Types of forms

Employee Payroll and Tax Forms

-

Employee Paystubs

When it is used

Provides detailed information on an employee's earnings, deductions, and net pay for each pay period

Who needs to use it

-

Business Owners

-

Employees

Frequency

Typically issued each pay period

-

-

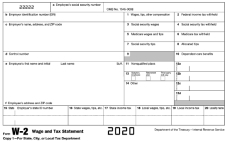

W-2 (Wage and Tax Statement)

When it is used

Reports an employee's annual wages and the amount of taxes withheld

Who needs to use it

-

Business Owners

-

Employees

Frequency

Annually, typically in January

-

-

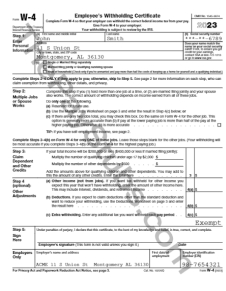

W-4 (Employee's Withholding Certificate)

When it is used

Used by an employee to specify personal and financial details that determine the amount of tax withheld from their paycheck

Who needs to use it

-

Business Owners

-

Employees

Frequency

When starting a new job or adjusting withholding

-

Contractor/Freelance Payroll and Tax Forms

-

Contractor Paystubs

When it is used

Provides detailed information on a contractor's earnings for each pay period

Who needs to use it

-

Business Owners

-

Freelancers/Contractors/Self-Employed

Frequency

Issued each pay period (varies depending on contracts)

-

-

1099-NEC (Nonemployee Compensation)

When it is used

Reports income earned by independent contractors or other non-employees

Who needs to use it

-

Business Owners

-

Freelancers/Contractors/Self-Employed

Frequency

Annually, typically in January

-

-

1099-MISC (Miscellaneous Income)

When it is used

Reports various types of income, such as rents, prizes and awards, or other income

Who needs to use it

-

Business Owners

-

Freelancers/Contractors/Self-Employed

Frequency

Annually, typically in January

-

-

W-9 (Request for Taxpayer Identification Number and Certification)

When it is used

Used to provide taxpayer identification number (TIN) to entities that will pay and report income

Who needs to use it

-

Business Owners

-

Freelancers/Contractors/Self-Employed

Frequency

When starting a new job or contract

-

Individual Tax Return Forms

-

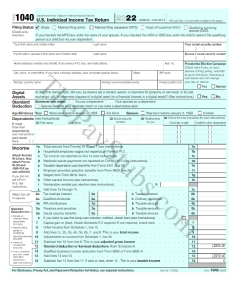

1040 (U.S. Individual Income Tax Return)

When it is used

The standard form individuals use to file personal income taxes

Who needs to use it

-

Any US Individual

Frequency

Annually, due in April

-

-

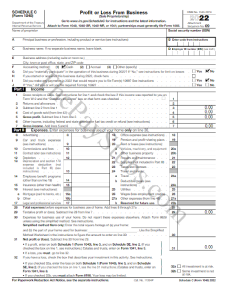

1040 Schedule C (Profit or Loss from Business (Sole Proprietorship))

When it is used

Used to report income or loss from a business operated or a profession practiced as a sole proprietor

Who needs to use it

-

Business Owners

-

Freelancers/Contractors/Self-Employed

Frequency

Annually, with 1040

-

-

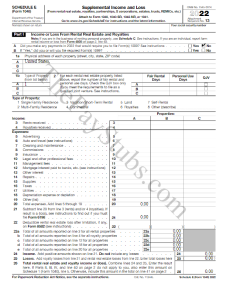

1040 Schedule E (Supplemental Income and Loss)

When it is used

Used to report income or loss from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests

Who needs to use it

-

Any US Individual with rental, royalty, partnership, S corporation, or trust income

Frequency

Annually, with 1040

-

-

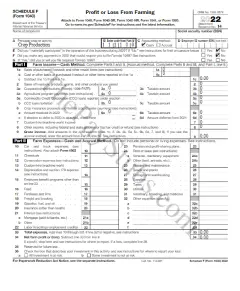

1040 Schedule F (Profit or Loss from Farming)

When it is used

Used to report farm income and expenses

Who needs to use it

-

Any US Individual who owns a farm

Frequency

Annually, with 1040

-

-

1040 Schedule 1 (Additional Income and Adjustments to Income)

When it is used

Used to report additional income, such as alimony, and any adjustments to income, like student loan interest or educator expenses

Who needs to use it

-

Any US Individual with additional income or adjustments not listed on the main 1040

Frequency

Annually, with 1040

-

-

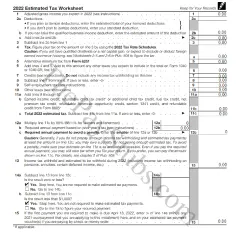

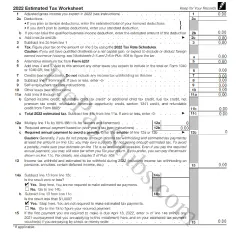

1040-ES (Estimated Tax for Individuals)

When it is used

Used to calculate and pay estimated tax, typically for income not subject to withholding

Who needs to use it

-

Any US Individual, especially those with income not subject to withholding

Frequency

Quarterly

-

-

1040-SE (Self-Employment Tax)

When it is used

Used to figure the tax due on net earnings from self-employment

Who needs to use it

-

Freelancers/Contractors/Self-Employed

Frequency

Quarterly

-

-

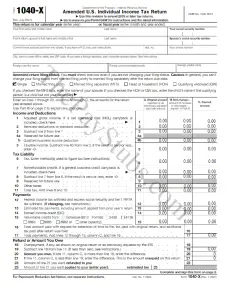

1040-X (Amended U.S. Individual Income Tax Return)

When it is used

Used to amend a previously filed Form 1040, 1040A, 1040EZ, 1040NR, 1040NR-EZ, 1040-PR, or 1040-SS

Who needs to use it

-

Any US Individual who needs to correct a filed 1040

Frequency

As needed

-

Business and Self-Employment Tax Forms

-

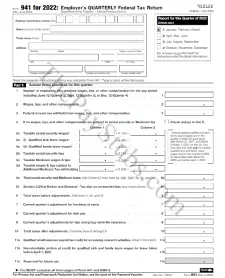

941 (Employer's Quarterly Federal Tax Return)

When it is used

Reports wages paid, tips your employees have reported to you, federal income tax withheld, both the employer's and the employee's share of social security and Medicare taxes, and additional Medicare tax withheld

Who needs to use it

-

Business Owners

Frequency

Quarterly

-

-

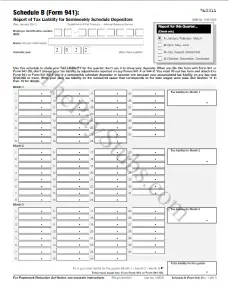

941 Schedule B (Report of Tax Liability for Semiweekly Schedule Depositors)

When it is used

Used by employers who report Form 941 taxes on a semiweekly deposit schedule to tell the IRS on which days they had a payroll tax liability

Who needs to use it

-

Business Owners

Frequency

Quarterly, with 941 if required

-

-

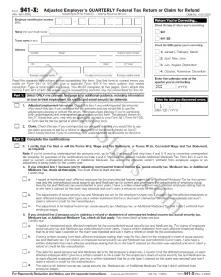

941-X (Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund)

When it is used

Corrects errors made on Form 941

Who needs to use it

-

Business Owners

Frequency

As needed to correct a filed 941

-

-

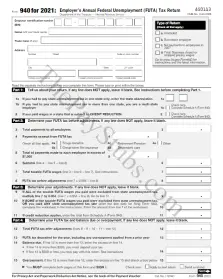

940 (Employer's Annual Federal Unemployment (FUTA) Tax Return)

When it is used

Reports your annual Federal Unemployment Tax Act (FUTA) tax

Who needs to use it

-

Business Owners

Frequency

Annually

-

-

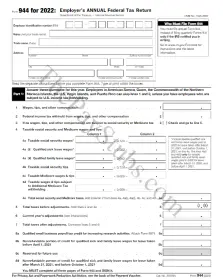

944 (Employer's Annual Federal Tax Return)

When it is used

Used by employers to report federal income tax withheld and both the employer's and the employee's share of social security and Medicare taxes

Who needs to use it

-

Small Business Owners

Frequency

Annually

-

-

2106 (Employee Business Expenses)

When it is used

Used by employees to deduct ordinary and necessary expenses for their job

Who needs to use it

-

Employees with deductible business expenses

Frequency

Annually, with 1040

-

-

SS4 (Application for Employer Identification Number)

When it is used

Used by businesses to apply for an employer identification number (EIN)

Who needs to use it

-

Business Owners

Frequency

Once, when starting a business

-

Business and Partnership Income Reporting

-

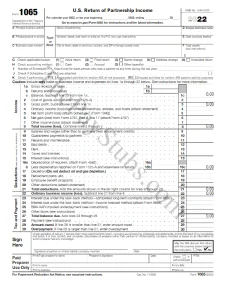

1065 (U.S. Return of Partnership Income)

When it is used

Used by partnerships to report income, deductions, gains, losses, and other relevant information from the operation of a partnership. It provides a comprehensive overview of the partnership's financial activity

Who needs to use it

-

Business Owners in a partnership

Frequency

Annually

-

-

8829 (Expenses for Business Use of Your Home)

When it is used

This form is used to calculate and deduct allowable expenses for the business use of a home. It includes expenses such as mortgage interest, property taxes, utilities, and maintenance costs

Who needs to use it

-

Business Owners

-

Freelancers/Contractors/Self-Employed

Frequency

Annually, with 1040

-

-

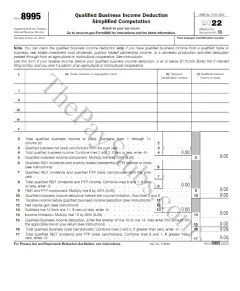

8995 (Qualified Business Income Deduction Simplified Computation)

When it is used

This form is used to calculate the qualified business income (QBI) deduction for eligible individuals. It simplifies the process of determining the deduction based on the taxpayer's business income, deductions, and other factors

Who needs to use it

-

Business Owners

-

Freelancers/Contractors/Self-Employed

Frequency

Annually, with 1040

-

-

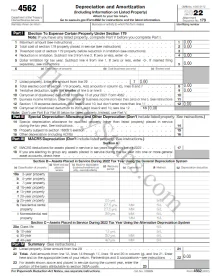

4562 (Depreciation and Amortization (Including Information on Listed Property))

When it is used

This form is used to report the depreciation and amortization of business assets, including listed property such as vehicles and equipment. It helps determine the allowable deductions for the wear and tear or obsolescence of business assets over time

Who needs to use it

-

Business Owners

-

Freelancers/Contractors/Self-Employed

Frequency

Annually, with 1040 or business tax return

-

-

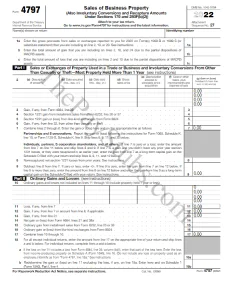

4797 (Sales of Business Property)

When it is used

This form is used to report the sale or exchange of business property, such as real estate, equipment, or vehicles. It helps determine the taxable gain or loss from the sale and provides important information for tax calculations

Who needs to use it

-

Business Owners

Frequency

As needed, with 1040 or business tax return

-

Other 1099 Income Forms

-

1099-DIV (Dividends and Distributions)

When it is used

This form reports dividends and distributions received from stocks, mutual funds, or other investments. It provides details about the income earned from these investments, which may be subject to taxation

Who needs to use it

-

Any US Individual with dividend income

Frequency

Annually, typically in January

-

-

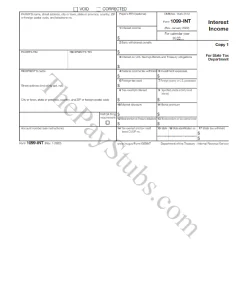

1099-INT (Interest Income)

When it is used

This form reports interest income earned from various sources, such as bank accounts, loans, or investments. It helps determine the taxable interest income that individuals have earned throughout the year

Who needs to use it

-

Any US Individual with interest income

Frequency

Annually, typically in January

-

-

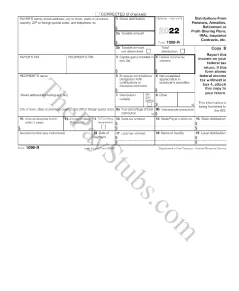

1099-R (Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans)

When it is used

This form reports distributions received from pensions, annuities, retirement plans, or profit-sharing plans. It provides information about the taxable portion of these distributions, which may be subject to income tax

Who needs to use it

-

Any US Individual with pension or annuity income

Frequency

Annually, typically in January

-

-

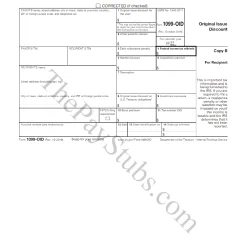

1099-OID (Original Issue Discount)

When it is used

This form reports the original issue discount (OID) on certain types of bonds or notes. It helps determine the taxable interest income for individuals who have purchased these bonds or notes

Who needs to use it

-

Any US Individual who purchased certain types of bonds or notes

Frequency

Annually, typically in January

-

-

1099-G (Certain Government Payments)

When it is used

This form reports certain government payments received, such as unemployment compensation, state tax refunds, or agricultural payments. It provides information about the taxable portion of these payments

Who needs to use it

-

Any US Individual who received certain types of government payments

Frequency

Annually, typically in January

-

-

1099-C (Cancellation of Debt)

When it is used

This form reports the cancellation of debt, which may be treated as taxable income. It provides details about the canceled debt and helps determine the potential tax liability associated with the debt cancellation

Who needs to use it

-

Any US Individual who had a debt cancelled

Frequency

Annually, typically in January

-

Education & Mortgage Information Reporting

-

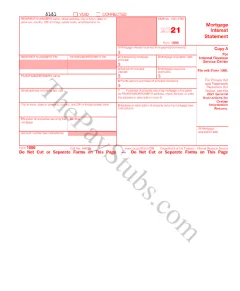

1098 (Mortgage Interest Statement)

When it is used

This form reports mortgage interest paid on a mortgage loan, providing important information for tax purposes. It helps determine the deductible amount of mortgage interest on an individual's tax return

Who needs to use it

-

Any US Individual who paid mortgage interest

Frequency

Annually, typically in January

-

-

1098-T (Tuition Statement)

When it is used

This form reports qualified tuition and related expenses paid by an individual or their dependent. It provides information that may be used to claim educational tax benefits, such as the tuition and fees deduction or education credits

Who needs to use it

-

Any US Individual who paid tuition

Frequency

Annually, typically in January

-

Non-resident Alien Tax Compliance

-

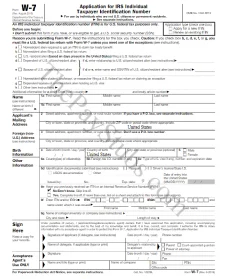

W7 (Application for IRS Individual Taxpayer Identification Number)

When it is used

This form is used by non-resident aliens who need an Individual Taxpayer Identification Number (ITIN) to comply with US tax requirements. It is necessary for individuals who are not eligible for a Social Security Number but have a US tax filing obligation

Who needs to use it

-

Non-resident aliens who need an ITIN

Frequency

Once, when needed

-

Cash Transactions Reporting

-

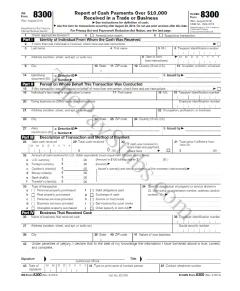

8300 (Report of Cash Payments Over $10,000 Received in a Trade or Business)

When it is used

This form is used to report cash payments received in a trade or business that exceed $10,000. It helps the IRS monitor and track large cash transactions to prevent money laundering and other illegal activities

Who needs to use it

-

Business Owners

Frequency

As needed, when receiving large cash payments

-

Information Return Extension Application

-

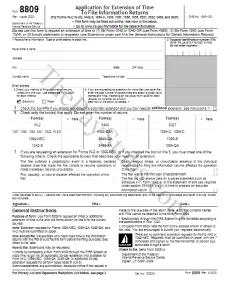

8809 (Application for Extension of Time to File Information Returns)

When it is used

This form is used to request an extension of time to file certain information returns. It provides additional time to gather necessary information and accurately complete the required returns

Who needs to use it

-

Any US Individual or Business Owners who need more time to file certain

information returns

Frequency

As needed, typically close to tax deadlines

-