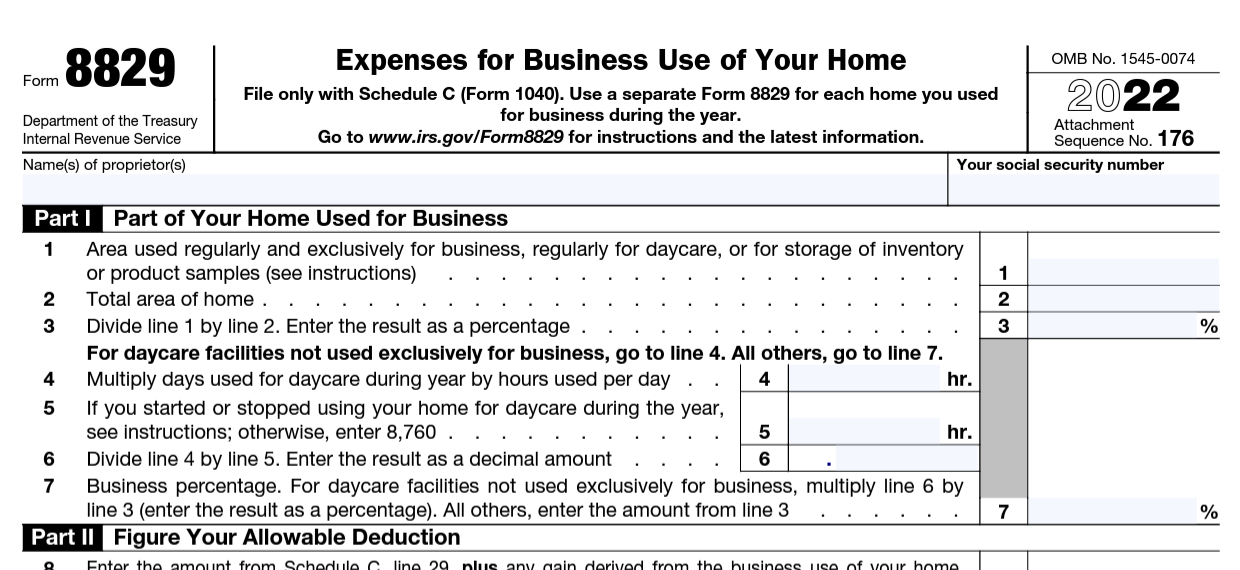

What is Form 8829?

Form 8829, Expenses for Business Use of Your Home, is a US tax form that accompanies Form 1040. Form 8829 is designed to help taxpayers calculate the deductible expenses associated with using a portion of their home for business purposes. In order to claim these expenses, the taxpayer must meet certain requirements, such as using all or a portion of the home exclusively and regularly for business and having the home be the taxpayer's main place of business, or a place where the taxpayer meets clients or customers.

The expenses that can be claimed on Form 8829 include a portion of mortgage interest, property taxes, utilities, insurance, repairs & maintenance, rent, depreciation, and other expenses. The amount of expenses that can be claimed is limited by the amount of income generated by the business and by the square footage of the portion of the home used for business.

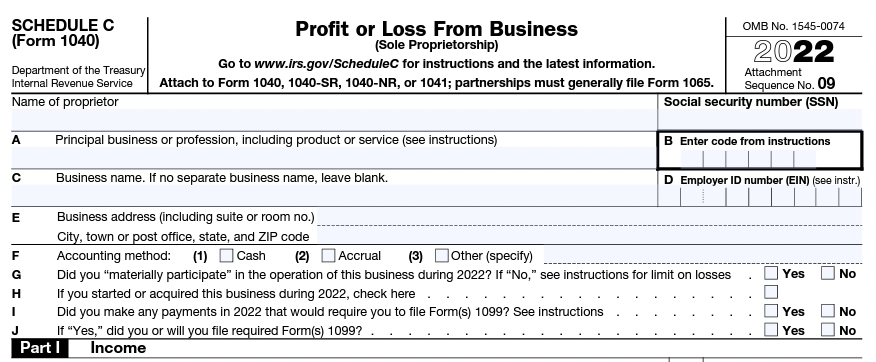

The allowable expenses calculated on Form 8829 will be carried to Schedule C, Profit or Loss From Business, where they will be reflected in your business income or loss for the tax year. The information on Schedule C is then carried to your Form 1040. Taxpayers with multiple homes used for business purposes must file a separate Form 8829 for each home.

If the taxpayer sells their home, they may also need to report any gain or loss on the sale of their home, taking into account the business use of the home and any depreciation taken on the home office.

Who needs to file Form 8829?

Form 8829 must be filed by individuals who use a portion of their home for business purposes and wish to claim the associated expenses as deductions on Schedule C on their federal income tax return. This includes the following:

-

Self-employed individuals: Self-employed individuals who run a business from their home, such as a consulting or freelance business, and use a portion of their home for business purposes may be eligible to claim the associated expenses as deductions on their federal income tax return.

-

Independent contractors: Independent contractors who work from home and use a portion of their home for business purposes may be eligible to claim the associated expenses as deductions on their federal income tax return. Should you need to produce your own payslips, you can check out the paystub generator.

-

Employees who are required to work from home: Employees who are required to work from home, either full-time or part-time, and use a portion of their home for business purposes may be eligible to claim the associated expenses as deductions on their federal income tax return. Note that if the employer reimburses any expenses, then the taxpayer cannot claim those expenses on their tax return. In this case, the taxpayer should only include business expenses not reimbursed by their employer on Form 8829.

To be eligible to claim expenses on Form 8829, the business use of the home must meet certain requirements, such as being used exclusively and regularly for business and being the taxpayer's main place of business or a place where the taxpayer meets clients or customers.

Who is not required to file Form 8829?

Individuals who do not use a portion of their home for business purposes are not required to file Form 8829. In addition, individuals who use their home for business purposes, but do not meet the requirements for claiming the associated expenses as deductions on their federal income tax return, are also not required to file the form.

The requirements for claiming expenses on Form 8829 include:

-

The business use of the home must be exclusively and regularly for business.

-

The home must be the taxpayer's main place of business or a place where the taxpayer meets clients or customers.

-

The expenses related to business use of the home must not be reimbursed by an employer..

If an individual does not meet these requirements, they are not eligible to claim the expenses associated with the business use of their home and are not required to file Form 8829.

When is the deadline for Form 8829?

Form 8829 is filed alongside Form 1040, which is generally due on or before the 15th day of the 4th month after the tax year in question (typically April 15th). If this day falls on a holiday, the deadline will automatically be pushed to the next weekday. If the taxpayer files for an extension of time to file their tax return, the due date for Form 8829 will be extended accordingly.

Form 8829 must be filed each year that the taxpayer claims expenses for the business use of their home. The form should be filed along with the taxpayer's federal income tax return, and the taxpayer should collect and retain any supporting documentation needed to prove the expenses, such as a general ledger, receipts, bank statements, and/or other records of expenses.

If an extension of time to file the tax return is granted, the deadline for Form 8829 will be extended accordingly.

Can the deadline for Form 8829 be extended?

Yes, the deadline for Form 8829 can be extended if the taxpayer files for an extension of time to file their federal income tax return. An extension of time to file the tax return does not extend the time to pay any taxes owed, but it does give the taxpayer additional time to complete and file their tax return, including Form 8829.

To file for an extension of time to file their federal income tax return, the taxpayer must file Form 4868, "Application for Automatic Extension of Time to File U.S. Individual Income Tax Return." This form must be filed by the original due date of the tax return, which is typically April 15th of each year. The extension granted by Form 4868 is typically six months, which means that the taxpayer has until October 15th of each year to file their tax return, including Form 8829.

An extension of time to file the tax return does not extend the time to pay any taxes owed. The taxpayer must estimate their tax liability and pay any taxes owed by the original due date of the tax return to avoid interest and penalties.

What is the penalty for late filing of Form 8829?

While there is no penalty specifically for the late filing of Form 8829, if a taxpayer fails to file their individual income tax return by the due date (typically April 15th), they may be subject to a penalty for late filing. Because Form 8829 must be filed alongside Form 1040, neglecting to file it will generally result in a letter from the IRS, or even an IRS audit if necessary.

The penalty for late filing is typically 5% of the amount of taxes owed for each month that the return is late, up to a maximum of 25% of the amount of taxes owed. In addition to the late filing penalty, the taxpayer may also be subject to interest on any taxes owed. The interest rate for underpayment of taxes is set by the IRS and is adjusted periodically.

The late filing penalty can be waived by the IRS in certain circumstances, such as if the taxpayer can show that the failure to file was due to reasonable cause and not due to willful neglect.

What happens if I don't file Form 8829?

If you don't file Form 8829, the IRS will not allow you to claim the expenses associated with the business use of your home as deductions on your federal income tax return. This means that you may end up paying more in taxes than you would have if you had claimed the expenses.

In addition to not being able to claim the expenses, if you do not file Form 8829 and the IRS determines that you should have, you may be subject to a penalty for late filing. The penalty for late filing is typically 5% of the amount of taxes owed for each month that the return is late, up to a maximum of 25% of the amount of taxes owed.

If you have a valid reason for not filing Form 8829, such as a reasonable cause, the IRS may choose to waive the late filing penalty. The IRS determines what constitutes reasonable cause on a case by case basis.

What supporting documents do I need to file with Form 8829?

While you do not need to file supporting documents with Form 8829, you should still keep records on hand. These records could include the following types of supporting documents:

-

Receipts, bank statements, or other records of expenses: This includes receipts for mortgage interest, property taxes, utilities, insurance, repairs, and depreciation, as well as any other expenses related to the business use of your home.

-

Documentation of the business use of your home: This includes any documentation that demonstrates that the business use of your home meets the IRS’s requirements, such as being exclusively and regularly used for business and being the main place of business or a place where you meet clients or customers.

-

Calculations of the expenses claimed: This includes a calculation of the portion of your home used for business, the square footage of the portion of your home used for business, and the expenses claimed on Form 8829. The Form will walk you through this calculation, and if you’re using tax software, it will do the calculation for you, as will a tax professional.

-

Other relevant documentation: This includes any other relevant documentation that supports the expenses claimed on Form 8829, such as a square footage calculation, depreciation schedules, and receipts for any capital expenditures (cars, expensive computers, expensive pieces of furniture, etc).

How do I file Form 8829?

Form 8829 is filed as part of the taxpayer's federal income tax return. The form can be filed either electronically, using a tax software or the help of a tax professional, or by mail.

Here are the steps to file Form 8829:

-

Gather all necessary documentation: Collect receipts and records of expenses, documentation of the business use of your home, calculations of the expenses claimed, and any other relevant documentation.

-

Complete Form 8829: Fill out the form by calculating the expenses associated with the business use of your home, including a portion of mortgage interest, property taxes, utilities, insurance, repairs, and depreciation.

-

File Form 8829 along with your federal income tax return: If you're filing electronically, you can use tax preparation software to complete and file your tax return, including Form 8829. If you're filing by mail, you can print a copy of the form, attach it to your federal income tax return, and send it to the address listed on the form’s instructions.

-

Keep records: Keep all supporting documentation and records of expenses for at least three years, in case the IRS asks for proof of expenses in the future.

Where should I mail Form 8829 to?

If you decide to mail your tax return, Form 1040 and the accompanying Form 8829 should be mailed to the appropriate Internal Revenue Service (IRS) processing center. Here are the various IRS processing centers as of March 2023:

| If you live in... | And you are not enclosing a payment, use this address | and you are enclosing a payment, use this address |

| Arkansas ,Connecticut, Delaware, District of Columbia, Illinois, Indiana, Iowa, Kentucky, Maine, Maryland, Massachusetts, Minnesota, Missouri, New Hampshire, New Jersey, New York, Oklahoma, Rhode Island, Vermont, Virginia, West Virginia, Wisconsin | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0002 | Internal Revenue Service P.O. Box 931000 Louisville, KY 40293-1000 |

| Pennsylvania | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0002 | Internal Revenue Service P. O. Box 802501 Cincinnati, OH 45280-2501 |

| Florida, Louisiana, Mississippi, Texas | Department of the Treasury Internal Revenue Service Austin, TX 73301-0002 | Internal Revenue Service P.O. Box 1214 Charlotte, NC 28201-1214 |

| Alabama, Georgia, North Carolina, South Carolina, Tennessee | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0002 | Internal Revenue Service P O Box 1214, Charlotte, NC 28201-1214 |

| Arizona, New Mexico

| Department of the Treasury Internal Revenue Service Austin, TX 73301-0002 | Internal Revenue Service P.O. Box 802501, Cincinnati, OH 45280-2501 |

| Alaska, California, Colorado, Hawaii, Idaho, Kansas, Michigan, Montana, Nebraska, Nevada, Ohio, Oregon, North Dakota, South Dakota, Utah, Washington, Wyoming | Department of the Treasury Internal Revenue Service Ogden, UT 84201-0002 | Internal Revenue Service P.O. Box 80250, Cincinnati, OH 45280-2501 |

Always be sure to check the IRS website for the most recently updated mailing addresses, as well as for any special instructions related to mailing your return. It's also important to note that if you owe taxes and you're mailing your return, you should send your payment (via check, not cash) along with your tax return to the appropriate address.

It's important to note that if you're filing electronically, you do not need to mail in a physical copy of Form 8829. The form should be included as part of your electronic tax return and does not need to be filed separately.

Can I file Form 8829 electronically?

Yes, you can file Form 8829 electronically. Electronic filing, also known as e-filing, is a fast, convenient, and secure method of filing your federal income tax return, including Form 8829.

E-filing is done through tax preparation software, which guides you through the process of completing and filing your tax return, including Form 8829. The software will calculate the expenses associated with the business use of your home and complete the form for you.

You can also solicit the help of a tax professional, who will file Form 1040 and Form 8829 on your behalf. They can either file electronically or by paper.

Once you have completed and reviewed your tax return, including Form 8829, you can electronically transmit the return to the IRS. The IRS will acknowledge receipt of your e-filed return, and you will typically receive your refund faster than if you had filed a paper return.