Is College Tuition Tax Deductible? - The Full Guide

Is college tuition tax deductible? As college tuition fees skyrocket throughout the United States, this question is more and more relevant for the broad population.

As with most tax questions, the answer to this one is complicated. College tuition is not directly tax-deductible in the same way charitable gifts are. However, there are many strategies for parents and students alike to take the most tax-related advantages for tuition payments.

There are three main ways to approach saving on your taxes through tuition payments:

preparation strategies, payment while the student is in school, and paying back loans. Every case has some way to use your tuition costs to save on taxes. The situations just vary significantly.

Also read: A Full Guide on How to Calculate Income Tax On A Pay Check

What are Tax Deductions for College Students?

Tax deductions reduce the amount of tax you incur and reduce your income tax burden. Tax deductions for college students can still reduce your tax liability.

Typically, you will have an easier time obtaining some of these tax deductions if you have a lower modified adjusted gross income. Many of them have income requirements and cutoffs.

Preparation Strategies

One of the best ways to navigate tax-deductible tuition is to do it beforehand (if you're a parent, that is). Perhaps the most popular education savings strategy is to start a 529 education savings account. These accounts allow you to prepare for your child's future studies by investing tax-free money into them year after year.

The savings account holder has no obligation if it is a year-round investment. And your withdrawals won't be taxed either as long as you use them for approved college expenses like tuition, books, and administrative fees.

They can even be used tax-free for room and board, but the student needs to be enrolled at least at half-time in the university for those withdrawals to remain untaxed.

You can use education saving account funds to pay down student loan debt. These withdrawals won't be taxed if the payment remains under $10,000.

A 529 account is similar to a Coverdell education savings account. However, the Coverdell account is not as beneficial for higher education expenses.

The primary benefit of a Coverdell account is its flexibility -- its funds can also be used for private primary and secondary school expenses. 529 accounts have more limitations in those cases. But Coverdell accounts also come with extra red tape to wade through, so they don't tend to be as wise for college savings.

Education Bonds

Education bonds are another way you can prepare education tax benefits before your child's enrollment or attendance. They have several requirements and qualifications, but they can be quite helpful if you manage to navigate the bureaucratic jungle they entail.

The basic principle behind education bonds is this: you can purchase US bonds without having to pay tax when you redeem them as long as you use the redemption funds exclusively for qualified education expenses.

The bonds can only be purchased by someone who is at least 24 years old, and cannot be put in the name of a child or dependent.

The idea behind them is for a parent or legal guardian to purchase the bond long before the child/children need the educational expenses entailed, allow the bond to grow at the guaranteed U.S. treasury rates, and then redeem it on behalf of the child once they are old enough to pursue higher education.

Also read: How to Review Your Paychecks Before Filing Income Taxes

Early Distributions from IRAs

Another less popular but equally effective way of preparing to spend tax-free money on your or your child's education is to take advantage of an IRA account. IRA savings accounts are almost always and exclusively used for retirement purposes -- indeed, the acronym is short for Individual Retirement Account. They are an excellent way to invest entirely untaxed money into your future.

Typically, withdrawing from your IRA account before you are 59 years old results in a 10% tax penalty. But as long as you are exclusively using that withdrawal for higher education expenses, you will not incur that tax penalty. That makes these accounts another option for saving up for your child's future education.

Tax credits for Current Students

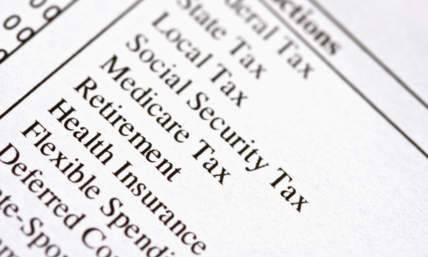

If you are a current student, there are two primary tax deduction options you can use as of 2022: the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit. One important thing to note here is that you cannot double-dip across the AOTC, the LLC, and any tax-free preparatory savings you're taking advantage of.

If you're withdrawing money from a tax-free savings account, you cannot then claim the AOTC or LLC on that money when your tax return comes around. Similarly, you cannot receive both the AOTC and LLC benefits.

Also read: Mandatory Deductions From Your Paycheck

American Opportunity Tax Credit

The American Opportunity Tax Credit allows parents (including non-dependent students) to lower their tax bills to up to $2,500 over four years. Because this refund tax credit has an effect on your tax refund even after you have reduced your tax liability from negative amounts or increased. Those who pay qualified tuition for the college or other institution may be eligible for the AOTC.

Lifetime Learning Credit

Lifelong Learning credits are similar to AOTC but less restrictive. These credits provide scholarships to qualified students enrolled in qualifying schools.

In contrast to the AOTC, the credits can be claimed for as long as one year. You can also pursue any degree or enroll in a full-time job. This is an attractive asset to the LLC for those who do not have undergraduate experience. It must also include the need to attend school at the beginning of each tax season.

Scholarships, Fellowships, and Employer Aid

Generally, a scholarship is credited or given to a student in an academic program to assist in obtaining a degree. These can be helpful for students in college or graduate schools. A fellowship is usually a sum of money paid to individuals to assist with studying.

These can get a little bit tricky when it comes to taxes, and their tax deductibility tends to vary from program to program. Generally, such grants will tell you whether or not they are tax-free (or to what extent they are), so you shouldn't need to worry about them too much.

If you have been given a scholarship or fellowship and plan to also take advantage of the American Opportunity Tax Credit or the Lifetime Learning Credit, consult with a financial advisor -- it is possible that your grant amount will bring you outside of the income limits for those two opportunities, but it is worth checking in.

Employer Aid

If you are receiving educational aid from your employer, there is less variance across programs. You can claim up to $5250 in tuition, fees, books, supplies, and equipment as tax-deductible, but no more. Any educational assistance benefits that go beyond that number count as income, and will be taxed as such.

This taxation is a vital thing to anticipate if you receive such benefits. Your paycheck can take an immense hit if you take several classes in a year -- you risk being hit by significant fees either in your pay's withholding or in your tax return next year.

If you are taking classes that relate to the job that is giving you educational assistance benefits, you may be able to make that amount even higher. You will need to make a case to the IRS that the class relates to your work, but if you can successfully do so, some institutions will allow you to deduct all of your educational assistance from your taxes.

Also read: What Qualifies As Proof Of Income?

Work-related Education Deductions for the Self-employed

Perhaps there's some higher education that you want to pursue, but you're self-employed so college tax assistance seems entirely inaccessible for you. But that semblance is wrong! The IRS has a special deduction for work-related educational funds when it comes to self-employed individuals. This also goes for certain kinds of artists and performers.

If you're interested in exploring this deduction more, the IRS has a worksheet you can fill out to determine.

The Student Loan Interest Deduction

After going through the world of US higher education, a lot of graduates will be saddled with a heaping helping of student debt. This is where the loan interest deduction comes in exceptionally handy -- you can deduct whatever interest you pay during the tax year from your taxable income up to $2500 worth.

Sadly for parents, this deduction only works if the taxpayer is also the student in question -- if you are assisting a child with repayment, you cannot claim the interest as a deduction for your taxes.

There are also several requirements surrounding the nature of the loan itself for the interest to be tax deductible. For example, the entire amount of the loan must have been used for qualified education expenses, all disbursed within a reasonable period of taking the loan out (typically defined as 90 days).

One of the best things about the student loan interest deduction is that it is what is known as an above-the-line deduction. That means that you don't need to itemize deductions if you want to take advantage of them.

Since the recent advent of the standard deduction, many people find it both easier and financially wiser to take the standard deduction and avoid itemizing their deductions. The above-the-line nature of the student loan interest deduction allows you to use it on top of the standard deduction, which is lovely, especially for people in lower-income categories.

To calculate your deductions, you can use the Student Loans Interest Deduction Worksheet provided by the IRS.

The Tuition and Fees Deduction

The Tuition and Fees Deduction is an old tax benefit that was effective until December 31, 2020. We will explore it so that you can understand the context behind the current landscape as well as comprehend other online resources on education-related tax benefits.

Under the Tuition and Fees Deduction, taxpayers could claim up to a $4,000 deduction on qualified education expenses (tuition and fees) paid during the tax year. It was limited to certain income thresholds but was a very useful deduction when it was available to be claimed.

Also read: Tax strategies for high-income earners

Frequently Asked Questions

Whenever you're dealing with tax credits and deductions in the U.S. system, you're inevitably going to run up against all sorts of red tape and complications. If you still don't understand what's going on, that's perfectly alright. We will hopefully be able to answer any and all of your further questions below.

Can I claim my child's college tuition on taxes?

It really depends. But if you want to know whether you can claim tuition expenses you paid in the last tax year on this year's tax return, the answer is probably not. While there are many different strategies you can take on to maximize your tax benefits here, most of them will not work for you at this point in time.

If you're asking because you have a child who is currently in school, your best bet is either the American Opportunity Tax Credit or the Lifetime Learning Credit. The better option among the two for you will depend on your specific circumstance, including your specific income status as well as what stage of life your child is in for this tax year.

Is college tuition tax-deductible for 2021?

The main change that has taken place in the 2021 tax year is the loss of the tuition and fees deduction as discussed above. Beyond that, the other tax benefits we have explored like the American Opportunity Tax Credit and the Lifetime Learning Credit are still tax deductible in 2021.

How do I claim college tuition on my taxes?

There are several different ways you can claim college tuition and fees on your taxes. The best way you can do this is long beforehand by investing in a 529 savings account or education bonds, but if you have not done so already, you will need to claim either the AOTC or the LLC credits.

The best way to do this is through your tax service as you are filing your return. Both credits require a specific form -- form 1098-T -- to be sent to you from your educational institution. The institution is supposed to send that to you by January 31 each year. Once you have received that form, you can fill it out along with any supplemental materials your specific credit requires.

After having completed the form and materials, you can scan them in, upload them to your tax return service, and the service should take you forward from there.

What college expenses are tax deductible?

Within each of these education tax deductions, you can only count certain items as tax-deductible -- these are known as qualified education expenses or qualified higher education expenses. In each case, the details may vary, but some are true throughout.

In general, qualified expenses are tuition, fees, or related expenses that a given institution of higher education requires for the student in question to be able to attend or enroll. This does not include room and board, insurance, medical expenses, or any living/recreation expenses unless otherwise specified.

The most general exception to this rule is if any of those expenses are required for the student to enroll in the university. Often, higher education institutions will require students to pay an activity fee of some kind -- these are counted within your tax-free education expenses.

The two most notable situational exceptions here are within the AOTC and the LLC. In the former, you can count books, equipment, and other supplies required by the student for their coursework as qualified education expenses. Delightfully enough, these can count towards the AOTC even if you have purchased them from outside the university itself.

For the LLC, you can write off payments involved in recreation, games, sports, hobbies, and non-credit courses -- as long as you can justify that the expense allowed you to acquire job skills or improve existing ones.

There is also an exception when withdrawing money from an education savings account like the 529 plan. Here, the withdrawal remains untaxed for room and board.

Can I write off a laptop for college?

You can, in some cases, write off a laptop for college under the AOTC or the LLC. For the AOTC, the laptop needs to be a requirement of the course. That can manifest in several different ways -- it could be an art course that requires a laptop that can run drawing software or an English class that requires you to be able to write while in a museum.

If you're unsure about whether or not a laptop would count as required for the course in question, it's always worth it to double-check with your professor. If you can get a written note from them that a laptop is needed for the class, you will be good to go.

Is food a qualified education expense?

Sadly, food is not a qualified education expense in most cases. You cannot write off individual food purchases, especially ones not made directly from the university campus. If you reside on campus, the food you purchase from the university is an eligible expense to pay for using funds from an education savings account, but not from the other education tax benefits.

Do I need receipts for education expenses?

The answer to this is a bit complicated. In general, as long as the expense is under $75, you don't need a receipt at all. For fees paid directly to the institution, you shouldn't need to worry about a receipt, since those will be covered in the Form 1098-T that your university is required to send you by January 31, as discussed above.

You should only need a receipt for expenses that you're deducting through things like the AOTC. For example, if you have purchased a laptop required for a class from a vendor outside of your university, and plan to write it off under the AOTC, you need a receipt for that.

Our check stub generator allows you to create pay stubs in a simple and easy-to-use manner.