What is Form 8300?

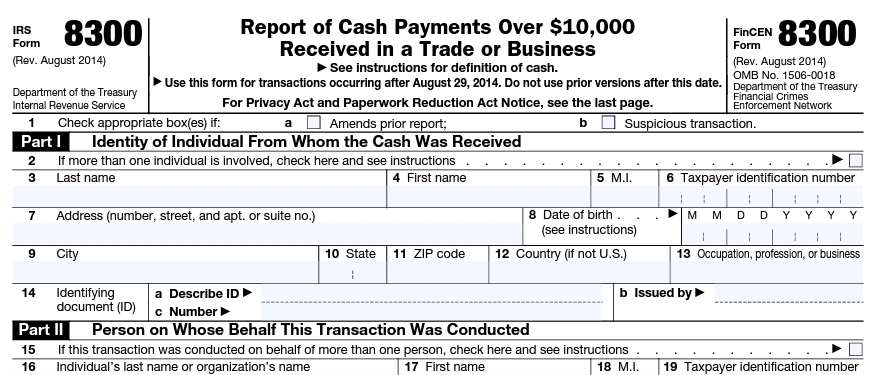

Form 8300 is a document used in the United States for reporting certain cash transactions to the Internal Revenue Service (IRS) and the Financial Crimes Enforcement Network (FinCEN). The form is officially titled "Report of Cash Payments Over $10,000 Received in a Trade or Business."

Businesses and individuals are required to file Form 8300 when they receive cash payments of more than $10,000 in a single transaction or in related transactions within a 12-month period. The purpose of this form is to help the government identify and combat money laundering, tax evasion, and other illegal activities that could involve large cash transactions.

The form requires information about the person or entity receiving the payment, the person or entity sending the payment, and details about the transaction itself. Once completed, Form 8300 must be filed with the IRS within 15 days of the qualifying transaction or transactions that equal or exceed $10,000 in cash.

Who needs to file Form 8300?

Form 8300 must be filed by individuals or businesses engaged in a trade or business who receive cash payments exceeding $10,000 in a single transaction or in related transactions within a 12-month period. The requirement applies to a wide range of businesses and professions, including but not limited to:

-

Retailers and wholesalers

-

Real estate brokers and agents

-

Vehicle dealers (cars, boats, planes, etc.)

-

Jewelers

-

Attorneys

-

Pawnbrokers

-

Travel agencies

-

Auctioneers

-

Insurance companies

The form should be filed for transactions involving cash, cashier's checks, bank drafts, traveler's checks, or money orders totalling a value of $10,000 or more. Note that personal checks and wire transfers are not considered cash for the purpose of Form 8300.

When you file Form 8300, the IRS also requires that you provide a written statement to all parties named in the form, to notify them that the form has been filed. The statement must include the following information:

-

The name and address of the cash recipient’s business.

-

Name and phone number of a contact person for the business.

-

The total amount of cash received in the 12-month period.

-

A statement that the cash recipient is reporting the information to the IRS.

It's essential for businesses to understand the reporting requirements and file Form 8300 when necessary to avoid potential penalties that could result from noncompliance.

Who is not required to file Form 8300?

While Form 8300 is required for many businesses and individuals involved in a trade or business that receive cash payments over $10,000, there are some exceptions to who must file the form and when. Generally, entities not required to file Form 8300 include:

-

Financial institutions: Banks, credit unions, and other similar entities that are already subject to the Bank Secrecy Act (BSA) reporting requirements don't need to file Form 8300. These institutions are required to file Currency Transaction Reports (CTRs) for cash transactions exceeding $10,000.

-

Non-business transactions: Form 8300 is meant for transactions related to a trade or business. Therefore, if you receive a large cash payment in a personal, non-business transaction, you generally do not need to file Form 8300. For example, if you sell your personal car for cash and it is not part of your business, you typically would not need to file the form.

However, keep in mind that the IRS and FinCEN may still be interested in large cash transactions related to non-business activities if they suspect illegal activities or money laundering.

It's important to be aware of the specific circumstances and guidelines surrounding the filing of Form 8300, as well as the nature of the transactions, to determine whether or not you are required to file.

When is the deadline for Form 8300?

The deadline for filing Form 8300 is 15 days after the date of the qualifying transaction. If the 15th day falls on a weekend or a federal holiday, the form is due on the next business day. It's important to file the form in a timely manner to avoid potential penalties for noncompliance.

For example, if your business received related cash payments exceeding $10,000 on April 10, you would need to file Form 8300 with the IRS by April 25. If April 25th falls on a weekend or holiday, the deadline is automatically extended to the next business day. If you receive multiple related cash payments that exceed $10,000 in total within a 12-month period, you need to file Form 8300 within 15 days of the date when the total amount received equals or exceeds $10,000.

Can the deadline for Form 8300 be extended?

The deadline to file Form 8300 is strict and cannot be extended. Form 8300 must be filed within 15 days of the qualifying transaction. If the 15th day falls on a weekend or a federal holiday, the form is due on the next business day. The IRS and FinCEN do not provide any provisions for extending the deadline, and failure to comply with the deadline may result in penalties.

Here are some tips to help you meet the deadline:

-

Be proactive: Familiarize yourself with the Form 8300 requirements and be aware of any transactions that may require filing. Understanding the filing requirements will help you identify qualifying transactions quickly and allow you to start the filing process promptly.

-

Gather information early: As soon as you become aware of a qualifying transaction, start collecting the necessary information and documentation to complete Form 8300. The sooner you have all the required details, the easier it will be to file the form on time.

-

File the form electronically: Using the FinCEN BSA E-Filing System to file Form 8300 electronically can save time and provide you with immediate confirmation of receipt. Filing electronically is more efficient and reduces the likelihood of errors compared to paper filing.

-

Seek professional assistance: If you're unsure about the process or need help completing the form, consult a tax professional or attorney experienced in these matters. They can provide guidance and support to ensure you meet the filing deadline.

By following these tips and remaining proactive, you can minimize the risk of missing the deadline and avoid potential penalties associated with late or non-filing of Form 8300.

What is the penalty for late filing of Form 8300?

The penalties for not filing Form 8300 on time or providing incomplete or incorrect information can be significant. As of 2023, the IRS website lists the penalties as follows (keep in mind that these amounts may be adjusted for inflation and may change over time):

-

For each failure to file a complete and correct Form 8300 on time, the penalty is $260 per form. If the failure is corrected on or before the 30th day after the original deadline, the penalty is reduced to $50 per form.

-

If the failure to file is due to intentional disregard of the requirement, the penalty increases to the greater of $26,480 or the amount of cash received in the transaction (up to $105,500) per form.

-

If the filer is a small business with gross receipts of $5 million or less, the maximum penalty for unintentional violations in a calendar year is $1,059,500.

-

For other businesses, the maximum penalty for unintentional violations in a calendar year is $3,178,500.

These penalties can be significant, especially for businesses with multiple late filings or incomplete forms. It is crucial to comply with the filing requirements and deadlines to avoid such penalties.

What happens if I don't file Form 8300?

If you fail to file Form 8300 when required, you may face potentially significant civil or criminal penalties depending on the nature of the circumstances. The penalties for not filing Form 8300 or providing incomplete or incorrect information can be substantial.

Civil penalties:

-

The penalty for each failure to file a complete and correct Form 8300 on time is $260 per form.

-

If the failure to file is due to intentional disregard of the requirement, the penalty increases to the greater of $26,480 or the amount of cash received in the transaction (up to $105,500) per form.

-

Maximum penalties for unintentional violations in a calendar year vary depending on the size of the business, ranging from $1,059,500 for small businesses to $3,178,500 for larger businesses.

Criminal penalties:

-

In cases where the failure to file Form 8300 is determined to be willful, the individuals responsible for the noncompliance may face criminal penalties. These penalties can include fines, imprisonment, or both.

What supporting documents do I need to file with Form 8300?

When filing Form 8300, you generally do not need to submit supporting documents along with the form. However, you must provide accurate and complete information on the form itself, which may require collecting specific documents and details about the transaction and the parties involved.

Information you'll need for Form 8300 includes:

-

Personal details of the individual or business receiving the payment, such as name, address, Taxpayer Identification Number (TIN), and occupation.

-

Personal details of the individual or entity providing the payment, such as name, address, TIN, date of birth, and occupation.

-

Description of the transaction, including the date(s), amount(s) of cash received, and nature of the goods or services provided.

-

Method of payment (cash, cashier's check, bank draft, traveler's check, or money order) and specific details about the payment instruments, such as serial numbers and issuing banks or institutions.

While you don't need to submit these supporting documents along with Form 8300, it is important to retain them for your records in case the IRS or FinCEN requests further information or conducts an audit. You should keep copies of Form 8300 and all related documents for at least five years from the date of the transaction.

How do I file Form 8300?

You can file Form 8300 electronically or by mailing a paper form. Here are the two methods:

-

Electronic Filing: The preferred method for filing Form 8300 is electronically through the Financial Crimes Enforcement Network's (FinCEN) BSA E-Filing System. To do this, you need to create an account and enroll in the system. Visit the BSA E-Filing System website and follow the instructions to register, enroll, and submit your form(s).

-

Paper Filing: If you choose to file a paper Form 8300, you can download the form from the IRS website (https://www.irs.gov/pub/irs-pdf/f8300.pdf).

Before submitting the form, double-check that all the required information is accurate and complete. Retain a copy of the completed form and any supporting documents for at least five years, as the IRS or FinCEN may request them for review or during an audit.

When you file Form 8300, the IRS also requires that you provide a written statement to all parties named in the form, to notify them that the form has been filed. The statement must include the following information:

-

The name and address of the cash recipient’s business.

-

Name and phone number of a contact person for the business.

-

The total amount of cash received in the 12-month period.

-

A statement that the cash recipient is reporting the information to the IRS.

Where should I mail Form 8300 to?

If you choose to file a paper Form 8300, you should mail the completed form to the following address:

Internal Revenue Service

Detroit Computing Center

P.O. Box 32621

Detroit, Ml 48232.

However, keep in mind that the preferred method for filing Form 8300 is electronically through the Financial Crimes Enforcement Network's (FinCEN) BSA E-Filing System. To file electronically, visit the BSA E-Filing System website and follow the instructions to register, enroll, and submit your form.

Can I file Form 8300 electronically?

Yes, you can file Form 8300 electronically, and it is the preferred method for submitting the form. To file electronically, you need to use the Financial Crimes Enforcement Network's (FinCEN) BSA E-Filing System.

Follow these steps to file Form 8300 electronically:

-

Visit the BSA E-Filing System website.

-

Create an account by registering on the website.

-

Enroll in the BSA E-Filing System by following the instructions provided.

-

Once enrolled, you can complete and submit Form 8300 through the system.

Filing Form 8300 electronically has several advantages, such as faster processing, confirmation of receipt, and reduced likelihood of errors compared to paper filing.

Should you have the requirement to produce pay stubs for either yourself or your workers, you can always turn to the online paystub generator.