, be sure to check out the online paystub templates.

Where Can I Get A 1040-ES Form?

You can access the Form 1040-ES package here on ThePayStubs or on the IRS website. The Form 1040-ES package has instructions, a guide to the form, worksheets, schedules, and the four quarterly payment vouchers. The package is updated annually to include the four vouchers you need for the current year, and the provided tax rate schedule will also be updated annually.

When Is My Form 1040-ES Payment Voucher Due?

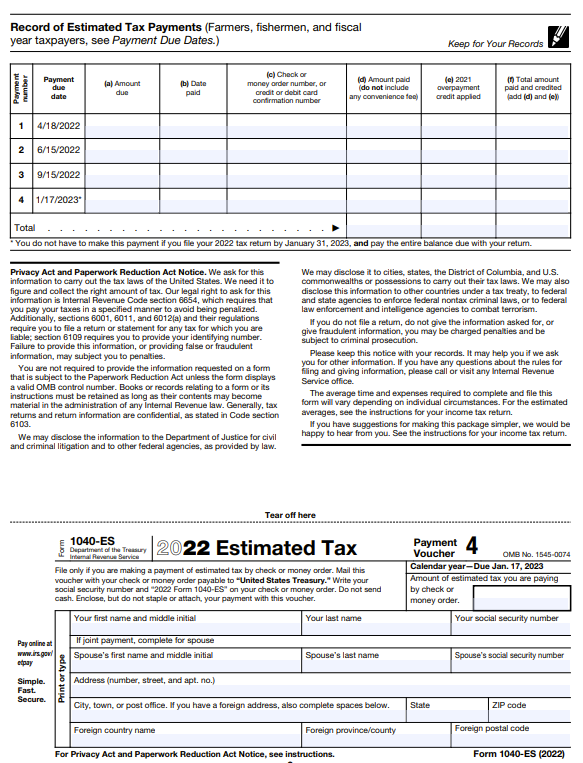

There are four estimated tax payments due throughout each year. These are commonly referred to as your quarterly estimated taxes, although the dates don’t fall exactly 3 months apart. The payment vouchers in the Form 1040-ES package are labeled, so you should submit Payment Voucher 1 by April 15, Payment Voucher 2 by June 15, Payment Voucher 3 by September 15, and Payment Voucher 4 by January 15 of the following year. If you file your Form 1040 and pay the tax in full by January 31, you can skip the final January 15 payment. If these due dates fall on a holiday or weekend, the due date is pushed to the following business day.

If you expect to have $1,000 or more in total annual taxes due, you should plan to send in your 1040-ES payment vouchers each quarter. Alternatively, you can pay your annual estimated tax in full by the first due date, April 15. If you miss a quarterly payment, you may be subject to late payment penalties and interest– even if you pay enough estimated taxes in total by the end of the year.

Who Must Pay Penalties For Underpayment On Form 1040-ES?

Typically, you must pay a penalty if your total estimated tax payments for the year did not equal at least the lesser of:

-

90% of your current year tax

-

100% of your previous year tax

There are special rules for fishermen and higher income taxpayers. Fishermen can substitute 66.67% for the 90% of current tax year requirement. Higher income taxpayers– those with an AGI of $150,000 for most taxpayers or $75,000 for taxpayers who are married filing separately– should substitute 110% for the 100% of previous tax year requirement.

The penalty is figured separately for each of the four required payments. The IRS assumes you make money evenly throughout the year, so one quarter of your total tax should be paid with each Form 1040-ES payment voucher. That means, you may owe the tax penalty from an earlier due date, even if you paid enough to make up for the underpayment at a later date.

Exception To The Quarterly Payment Rule

There is one exception to the requirement to pay quarterly. If you have a change in income that requires you to start making estimated tax payments after the first quarter of the year, you should use the annualized income installment method and file Schedule AI, Annualized Income Installment Method, of the Form 2210, Underpayment of Estimated Tax by Individuals, Estates, and Trusts. Filing this form may reduce or eliminate your underpayment penalty for a given quarter.

Other Exceptions To The Underpayment Penalty

You won’t have to pay a penalty or file Form 2210 if either of the following apply:

-

You were a U.S. citizen or resident alien and you had no tax liability for the prior year

-

The total tax shown on your Form 1040, minus the amount of tax you paid through federal tax withholding is less than $1,000

Waiving Your Penalty

You can ask the IRS to waive your penalty if you retired after reaching age 62 or became disabled, and your underpayment was not due to willful neglect. You can also request a waiver of your penalty if your underpayment was due to a casualty, disaster, or other unusual circumstance. The IRS will review the information you provide and determine whether to grant your request for a waiver. If they determine you still owe a penalty, they will send you a bill for the balance.

Where Do I Send My 1040-ES Payment Voucher?

You can make estimated tax payments that will apply to your Form 1040-ES Payment Voucher online, over the phone, in person, or via the mail. Here are your options.

How To Pay Form 1040-ES Online

To pay online, you can use IRS Direct Pay. Select Estimated Tax for your reason for payment, apply the payment to your Form 1040-ES, and select the tax period for payment. Only the tax periods currently available for payment will appear in the drop down box. Paying online is easy and secure, and it is the method recommended by the IRS. Online transfers directly from your checking or savings account can be processed at no cost to you. You can also pay with a debit card, credit card, or certain cash apps. However, these payment methods come with processing fees.

How To Pay Form 1040-ES By Phone

You can pay via the phone by calling a debit or credit card service provider or the Electronic Federal Tax Payments System (EFTPS). You can also use the IRS2Go mobile app to pay on your phone.

Link2Gov Corporation

888-PAY-1040

WorldPay US, Inc.

844-PAY-TAX-8

ACI Payments, Inc.

888-UPAY-TAX

EFTPS

800-555-4477 (English)

800-244-4829 (Spanish)

Where To Pay Form 1040-ES In Person

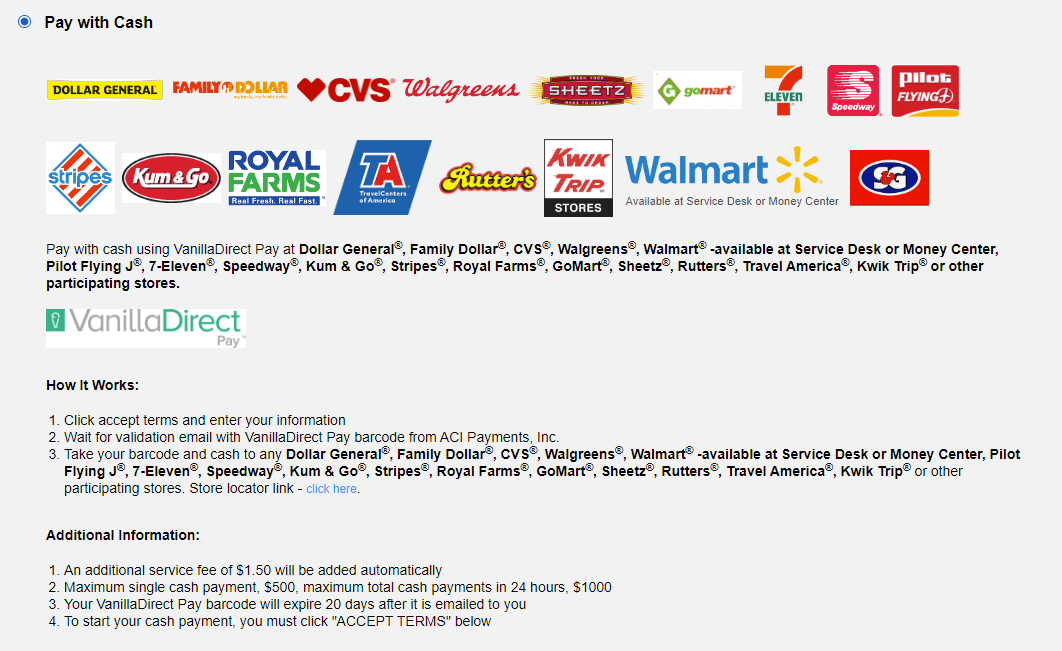

To make a cash payment in person, you must first be registered on the ACI Payment website. Then, you can go in person to a retail partner of the IRS to make a cash payment of $1,000 or less per day per transaction. The ACI Payment website lists approved retail partners under the “cash” payment option. Be aware, there will be different fees depending on the retail partner and payment method you use.

Where To Mail Form 1040-ES Payment Voucher

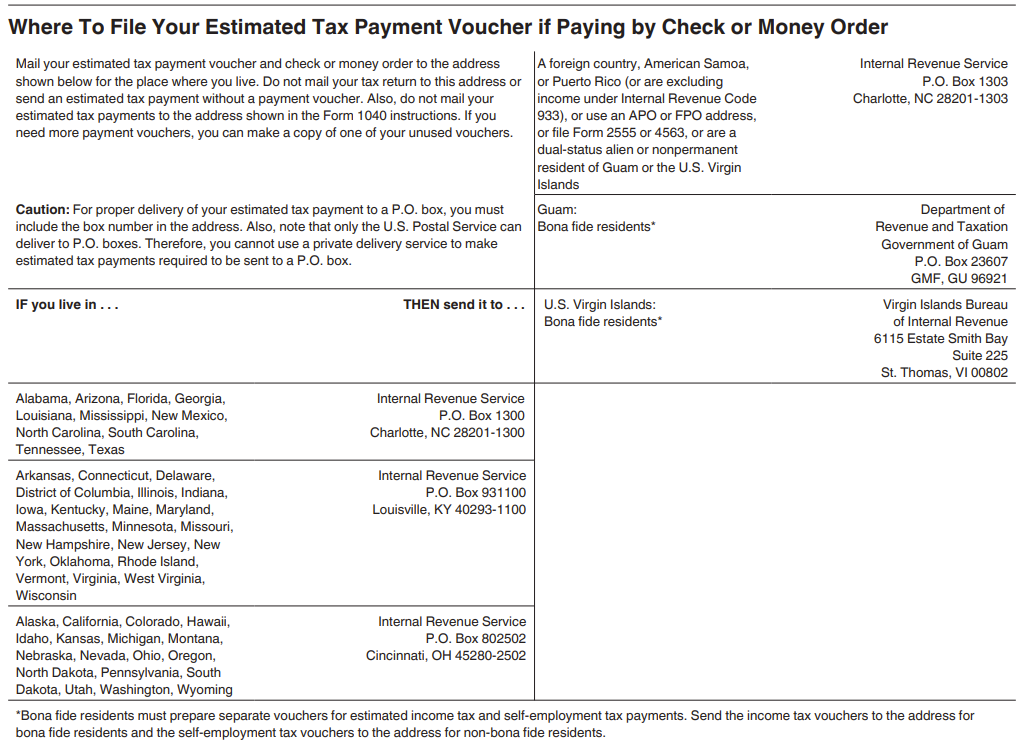

You cannot make a cash payment via the mail. However, you can pay by check or money order. If you choose to mail in your Form 1040-ES payment vouchers, be sure to mail in the correct voucher for the quarter. Each voucher is labeled in the top right corner.

The address in which you need to mail your tax payment vouchers depends on the state or country in which you reside. If you mail your Form 1040-ES payment vouchers, they will be considered timely if the envelope with your payment is appropriately paid and postmarked by the due date.

How Do I Calculate My Estimated Tax Payment?

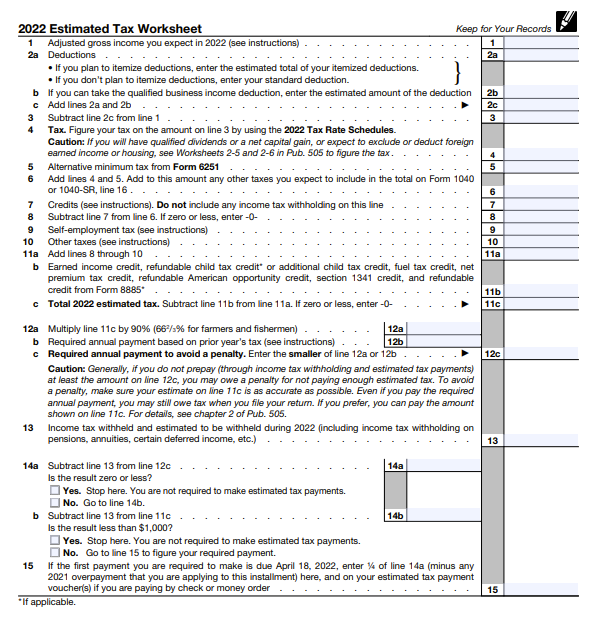

The estimated tax worksheet is available on page 8 of the Form 1040-ES package, found on the IRS website. Because you have to pay your estimated taxes before you know your actual income for the year, you will need to have a good idea of estimates for each of the figures. You can use your previous year’s tax return for a guide, as long as not much has changed in your tax situation.

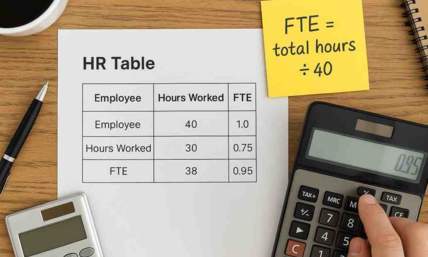

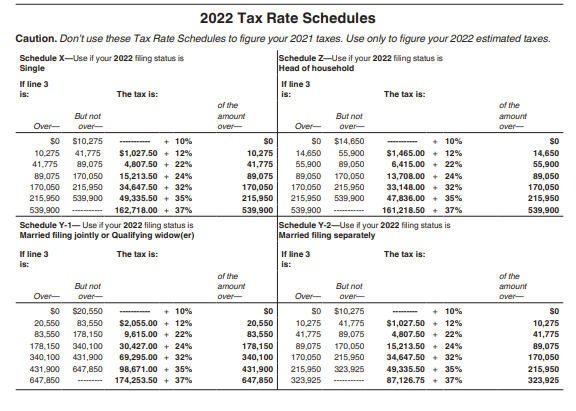

Line 1 asks for your adjusted gross income (AGI) that you expect for the entire year. Line 2a is for your planned deductions. You will need to know if you are planning to itemize your deductions or take the standard deduction for your tax filing status for the year. Line 2b is where you’ll enter the amount of the qualified business income (QBI) deduction, if you qualify for it. Because the QBI deduction is in addition to the standard or itemized deduction, you will add lines 2a and 2b together and enter the sum in 2c. Line 3 subtracts the total of your deductions from 2c from your AGI in line 1. Line 4 is where you will calculate the tax on the amount listed in line 3. Use the tax rate schedule given in the Form 1040-ES package.

Complete line 5 if you expect to be subject to the alternative minimum tax from Form 6251, Alternative Minimum Tax. Add the amount from line 5 to the amount you calculated in line 4 and enter the sum in line 6. Enter any credits you expect to have in line 7. Subtract line 7 from line 6 and enter the figure in line 8. Lines 9 and 10 are for your self employment tax and other taxes. Add lines 8 through 10 and enter the sum in line 11a. Line 11b includes a list of refundable tax credits– those which you can receive more in a refund than you owe in taxes. If you have any of the listed tax credits, enter the amount in line 11b. Subtract line 11b from 11a and enter the figure in 11c for your total estimated annual tax.

Lines 12a, 12b, and 12c allow you to check the amount you are required to pay to avoid a penalty. Line 12a multiplies your current year calculation from 11b by 90% for most taxpayers (or 66.67% for farmers and fishermen). Line 12b is for your required annual payment based on your prior year’s tax. Line 12c is the smaller of lines 12a and 12b.

Line 13 is where you’ll enter your estimated tax withholdings for the current year– this could be from your employment or voluntary withholding on pensions, annuities, and other payments you receive. Subtract line 13 from line 12c and enter the value in 14a. If the amount is zero or less, you do not need to make an estimated tax payment. If the amount is positive, continue to line 14b. Subtract line 13 from line 11c and enter the value in 14b. If the result is less than $1,000, you do not need to make an estimated tax payment. If the amount is greater than $1,000, you should go to line 15 to figure your required payment. Enter ¼ of the value from line 14a in line 15. You should pay this amount each quarter, unless you pay the amount in full by the due date of the first quarter.

How Do I Fill Out The Form 1040-ES Payment Voucher?

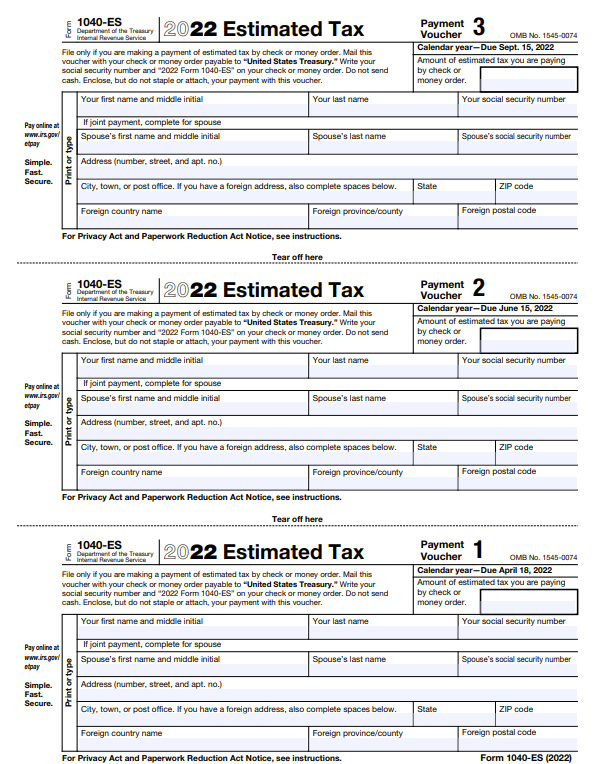

There are four separate Form 1040-ES payment vouchers each tax year. The top right of the form lists the quarter. Be sure to use the right voucher if you are sending a payment in the mail. You should enter the amount of the estimated tax you are paying by check or money order in the box just below the due date in the top right. You will need to enter your name, social security number, spouse’s name and social security number (if applicable), and address in order for the IRS to apply the payment appropriately to your tax account.

If you file online or by the phone, the questions you answer will help to automatically fill in the same details that would have been provided on the Form 1040-ES payment voucher. You should have the same information on hand when you plan to complete the payment via another method– including in person for cash payments at a retail partner of the IRS.