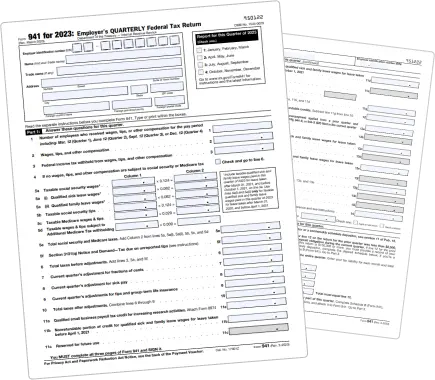

Easily Create Any Type Of 941 Tax Form

Generate any type of Form 941 in an instant. Fast, easy to use and eliminates errors. We have all the form types to choose from.

941 Form Types

Form 941, known as the Employer’s Quarterly Federal Tax Return, is used by employers to report income taxes, social security tax, or Medicare tax withheld from employee's paychecks and to pay the employer's portion of social security or Medicare tax

Form 941: Employer's Quarterly Federal Tax Return

Reports wages paid, tips, and other compensation, as well as federal income tax, Social Security, and Medicare taxes withheld by employers.

-

Easy to use

-

30-days money back guarantee

-

Accurate

-

Satisfaction Guaranteed

-

Secured

-

24/7 Customer Service

Form 941 Schedule B: Report of Tax Liability for Semiweekly Schedule Depositors

Employers use this form to report their tax liability for each day in a quarter if they are required to deposit federal employment taxes on a semiweekly schedule.

-

Easy to use

-

30-days money back guarantee

-

Accurate

-

Satisfaction Guaranteed

-

Secured

-

24/7 Customer Service

Form 941-X: Adjusted Employe's Quarterly Federal Tax Return or Claim for Refund

Used by employers to correct errors on a previously filed Form 941.

-

Easy to use

-

30-days money back guarantee

-

Accurate

-

Satisfaction Guaranteed

-

Secured

-

24/7 Customer Service

Benefits of using our 941 Forms

Filling out forms can be repetitive and can also take up a lot of valuable time. Our 941 generator can dramatically reduce the time it takes to fill out the form itself. Imagine what you could accomplish with all that free time on your hands. Our agents are available 24/7 via chat, phone and e-mail, and they will answer all kinds of questions and inquiries you might have.

Ease of Access

Quickly locate and download the form you need from our comprehensive directory

Up-to-date Forms

We ensure that you have the most current version of each form

Detailed Instructions

We provide user-friendly instructions for each form, helping you avoid mistakes and understand your tax obligations

Secure Handling of Information

our data is safe with us—we adhere to strict privacy standards

Reliable Support

Our team of tax professionals is ready to assist you with any queriesHow It Works

A step-by-step guide on using the platform for 941 forms:

Select the 941 form Type

you need

Fill in the required

information

Review and confirm

the details

Generate and download

your form