There are seven parts to the Form 940, in addition to your identifying information and the paid

preparer sections at the top and bottom of the form.

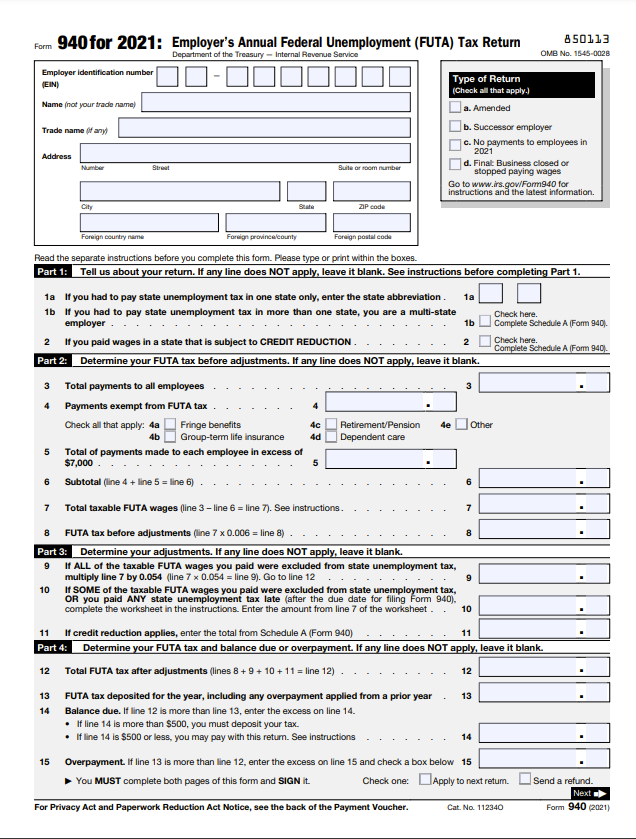

Identifying Information

The top section of the Form 940 is where you will enter your employer identification number

(EIN), name, trade name, and address. Name is the legal business

name, while a trade name is a

DBA, if any.

Checkbox For Type of Return

The top section of the Form 940 is where you will enter your employer identification number

(EIN), name, trade name, and address. Name is the legal business

name, while a trade name is a

DBA, if any.

Part 1: Tell us about your return

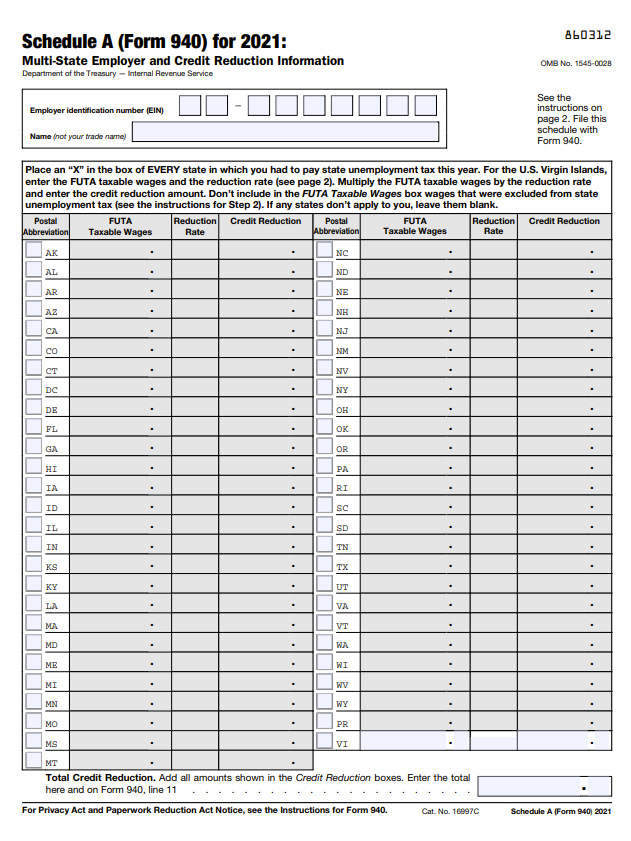

Part one asks about your state unemployment tax situation. If you pay unemployment taxes in only

one state, enter the state abbreviation in line 1a. If you paid in multiple states, check line

1b and complete Schedule A. If you paid wages in a credit reduction state, check line 2 and

complete Schedule A.

Part 2: Determine your FUTA tax before adjustments

Part 2 calculates your FUTA tax based on your payroll

data. Line 3 is where you will enter total

payments you made to all employees. Line 4 removes payments exempt from FUTA tax. If you have

any of these payments, you will need to check the boxes that apply:

- 4a Fringe benefits

- 4b Group-term life insurance

- 4c

Retirement/pension

- 4d Dependent care

- 4e Other

Line 5 removes payments made to each employee in excess of the $7,000 of wages subject to FUTA

tax. Line 6 sums the totals of lines 4 and 5 to calculate the entire reduction amount. Line 7

removes line 6 from line 3, and it is your total taxable FUTA wages.

Line 8 multiplies your total taxable FUTA wages from line 7 by 0.6% or 0.006. This calculates

your FUTA tax before adjustments, as if you received the maximum 5.4% credit from state

payments.

Part 3: Determine your adjustments

Line 9 asks if all of your taxable FUTA wages from line 7 were excluded from state unemployment

payments. If so, multiply line 7 by 5.4% or 0.054 and enter the result in line 9.

Line 10 asks if some of the taxable FUTA wages from line 7 were excluded or if you made any

state unemployment payments late. If so, enter the amount from the worksheet from the Form 940

instructions.

If you are in a credit reduction state, enter the total from the Schedule A to the Form 940 in

line 11.

Part 4: Determine your FUTA tax and balance due or overpayment

Part 4 is where you determine how much FUTA tax you owe and calculate any overpayment or unpaid

balance. The adjustments from part 3 add back to your FUTA tax before adjustments from part 2,

and the result is entered on line 12.

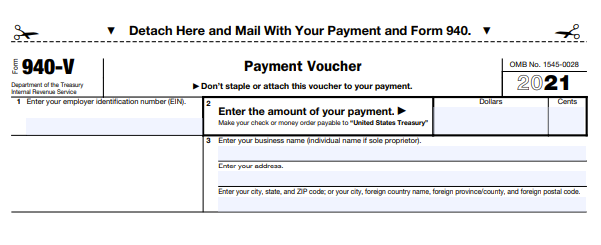

Line 13 is where you enter your FUTA tax deposits made during the year. Line 14 calculates your

balance due if line 12 is more than line 13. If the total is greater than $500, you have to

deposit your tax payment. If the total is less than $500, you can submit the Form 940-V payment

voucher with the tax return.

If line 13 is more than line 12, you are due a refund for an overpayment. You can either check a box

to apply it to the next return or send a refund.

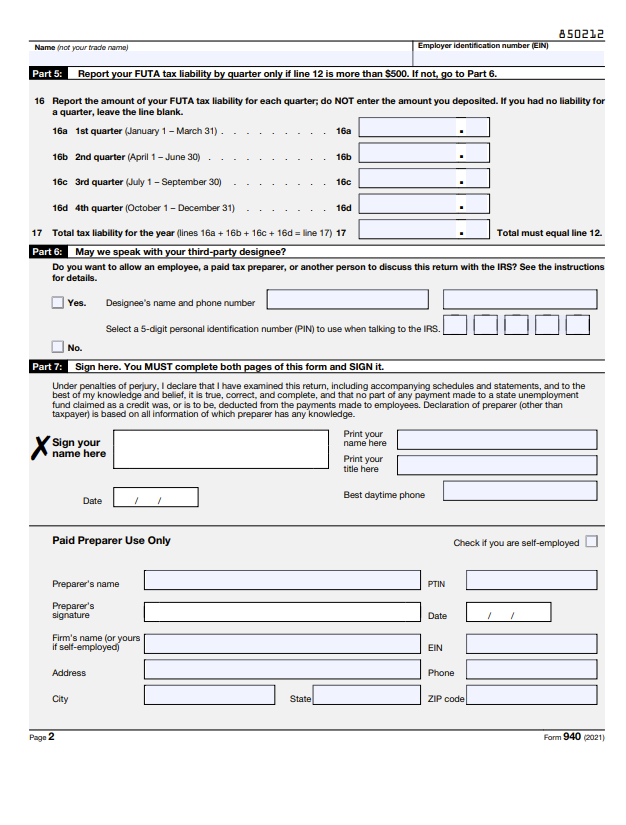

Part 5: Report your FUTA tax liability by quarter only if line 12

is more than $500

If your total FUTA liability from line 12 is greater than $500, you will fill out part 5. It

asks for the FUTA liability for each quarter. Lines 16a, 16b, 16c, and 16d are the four quarters

of the year. Line 17 sums the total tax liability for all four quarters. This number equals line

12.

Part 5: Report your FUTA tax liability by quarter only if line 12

is more than $500

If your total FUTA liability from line 12 is greater than $500, you will fill out part 5. It

asks for the FUTA liability for each quarter. Lines 16a, 16b, 16c, and 16d are the four quarters

of the year. Line 17 sums the total tax liability for all four quarters. This number equals line

12.

Part 6: May we speak with your third-party designee?

If you have an employee, paid tax

preparer, or another person who is allowed to talk to the Internal Revenue Service about

your Form 940, check the box for yes and enter their name and phone number. You can assign them

a 5 digit PIN to use when speaking with the Internal Revenue Service. If not, check the box for

no.

Part 7: Sign here

Your form is not complete until you appropriately sign and date it and enter a daytime phone

number.

Paid Preparer Use Only

If you used a paid preparer, their information will go at the bottom of the Form 940.