We've Helped Customers Create Their 1098-T Form Using Our Generator

What Is Form 1098-T?

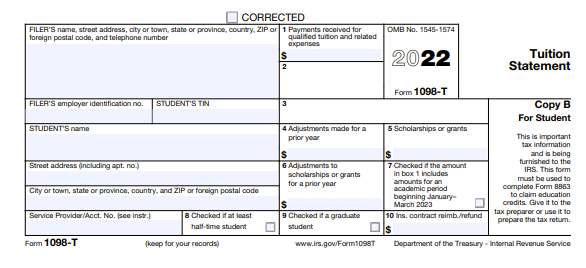

Eligible educational institutions file Form 1098-T, Tuition Statement, for any students with reportable transactions. Insurers also file Form 1098-T for individuals to whom they paid reimbursements or refunds of qualified tuition and related expenses.

What Is An Eligible Educational Institution?

An eligible educational institution is an accredited public, private, or nonprofit school offering higher education beyond high school. It includes colleges, universities, trade schools, and any other post secondary educational institutions eligible to participate in student aid programs offered by the U.S. Department of Education.

What Is Qualified Tuition And Related Expenses?

Qualified tuition and related expenses include amounts the student paid for tuition, fees, and course materials required for the student to enroll in or attend an eligible educational institution. Room and board, insurance, medical expenses (including student health fees), transportation, and other living expenses are not qualified educational expenses, even if they are paid to enroll in or attend an eligible educational institution. Additionally, tuition paid for courses involving sports, games, and hobbies are not qualified tuition expenses, unless the course is part of the student’s degree program.

Who Must File Form 1098-T?

Form 1098-T must be filed by an eligible educational institution that collects payments from students for qualified tuition and related expenses. If a third party collects payment on the eligible educational institution’s behalf, they must file Form 1098-T. If the third party does not have the information necessary to comply with the reporting requirements, the eligible educational institution must still file the Form 1098-T.

Additionally, insurers engaged in a trade or business of issuing refunds or reimbursements of qualified tuition and related expenses are required to file Form 1098-T.

Exceptions to Form 1098-T Filing Requirement

An eligible educational institution does not need to file Form 1098-T for students who:

- Receive no academic credit

- Are Nonresident aliens, unless requested otherwise

- Have qualified tuition and related expenses waived or paid entirely through scholarships

- Have qualified tuition and related expenses paid entirely through a formal billing arrangement with the student’s employer or governmental agency

What Is Academic Credit?

Academic credit is any coursework that moves the student closer to a postsecondary degree, certificate, or other recognized postsecondary educational credential. For example, a student majoring in accounting would receive academic credit for a cost accounting course. The eligible educational institution would be required to issue a Form 1098-T for this student.

On the other hand, a CPA who already received a postsecondary degree and certification may take courses on occasion with a local college for continuing professional education (CPE) credits. The CPE courses do not qualify for academic credit for the purposes of the Form 1098-T, and no Form 1098-T would need to be filed for the CPA.

What Is An Academic Period?

Form 1098-T should be filed for students enrolled in an eligible educational institution for any academic period in the year. An academic period may be a semester, trimester, or quarter.

Who Receives Form 1098-T?

Students who have paid qualified tuition and related expenses to an eligible educational institution will receive a Form 1098-T, unless an exception described previously applies.

There are three copies of Form 1098-T.

Copy A: Internal Revenue Service: This copy goes directly from the eligible educational institution to the IRS. It allows the IRS to confirm information entered by students on their tax returns against this information.

Copy B: Student: This is the copy you will receive in the mail or electronically online from your eligible educational institution. You can use this information to qualify for educational tax credits when you file your Form 1040, U.S. Individual Income Tax Return.

Copy C: Filer: This copy is retained by the eligible educational institution for their own records.

What Is Form 1098-T Used For?

The Form 1098-T is used to help you determine your eligibility for educational tax credits. There may be situations where the amount you actually paid for qualified tuition and related expenses is different from what is listed on the form. When you figure your eligibility for tax credits or tuition and fees deduction, you should use the amount you actually paid. Be sure to keep detailed receipts and documentation, regardless of whether you use the amount reported to you on the Form 1098-T or a different amount paid.

For the purposes of tax credits, you are considered to have made any payments made by your family members on your behalf or payments made from the proceeds of your student loans. Scholarships and grants are typically not included in amounts you have paid, unless you have also included the amount in income in the year received.

Form 1098-T Requirement For American Opportunity And Lifetime Learning Credit

The Internal Revenue Service requires that you have received Form 1098-T in order to claim the American opportunity credit or lifetime learning credit. However, your educational institution may not be required to furnish you with a Form 1098-T if you fall under one of the exceptions listed above. For example, educational institutions are not required to furnish Form 1098-T to a student who is a nonresident alien. If you happen to fall under one of the exceptions, you can still file for the credit(s) if you can demonstrate that you otherwise qualify for the credit(s) and can substantiate your payment of qualified tuition and related expenses.

If you qualify for the credit(s) and should have received a Form 1098-T from your educational institution, but you have not received it by the time you file your tax return, you can still claim the credit(s). In this instance, you will need to contact your educational institution to request they furnish you with the Form 1098-T. You will also need to demonstrate that you qualify for the credit(s) and can substantiate your payment of qualified tuition and related expenses.

When Is Form 1098-T Due?

There are two due dates for filing Form 1098-T. The form is to be furnished to the student by January 31 of the year following the calendar year being reported. The form is due to the IRS by February 28 of the year following the calendar year being reported, or March 31 if filed electronically.

How To File Form 1098-T

The eligible educational institution can file Form 1098-T electronically or through the mail. If mailing Form 1098-T to the IRS, the due date requirement will be satisfied if the form is properly addressed, postmarked, and mailed using the U.S. postal service or an accepted private delivery service (PDS) by the due date. The IRS lists approved PDSs, here. The IRS mailing address to file Form 1098-T depends on the state or province in which the eligible educational institution is located.

Is There A Penalty For Late Filing?

An eligible educational institution that files a Form 1098-T late will be subject to penalties. The penalty is $50 per informational return filed less than 30 days late, $110 for returns filed more than 30 days late but before August 1, and $290 if the form is never filed or filed after August 1.

How Do I Get My Form 1098-T?

As a student, you will receive your 1098-T either online or through the mail by January 31. If you have not received your 1098-T by then, and you believe you should have, contact your educational institution’s financial office.

How To Get Form 1098-T Online

If your eligible educational institution is required to furnish students with a written copy of Form 1098-T, it can usually provide the form electronically instead of on paper, as long as it meets the requirements of the IRS. The requirements are:

- The student must have consented to receiving electronic forms before the date it is to be furnished to the student.

- The electronic format must contain all required information per IRS Publication 1179, General Rules and Specifications for Substitute Forms 1096, 1098, 1099, 5498, and Certain Other Information Returns.

- The form must be posted on or before the due date and remain available on the website through October 15 of the same year.

- The student must be informed, electronically or by mail, of the posting and how to access it.

What Is Reported On Form 1098-T?

The Form 1098-T reports information about your tuition and related expenses paid to an eligible educational institution. The first few boxes are for the filer’s name, address, telephone number, and employer identification number (EIN). The following boxes are for the student’s TIN, name, and address. The student’s TIN is typically a Social Security Number (SSN), but it may also be an Individual Taxpayer Identification Number (ITIN) for certain nonresident aliens (if a Form 1098-T is specifically requested), their spouses, or dependents who are unable to get a SSN.

Service Provider/Account Number

This box may be filled in with an account number unique to the student.

Box 1. Payments Received for Qualified Tuition and Related Expenses

Box 1 reports the total amount of payments received by all sources during the calendar year for qualified tuition and related expenses, minus reimbursements or refunds during the calendar year. It is not reduced by the amount of scholarships and grants listed in box 5.

Boxes 2 and 3 are reserved for future use.

Box 4. Adjustments Made for a Prior Year

Box 4 reports adjustments made to the student’s financial account in the calendar year that relate to a prior year. Refunds or reimbursements of qualified tuition and related expenses made in a prior year, after 2002, will be listed in box 4. Reductions in charges made for qualified tuition and related expenses that relate to amounts billed in a prior year, after 2002, will also be listed in box 4. Adjustments in box 4 do not require you to amend the prior year return, but you will need to recapture any credit you received in the prior year related to the adjustment on your current year tax return.

Box 5. Scholarships or Grants

Box 5 lists the total amount of scholarships or grants received by the eligible educational institution and used to pay for the student’s tuition or related expenses. It includes payments from third parties, other than family members and loan proceeds, that were used to pay for the student’s costs of education.

As a student, you may be able to increase the value of educational tax credits (such as the American opportunity credit) and certain educational assistance (such as Pell Grants) by including the educational assistance listed in Box 5 in your income in the year it is received. It is not required, but if you include scholarship or fellowship grants in your income, it will not reduce your qualified educational expenses available to figure your American opportunity credit. Depending on your tax situation, the increase in your tax credit may be enough to increase your tax refund or reduce the amount of tax you owe, even after the increase in tax liability from additional income.

If you need to prove your income, be sure to utilize the check stub maker where you can select your preferred paystub template.

Box 6. Adjustments to Scholarships or Grants for a Prior Year

Box 6 includes adjustments to reduce the amount of scholarships reported in a prior year, after 2002. If there is an amount in this box, you may have to file a Form 1040-X, Amended U.S. Individual Income Tax Return, for the prior year.

Box 7.Checkbox for Amounts for an Academic Period Beginning in January

Through March of 2023

Box 7 is checked if payments received during the calendar year relate to an academic period that begins in the following quarter.

Box 8. Check if at Least Half-Time Student

Box 8 is checked if the student was at least half-time during any academic period that began in the calendar year. A half-time student is a student enrolled in at least half the full-time academic workload for the given course of study at your reporting institution. It must be equal to or greater than the standards set by the Department of Education.

Box 9. Check if a Graduate Student

Box 9 is checked if the student was a graduate student.

Box 10. Insurance Contract Reimbursements or Refunds

If the organization filing the Form 1098-T is an insurer, the total amount of reimbursements or refunds of qualified tuition and related expenses made to the student will be listed in box 10. Amounts listed in box 10 will affect the amount of educational tax credits you are eligible to claim. It may also result in an increase in tax liability in the year of your refund.