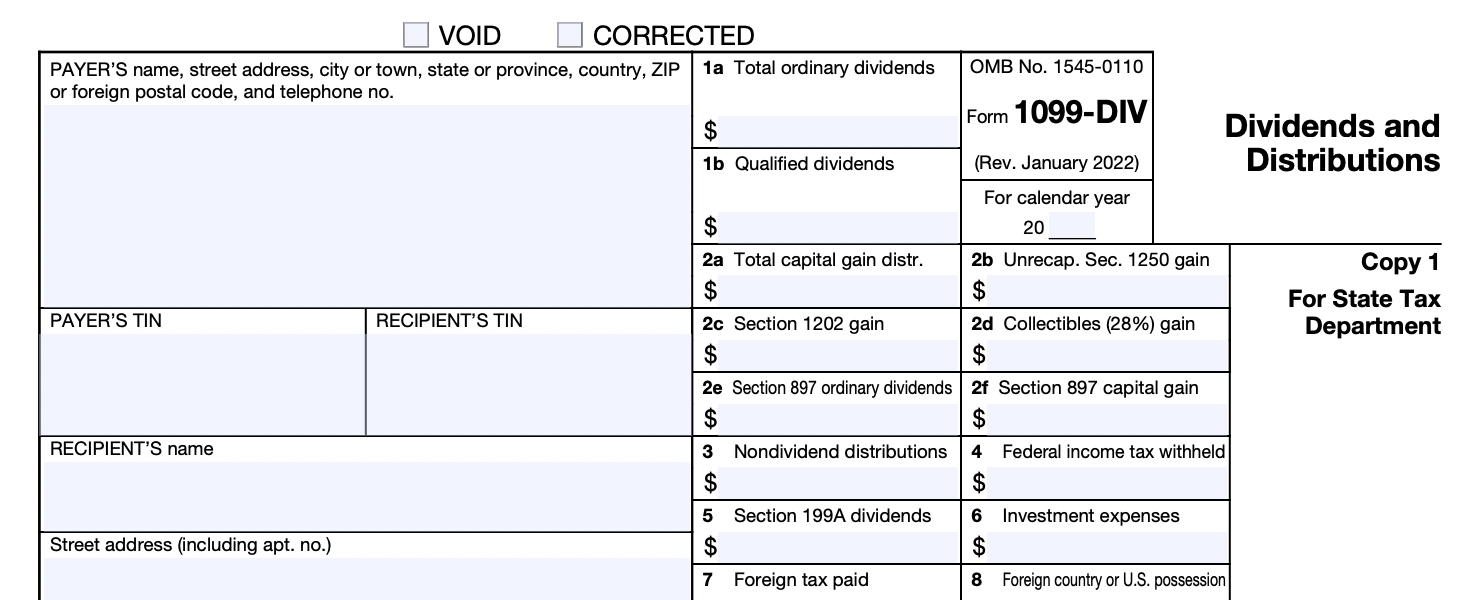

What is Form 1099-DIV?

Form 1099-DIV, Dividends and Distributions, is an important tax document for individuals and businesses who receive dividend income from investments. The form reports the amount of dividends received from various sources during each tax year. This includes ordinary dividends, qualified dividends, capital gain distributions, nonqualified dividends, and other distributions.

The recipient uses the information included on Form 1099-DIV to report the dividend income on their tax return for the year. Form 1099-DIV includes important information such as the recipient's taxpayer identification number and address, the payer's name and address, and the amounts of dividends and distributions received. The form will also specify whether the dividends are considered qualified dividends, which may be taxed at a lower rate, or nonqualified dividends, which are taxed as ordinary income.

Who needs to file Form 1099-DIV?

Form 1099-DIV is a critical part of the tax reporting process for dividend income. The form is used to report the total amount of dividends paid to a recipient during the tax year, and it is used by the Internal Revenue Service (IRS) to ensure that individuals and businesses are accurately reporting their dividend income on their tax returns.

If a payer has made payments of at least $10 in dividends to a recipient during the tax year, they are required to file Form 1099-DIV with the IRS and to provide a copy to the recipient. The payer could be a corporation, a mutual fund, a real estate investment trust (REIT), or any other entity that pays dividends. If the payer is an individual, they are required to file the form if they have paid dividends totaling at least $600 to a recipient during the tax year.

Recipients of dividend income should be aware of their obligation to report the income on their tax return, even if they do not receive a Form 1099-DIV from the payer. If a recipient does not receive a Form 1099-DIV from a payer that they received dividends from, they should contact the payer to inquire about the missing form.

Who is not required to file Form 1099-DIV?

The requirements for filing Form 1099-DIV are set by the Internal Revenue Service (IRS) and are designed to help track and report dividend income received by individuals and businesses. However, not all payers are required to file the form in every instance.

If the total amount of dividends paid to a recipient during the tax year is less than $10, the payer is not required to file a Form 1099-DIV. This exemption is designed to minimize the administrative burden of filing the form for small amounts of dividend income.

Additionally, some organizations, such as tax-exempt organizations, are exempt from filing Form 1099-DIV. This is because these organizations are already required to report their income and expenses to the IRS in a different manner.

Government entities, including state and local governments, are also exempt from filing Form 1099-DIV. This is because these entities are not considered taxpayers and do not pay taxes on the income they receive.

Finally, if a recipient of dividends is a foreign person or entity, the payer may not be required to file a Form 1099-DIV. This exemption can apply in situations where the payer is not physically located in the United States or if the recipient is a foreign corporation. However, in some cases, foreign recipients of dividends may still be required to report the income on their tax return and to pay taxes on the income, even if the payer is not required to file a Form 1099-DIV.

It is important for payers to understand their responsibilities when it comes to filing Form 1099-DIV, and to consult with a tax professional or the IRS if they have any questions or concerns. By accurately reporting dividend income, payers can help ensure that the tax system remains fair and that individuals and businesses are properly reporting their income.

When is the deadline for Form 1099-DIV?

The deadline for filing Form 1099-DIV with the Internal Revenue Service (IRS) is typically January 31st of each year. This deadline applies to both electronic and paper filings of the form. The form must be filed by this date to report the total amount of dividends paid to a recipient during the previous tax year. Filing by January 31st allows taxpayers time to properly report the information included on Form 1099-DIV on their individual tax returns.

It's important for payers to file the form on time, as failure to do so can result in penalties and fines from the IRS. The penalties for failing to file a Form 1099-DIV can range from $50, to $110, to $290 per form, depending on how late the form is filed for tax year 2022. The penalties can be even higher, all the way up to $580, for intentional disregard of the filing requirement.

In addition to filing the form with the IRS, payers are also required to provide a copy of the Form 1099-DIV to the recipient by January 31st of each year. The recipient uses this form to report the dividend income on their tax return, so it is important that they receive a copy in a timely manner.

Can the deadline for Form 1099-DIV be extended?

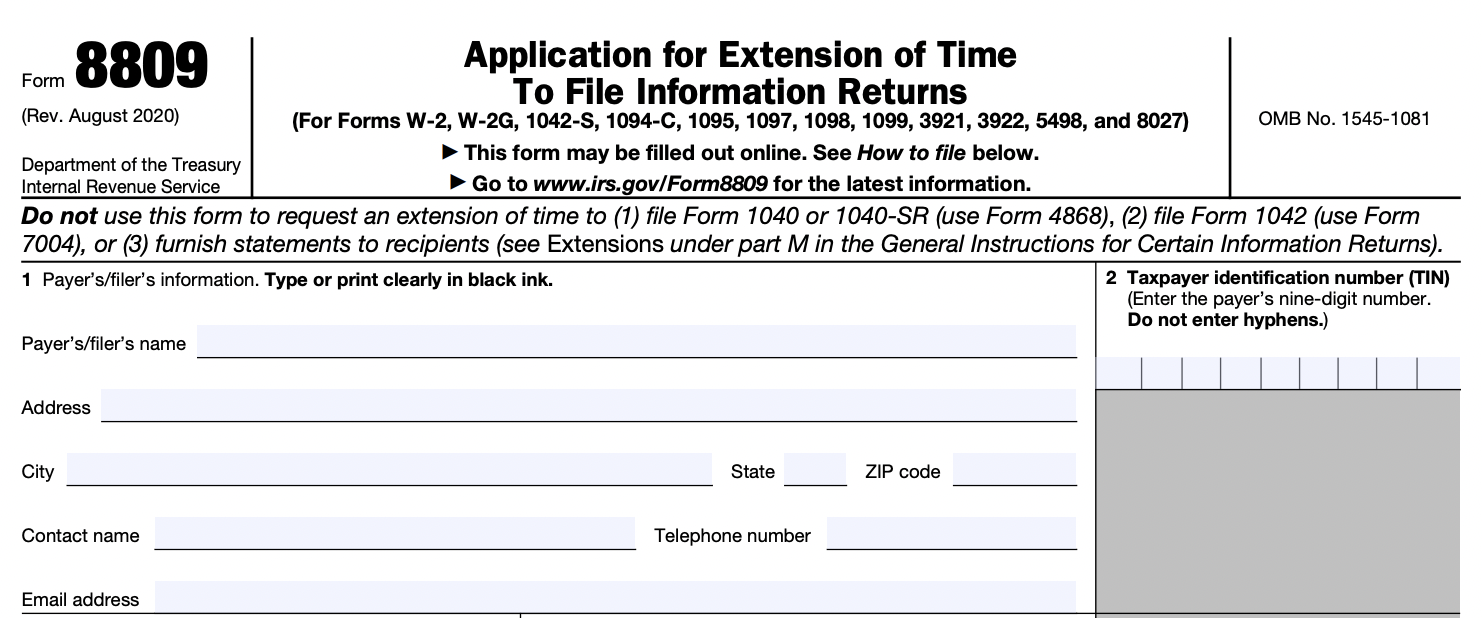

The normal deadline for filing Form 1099-DIV with the Internal Revenue Service (IRS) is January 31st of each year. However, if a payer is unable to file the form by this deadline, they can request an extension of time to file by submitting Form 8809, Application for Extension of Time to File Information Returns.

Form 8809 allows payers to request an extension of up to 30 days to file their Forms 1099-DIV. To be eligible for the extension, the payer must have a reasonable cause for the delay. If the extension is granted, the new deadline for filing Form 1099-DIV will be the last day of the 30-day extension period.

It's important to note that the extension of time to file Form 1099-DIV with the IRS does not relieve the payer of their obligation to provide a copy of the form to the recipient by the January 31st deadline. If a payer is unable to provide a copy of the form to the recipient by this deadline, they may be subject to penalties from the IRS.

What is the penalty for late filing of Form 1099-DIV?

Under the Internal Revenue Code, there are penalties for failure to file information returns, such as Form 1099-DIV, by the due date. The penalties are based on the length of time between the due date and the date the form is filed, and can be as high as $280 per form for late filings. Visit the IRS website to learn more about potential late filing penalties.

For example, if the form is filed within 30 days after the due date, the penalty is $50 per form. If the form is filed more than 30 days after the due date but before August 1st, the penalty is $110 per form. If the form is filed on or after August 1st, the penalty is $290 per form.

In cases of intentional disregard of the filing requirement, the penalty can be even higher. The penalty for intentional disregard is $580 per form. In addition to the penalties for late filing, payers may also be subject to additional penalties if they fail to provide a copy of the form to the recipient by the due date.

What happens if I don't file Form 1099-DIV?

If you don't file Form 1099-DIV, you may be subject to potentially significant penalties and fines from the Internal Revenue Service (IRS).

Form 1099-DIV is an important tax document used to report dividend income to the IRS and to the recipient of the income. Failing to file the form by the due date can result in penalties, which are calculated based on the length of time between the due date and the date the form is filed. The penalties can be as high as $290 per form for late filings and even higher for intentional disregard of the filing requirement.

In addition to the penalties for late filing, failing to file Form 1099-DIV can also impact the recipient of the income, as they may not have the necessary information to properly report the dividend income on their tax return. This can result in additional tax liability for the recipient, as well as interest and penalties from the IRS for underreporting their income.

Furthermore, failing to file Form 1099-DIV can also damage the payer's reputation and credibility in the eyes of investors, as it may be perceived as a failure to comply with the tax laws and regulations.

What supporting documents do I need to file with Form 1099-DIV?

When filing Form 1099-DIV, the following supporting documents should be kept on hand:

-

Details of dividend income paid: This information should include the payer's name and address, the recipient's name and address, the amount(s) of dividends and distributions received, and the date the amounts were paid.

-

Documentation of taxpayer identification numbers (TINs): This information should include the recipient's taxpayer identification number (TIN), which is usually their Social Security number, and the payer's TIN (EIN or SSN).

-

Backup withholding documentation: If backup withholding was taken from the recipient's dividend income, the payer should have documentation of the amount withheld and the reason for the withholding.

-

Statements or records of any foreign taxes paid: If foreign taxes were paid on the dividend income, the payer should have documentation of the amount paid and the country in which the taxes were paid. US recipients of Form 1099-DIV will use this information to file Form 1116, Foreign Tax Credit.

-

Records of any adjustments or corrections: If any adjustments or corrections were made to the amount of dividend income reported, the payer should have documentation of the correction and the reason for the adjustment.

It's important to keep accurate and complete records of all supporting documentation, as they may be requested by the Internal Revenue Service (IRS) for verification purposes. In the event of an audit, having the supporting documentation readily available can help the payer demonstrate compliance with the tax laws and regulations and avoid potential penalties.

How do I file Form 1099-DIV?

Form 1099-DIV can be filed either electronically or on paper, depending on the payer's preference and the number of forms being filed. Here's how to file Form 1099-DIV:

-

Electronic filing: The IRS encourages electronic filing of Form 1099-DIV, as it is faster and more accurate than paper filing. Payers can use commercial tax preparation software to electronically file their Forms 1099-DIV. The software will guide the payer through the process and generate the forms for filing.

-

Paper filing: If the payer chooses to file on paper, they should complete the Form 1099-DIV, making sure to include all of the required information, and mail it to the recipient. The payer should also file a copy of the form with the Internal Revenue Service (IRS) by the due date.

Whether you file electronically or on paper, the payer must file Form 1099-DIV with the recipient and the IRS by the due date, which is January 31st of the year following the year in which the dividend income was received.

It's important to file Form 1099-DIV accurately and on time, as the information on the form is used by the IRS to verify the recipient's reported income and ensure compliance with the tax laws and regulations. Inaccurate or late filings can result in penalties and fines from the IRS, so it's important to take the time to ensure that the form is complete and accurate before filing.

Where should I mail Form 1099-DIV?

If you choose to paper file, form 1099-DIV should be mailed to two different destinations: the recipient and the Internal Revenue Service (IRS).

-

Mail to the recipient: A copy of the completed Form 1099-DIV should be mailed to the recipient by the due date, which is January 31st of the year following the year in which the dividend income was received. The recipient will use this form to report the dividend income on their tax return.

-

Mail to the IRS: A copy of the completed Form 1099-DIV must also be filed with the IRS by the due date. The address to mail the form to depends on the payer's location. The IRS provides a list of addresses on its website, and commercial tax preparation software will automatically send the form to the correct address if the payer is filing electronically. Use the appropriate IRS filing address as follows:

| If your principal business, office or agency, or legal residence in the case of an individual, is located in | Use the following address |

| Alabama, Arizona, Arkansas, Delaware, Florida, Georgia, Kentucky, Maine, Massachusetts, Mississippi, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Texas, Vermont, Virginia | Internal Revenue Service Austin Submission Processing Center P.O. Box 149213 Austin, TX 78714 |

| Alaska, Colorado, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Montana, Nebraska, Nevada, North Dakota, Oklahoma, Oregon, South Carolina, South Dakota, Tennessee, Utah, Washington, Wisconsin, Wyoming | Department of the Treasury IRS Submission Processing Center P.O. Box 219256 Kansas City, MO 64121-9256 |

| California, Connecticut, District of Columbia, Louisiana, Maryland, Pennsylvania, Rhode Island, West Virginia | Department of the Treasury IRS Submission Processing Center 1973 North Rulon White Blvd. Ogden, UT 84201 |

| If your legal residence or principal place of business, or principal office or agency, is outside the United States... | Internal Revenue Service Austin Submission Processing Center P.O. Box 149213 Austin, TX 78714 |

Be sure to verify the address on the IRS’s website before filing. It's important to mail the forms to the correct address by the due date to ensure compliance with the tax laws and regulations and to avoid potential penalties from the IRS.

Can I file Form 1099-DIV electronically?

Yes, you can file Form 1099-DIV electronically. In fact, the Internal Revenue Service (IRS) encourages electronic filing, as it is faster and more accurate than paper filing.

To file Form 1099-DIV electronically, you can use commercial tax preparation software, or a professional tax preparer can electronically file it for you. The software will guide you through the process and generate the forms for filing. You simply need to enter the required information, such as the recipient's name and address, the amount of dividend income, and any backup withholding, and the software will handle the rest.

Electronic filing is faster and more convenient than paper filing, and it eliminates the need to print, sign, and mail paper forms. Additionally, electronic filing reduces the risk of errors and ensures that the forms are filed on time, which is important to avoid potential penalties from the IRS.