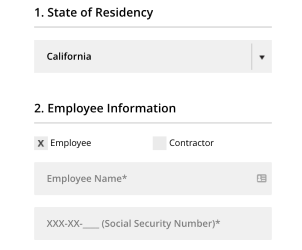

1. Enter Information such as company name, your work schedule and salary details

2. Choose your preferred theme and preview your pay stub.

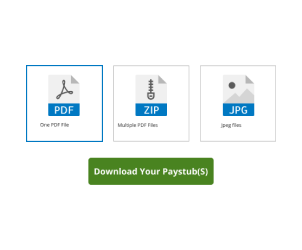

3. Download and print your stub instantly

We've Helped Customers Create Their 941-X Form Using Our Generator

What Is Form 941-X?

You can use Form 941-X, Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund, to correct errors on a previously filed Form 941.

Which Process Should I Use To Correct Errors On My Form 941?

There are several processes you can use to correct errors on your Form 941, and each comes with a specific set of rules as outlined in the instructions on page 6 of the Form 941-X. As long as there is no other conflicting guidance for your specific tax situation, underreported employment tax credit or social security tax deferrals should be treated like an overreported tax amount. Similarly, an overreported employment tax credit or social security tax deferral should be treated like an underreported tax amount.

Underreported Tax Amounts Only

If you only have underreported tax amounts, you can check the box on line 1 and pay the amount you owe on line 27 when you file Form 941-X.

Overreported Tax Amounts And Filing More Than 90 Days Before The Period Of Limitations On Credit Or Refund For Form 941 Or Form 941-SS Expires

If you have overreported tax amounts and you are filing Form 941-X more than 90 days before the period of limitations on the credit or refund for Form 941 or Form 941-SS expires, you can choose between the adjustment process or the claim process to correct the overreported tax amounts.

- Adjustment Process: If you want the amount from line 27 credited to your Form 941, Form 941-SS, or Form 944 in the period in which you file Form 941-X, check the box on line 1 of Form 941-X.

- Claim Process: If you want the amount from line 27 refunded to your or abated, check the box on line 2 of Form 941-X.

Overreported Tax Amounts And Filing Within 90 Days Of The Expiration of The Period Of Limitations On Credit Or Refund For Form 941 or Form 941-SS

If you have overreported tax amounts and you are filing within 90 days of the period of limitations on credit or refund for Form 941 or Form 941-SS, you must check the box on line 2 and use the claim process to correct the overreported tax amounts.

Both Underreported And Overreported Tax Amounts And Filing More Than 90 Days Before The Period Of Limitations On Credit Or Refund For Form 941 Or Form 941-SS Expires

If you have both underreported and overreported tax amounts and you are filing more than 90 days before the period of limitations on credit or refund for Form 941 or Form 941-SS expires, you can choose either the adjustment process or both the adjustment process and the claim process.

- Adjustment Process: If the underreported and overreported amounts combine to a total balance due or creates a credit that you would like to have applied to Form 941, Form 941-SS, or Form 944. File one Form 941-X, check the box on line 1, and follow the instructions on line 27.

- Both Adjustment Process and Claim Process: If you want the overreported tax amount refunded to you or

abated, file two separate Forms 941-X.

- For the adjustment process, correct the underreported tax amounts on the first Form 941-X, check the box on line 1, and pay the amount you owe from line 27 by the time you file Form 941-X.

- For the claim process, correct the overreported tax amounts on the second Form 941-X and check the box on line 2.

Both Underreported And Overreported Tax Amounts And Filing Within 90 Days Of The Expiration of The Period Of Limitations On Credit Or Refund For Form 941 or Form 941-SS

If you have both underreported and overreported tax amounts and you are filing within 90 days of the period of limitations on credit or refund for Form 941 or Form 941-SS, you must use both the adjustment process and the claim process.

- Adjustment Process: Correct the underreported tax amounts on the first Form 941-X, check the box on line 1, and pay the amount you owe from line 27 by the time you file Form 941-X.

- Claim Process: Correct the overreported tax amounts on the second Form 941-X and check the box on line 2.

What Information Is Reported On Form 941-X?

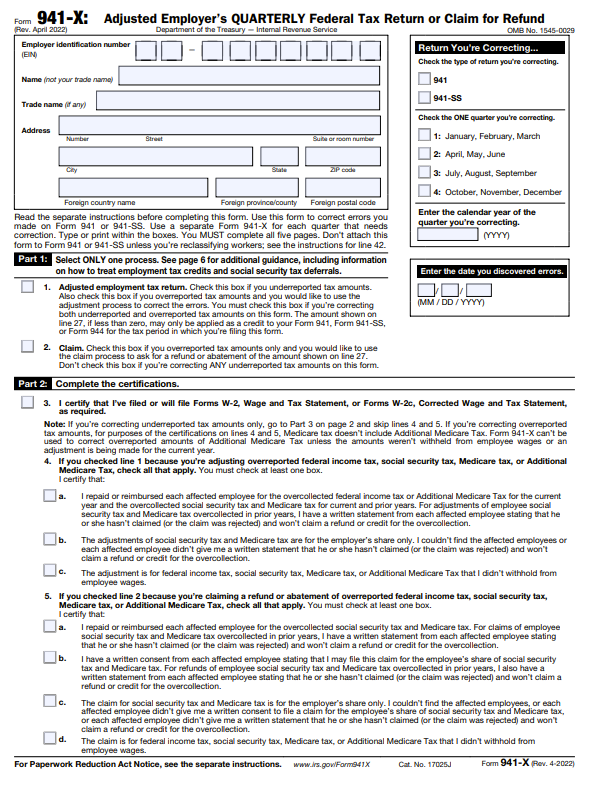

The top section of the Form 941-X has an information box where you will need to enter your employer identification number (EIN), name, trade name, and address. Your business name is its legal name, and the trade name is your “doing business as” (DBA) name, if any.

After you complete the information box in the top left, you will need to enter information about the return you are correcting in the box on the top right. Check the box for the type of return you are correcting, either the Form 941 or Form 941-SS. Then, check the quarter you are correcting and enter the four digit calendar year of the quarter you are correcting. If you must correct multiple quarters, you will need to file a separate Form 941-X for each quarter. You will also need to enter the date you discovered the errors.

If you need to create paystubs for your employees, you can check out the check stub maker. There are lots of paystub samples for you to select from.

Part 1: Select ONLY One Process.

From the “which process should I use” section above, check the box for the appropriate process you are using for Form 941-X. Box 1 is for adjusted employment tax returns, while box 2 is for claims.

Part 2: Complete the Certifications.

Part 2 includes checkboxes with statements for you to certify.

3. I certify that I’ve filed or will file Forms W-2, Wage and Tax Statement, or Forms W-2c, Corrected Wage and Tax Statement, as required.

4. If you checked line 1 because you’re adjusting overreported federal income tax, social security tax, Medicare tax, or Additional Medicare tax, you must certify at least one statement under line 4. Check as many as apply.

- I repaid or reimbursed each affected employee for the overcollected federal income tax or Additional Medicare Tax for the current year and the overcollected social security tax and Medicare tax for current and prior years. For adjustments of employee social security tax and Medicare tax overcollected in prior years, I have a written statement from each affected employee stating that he or she hasn’t claimed (or the claim was rejected) and won’t claim a refund or credit for the overcollection.

- The adjustments of social security tax and Medicare tax are for the employer’s share only. I couldn’t find the affected employees or each affected employee didn’t give me a written statement that he or she hasn’t claimed (or the claim was rejected) and won’t claim a refund or credit for the overcollection.

- The adjustment is for federal income tax, social security tax, Medicare tax, or Additional Medicare Tax that I didn’t withhold from employee wages.

5. If you checked line 2 because you’re claiming a refund or abatement of overreported federal income tax, social security tax, Medicare tax, or Additional Medicare Tax, you must certify at least one statement under line 5. Check as many as apply.

- I repaid or reimbursed each affected employee for the overcollected social security tax and Medicare tax. For claims of employee social security tax and Medicare tax overcollected in prior years, I have a written statement from each affected employee stating that he or she hasn’t claimed (or the claim was rejected) and won’t claim a refund or credit for the overcollection.

- I have a written consent from each affected employee stating that I may file this claim for the employee’s share of social security tax and Medicare tax. For refunds of employee social security tax and Medicare tax overcollected in prior years, I also have a written statement from each affected employee stating that he or she hasn’t claimed (or the claim was rejected) and won’t claim a refund or credit for the overcollection.

- The claim for social security tax and Medicare tax is for the employer’s share only. I couldn’t find the affected employees, or each affected employee didn’t give me a written consent to file a claim for the employee’s share of social security tax and Medicare tax, or each affected employee didn’t give me a written statement that he or she hasn’t claimed (or the claim was rejected) and won’t claim a refund or credit for the overcollection.

- The claim is for federal income tax, social security tax, Medicare tax, or Additional Medicare Tax that I didn’t withhold from employee wages.

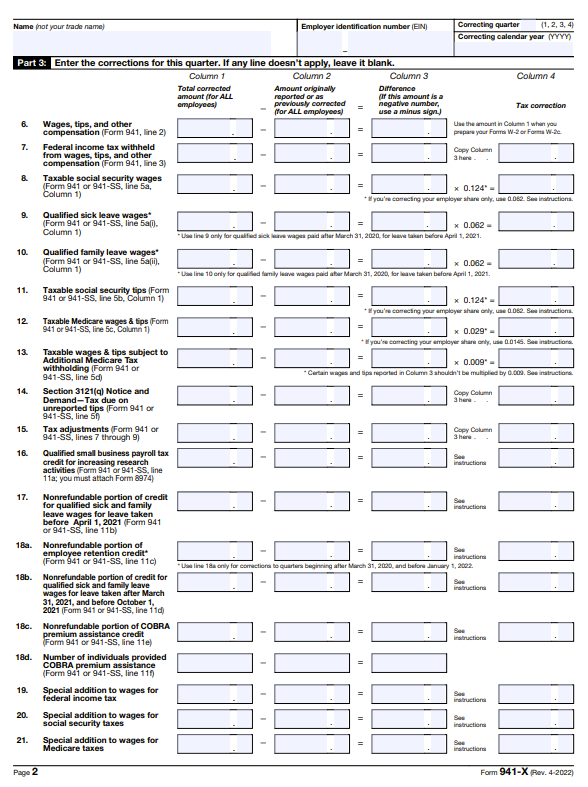

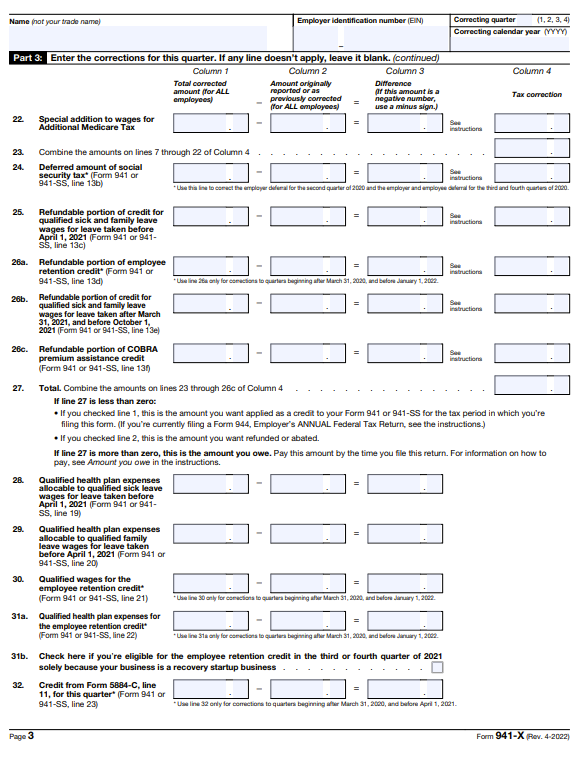

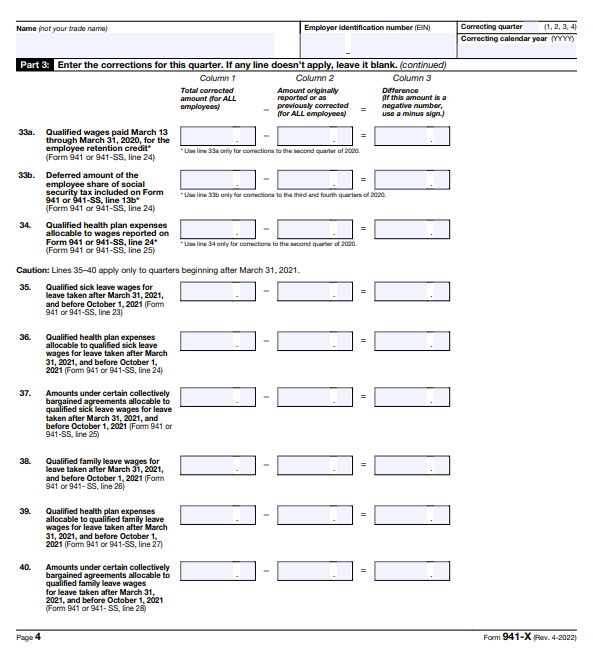

Part 3: Enter the Corrections for This Quarter.

Part 3 goes line by line from Form 941. You should enter the corrected amount in column 1 and the amount previously reported in column 2. Column 3 is the difference between column 1 and Column 2. Column 4 is the tax correction based on the specified tax rates for each line.

Line 27 is the total of all tax corrections in Column 4. If line 27 is less than zero, the amount will be applied as a credit to your Form 941 or Form 941-SS for the tax period in which you’re filing the Form 941-X, if you checked line 1, or will be refunded to you or abated, if you checked line 2. If line 27 is more than zero, you owe taxes. The amount should be paid by the time you file the Form 941-X. Lines 28 to 40 relate to COVID-related tax laws that impact employment taxes.

Part 4: Explain Your Corrections for This Quarter.

In part 4, you should check the boxes if they apply in lines 41 and 42 and give a detailed explanation of your corrections in the text box for line 43. Line 41 asks if you entered a correction that is the accumulation of both overreported and underreported amounts. If you check line 41, you should give details in the text box for 43. Line 42 asks if you have corrections related to reclassified workers. If so, give details in the text box for 43

Part 5: Sign Here.

In order to be accepted by the Internal Revenue Service (IRS) and avoid processing delays, you must complete all five pages of the Form 941-X and sign and date the form on page 5. Be sure to print your name and title and add your best daytime phone number in case the IRS needs to contact you about this form.

Paid Preparer Use Only

If you used a tax professional to file Form 941-X, they would enter their name, signature, date, firm name, address, EIN, preparer tax identification number (PTIN), and phone number.

When and Where Should I File Form 941-X?

You should file Form 941-X when you discover an error on a Form 941 you previously filed.

Period Of Limitations

The IRS imposes periods of limitations on Form 941 corrections, depending on the type of correction and when you identify the error. Typically, you may correct overreported taxes if you file Form 941-X within 3 years of the date the Form 941 was filed or 2 years from the date you paid the tax reported on the form, whichever is later. You may correct underreported taxes if you file Form 941-X within 3 years of the date the Form 941 was filed. If you filed the Form 941 before April 15 of the succeeding year, it is considered filed on April 15 for the purpose of the period of limitations. If you file within 90 days of the expiration of the period of limitations, be sure to follow the specific rules in the “which process should I use” section above.

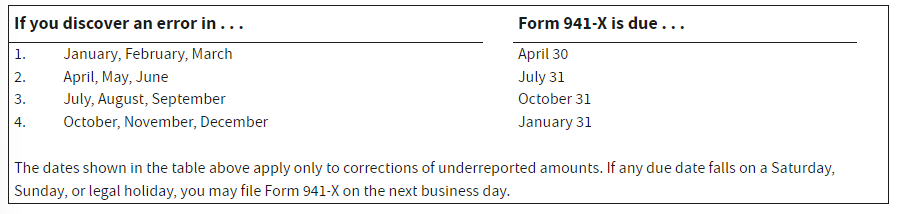

When To File Form 941-X

The due date depends on when you discover an error and whether you underreported or overreported your tax amount. Follow the directions in the “which process should I use to correct errors” section above.

If a due date falls on a holiday or weekend, you can file Form 941-X on the next business day. A properly addressed form is considered to be filed on time if it is postmarked by the U.S. postal service or sent by a private delivery service (PDS) on or by the due date.

If you have underreported tax, you must file Form 941-X by the due date for the return for the period in which you discovered the error. You must also pay the amount you owe by the time you file the Form 941-X. Typically, this allows your correction to be made without failure-to-pay or failure-to-deposit penalties and accumulated interest charges. The due dates are as follows:

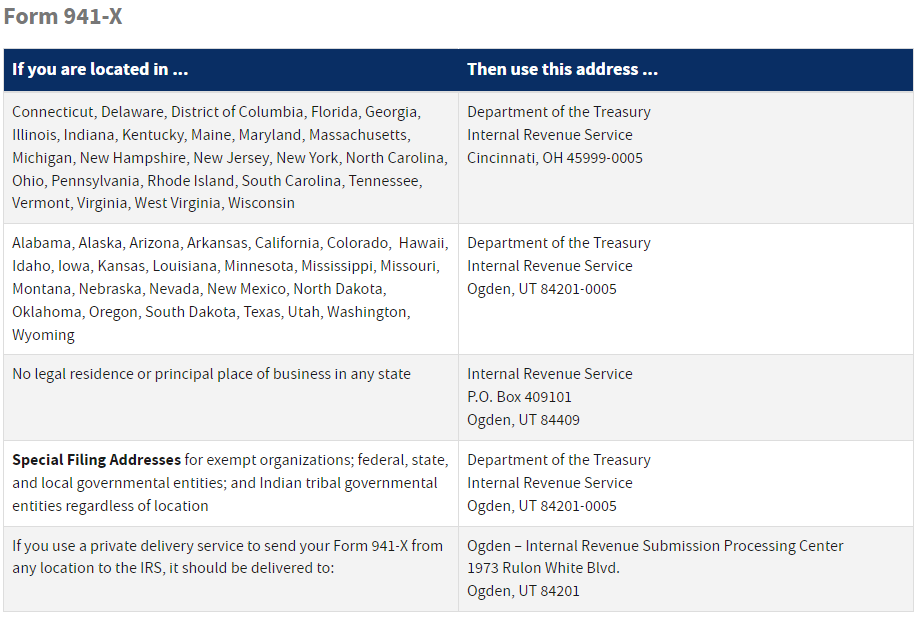

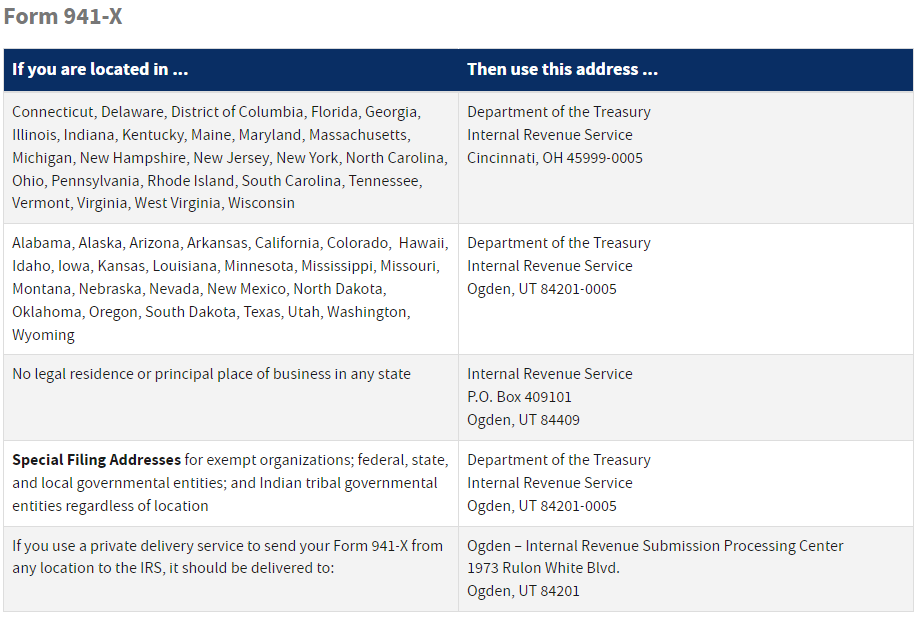

Where To File Form 941-X

Where to mail Form 941-X depends on the location of your principal place of business and whether your business is an exempt organization. The address is different if you choose to use a PDS to send your Form 941-X, rather than the U.S. postal service.

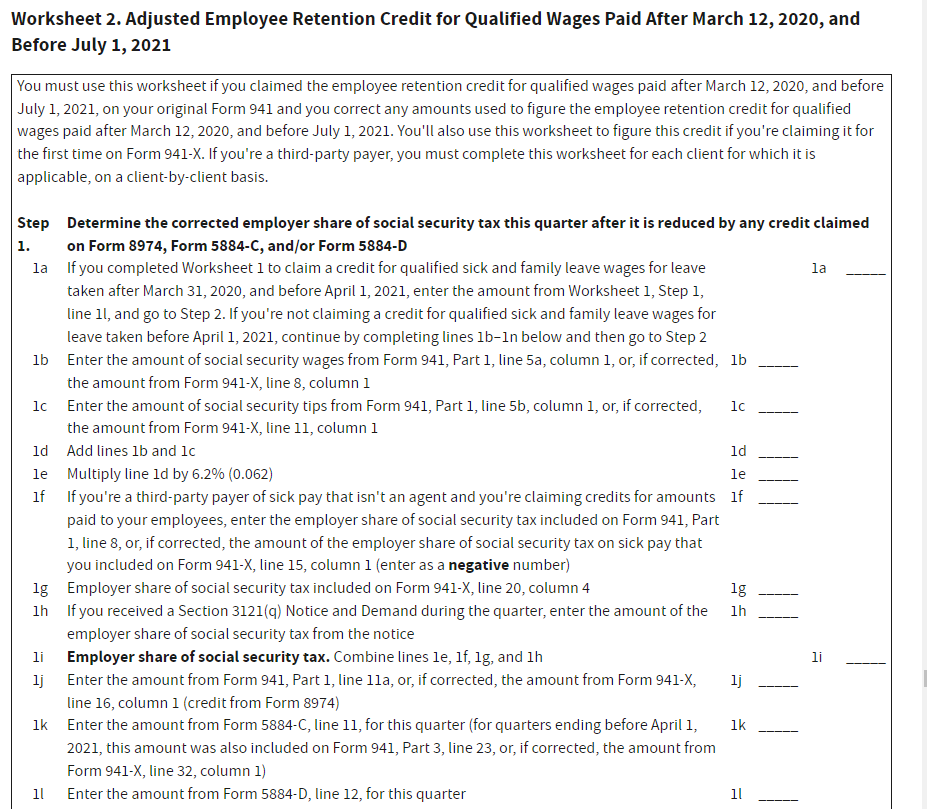

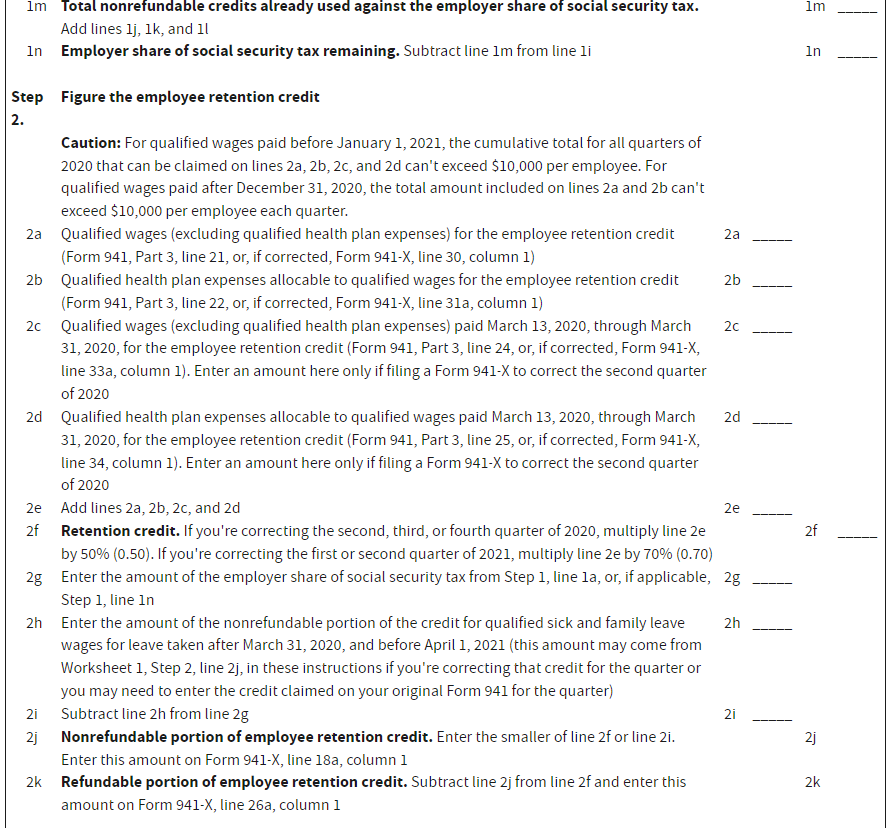

How To Claim The Employee Retention Credit On Form 941-X

The Taxpayer Certainty and Disaster Tax Relief Act of 2020 removed the restriction that kept any employer who received a PPP loan from claiming the employee retention credit. Qualified wages that were not counted as payroll costs in obtaining PPP loan forgiveness can be counted toward the employee retention credit. If you claimed an incorrect amount on your original Form 941 because you received a PPP loan, you can complete Worksheet 2 and file Form 941-X to claim the correct amount.

On Form 941-X, line 18a, the nonrefundable portion of the employee retention credit, and line 26a, the refundable portion of the employee retention credit, are used for corrections to quarters beginning after March 31, 2020 and before January 1, 2022. Enter the information from Worksheet 2 into these lines on Form 941-X. You will also need to explain your reason for the corrections in the text box of line 43 on Form 941-X.