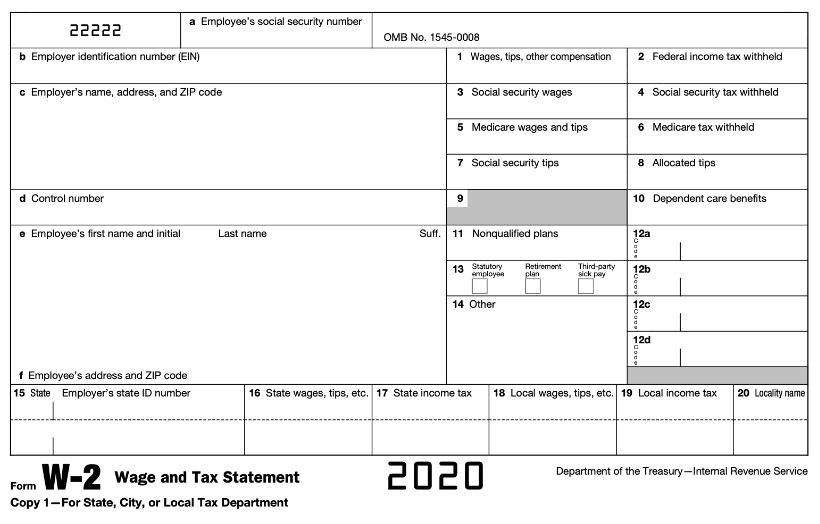

What Is A W2 Generator?

Heard a lot about the W2 form but you can’t quite define it? What even is a W2 generator? Let’s answer these questions and more. A W2 form or W2 online is not just another tax document but one of the most important tax documents you need to present. A wage and tax statement sums up what a W2 online is all about. Essentially, a w2 generator is a tool used to calculate all your yearly wages alongside the federal and state taxes withheld from the paychecks.

Let’s delve deeper into the anatomy of a W2 form, its uses, and how to create a W2 online using a W2 creator or a W2 maker in a few easy steps.

Each paycheck you receive from your employer has income tax deductions subtracted from it. That is due to the fact that both federal and state governments impose income tax throughout the calendar year. This helps you understand just how much money was made and how much went to taxes in a specific set period. A W2 form received in January 2021 for instance, will reflect the income and deductions of the year 2020.

This form is usually sent out to employees either as a hardcopy or a W2 online no later than January 31st of each year unless of course, that falls on a weekend then it must be sent out on the very next business day. There is an exception to this as well. If you are an independent contractor or a freelancer, then you will need to fill out a 1099 misc form by yourself as that is not a form given out by an employer for your services.

A business owner must send out the W2 form to both the employee as well as the IRS. There’s not much to be done with your W2 once you receive it. To the IRS, the W2 form is also known as international return since it is sent out to the various parties, mainly the following.

- The federal government

- The state

- The employee