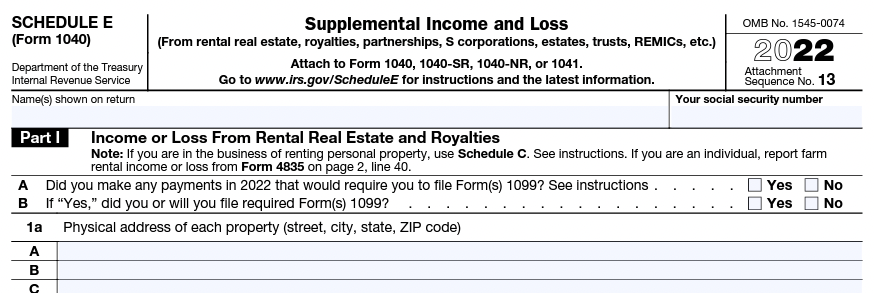

What is Form 1040 Schedule E?

Form 1040, Schedule E is a tax form used by the United States Internal Revenue Service (IRS) for taxpayers to report income from rental properties, partnerships, S corporations, estates, and trusts. The information reported on Schedule E is used to calculate the taxpayer's taxable income from these sources.

Schedule E, Supplemental Income and Loss, is used by individuals, trusts, and estates to report their share of income and expenses from various sources. The information reported on Schedule E is then included on Form 1040, the U.S. Individual Income Tax Return. Schedule E is an important document for taxpayers who have income from passive sources, such as rental properties, as it helps determine their tax liability.

Who needs to file Form 1040 Schedule E?

Form 1040 Schedule E is required for individuals who have passive income from a variety of sources.

-

Rental Income: Individuals who own rental real estate and receive passive rental income are required to file Schedule E. This includes those who own one or more rental properties and receive rent, security deposits, and any other income related to the rental.

-

Partnerships and S Corporations: Individuals who are partners in a partnership or shareholders in an S corporation are also required to file Schedule E if they receive income from these entities. This includes their share of the entity's profits and expenses.

-

Trusts and Estates: Beneficiaries of trusts and estates are also required to file Schedule E if they receive income from these entities. This includes their share of the trust's or estate's income, deductions, and credits.

-

Royalties: Individuals who receive royalty income, such as income from the use of a patent, trademark, or other intellectual property, are required to file Schedule E. This includes income from licensing or selling your intellectual property.

If you received any of the above forms of income, it's important to accurately report it on Schedule E, as this information will be used to calculate your taxable income and determine your tax liability. Failure to accurately report this income can result in the IRS charging penalties and interest.

Who is not required to file Form 1040 Schedule E?

Individuals who receive rental income, income from a partnership or S corporation, income from a trust or estate, or royalty income, are generally required to file Schedule E along with their Form 1040. Another less-common form of income reported on Schedule E is called REMIC income, or income earned from investing in Real Estate Mortgage Investment Conduits.

The income reported on Schedule E is then added up, and the total is carried over to the taxpayer’s form 1040, where it will be included in their taxable income.

If you did not receive any of these types of income, then you will not be required to file Schedule E along with your Form 1040. For more information about who must file Schedule E, check out the IRS’s website.

When is the deadline for filing Form 1040 Schedule E?

The deadline for filing Schedule E, as well as your individual tax return (Form 1040), is generally April 15th of each year. If April 15th falls on a weekend or a holiday, the deadline will be extended to the next business day.

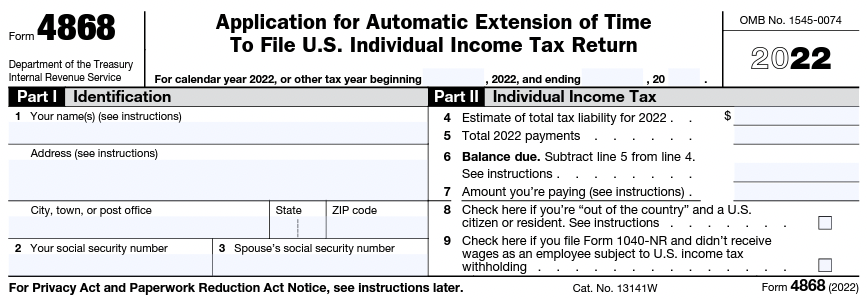

If you're unable to file your tax return by the April 15th deadline, you can request an extension of time to file using Form 4868, discussed below. Keep in mind that an extension of time to file is not an extension of time to pay, so any taxes owed must still be paid by the April 15th deadline to avoid penalties and interest.

If you're self-employed or have income from rental properties, partnerships, S corporations, trusts, estates, royalty income, or REMIC income, it's important to file your tax return and Schedule E by the April 15th deadline to avoid any potential penalties and interest.

Can the deadline for Form 1040 Schedule E be extended?

Yes, the due date for Form 1040 and the accompanying Schedule E can be extended. To request an extension of time to file your tax return and Schedule E, you'll need to submit Form 4868 to the IRS by the original due date (April 15th). Once approved, Form 4868 provides a six-month extension of time to file your tax return. Once the extension is granted, you'll have until October 15th to file your tax return and the accompanying Schedule E.

Keep in mind that an extension of time to file your tax return is not an extension of time to pay taxes owed. As a result, you should play on paying all taxes owed by the original due date of April 15th in order to avoid penalties and interest, which can be significant.

While an extension of time to file is usually granted without a problem, it's not guaranteed. Additionally, if you're unable to pay the taxes owed, you may still be subject to penalties and interest. Similarly, if the IRS determines that you owe additional taxes after the extension period has passed, you may still be subject to penalties and interest.

What is the penalty for late filing of Form 1040 Schedule E?

The penalty for late filing of Form 1040 Schedule E, as well as your individual tax return (Form 1040), can be substantial. The penalty for late filing is calculated as a percentage of the taxes owed and is charged for each month or part of a month that the tax return is late.

The penalty for late filing is typically 5% of any unpaid taxes for each month or part of a month that the tax return is late, up to a maximum of 25%. So, if your tax return is three months late, the penalty would be 15% of the taxes owed. If your tax return is more than 60 days late, there is also a minimum penalty of $205 or 100% of the taxes owed, whichever is smaller.

The penalty for late filing is separate from the penalty for late payment, which is typically 0.5% of the taxes owed for each month or part of a month that the taxes are not paid. The maximum penalty for late payment is 25%. Both penalties can be accrued at the same time, making the total penalty potentially significant.

What happens if I don't file Form 1040 Schedule E?

If you don't file Form 1040 Schedule E, you may face significant consequences from the Internal Revenue Service (IRS). Failing to file Schedule E can result in penalties, fines, and interest charges, as well as the possibility of criminal charges for tax evasion if neglecting to file is intentional and the amount of taxes owed is significant.

The most immediate consequence of failing to file Schedule E is that you may be charged penalties for late filing. The penalty is calculated as a percentage of the unpaid taxes and is charged for each month or part of a month that the tax return is late. The late filing penalty can be substantial and can add up quickly.

In addition to the late filing penalty, failing to file Schedule E can also result in the loss of deductions and credits that you're entitled to claim. This can increase your taxable income and result in a higher tax liability.

If the IRS determines that you owe additional taxes, you may also be subject to fines and interest charges. The interest charged by the IRS is typically higher than the interest charged by banks and other lending institutions, so it can add up very quickly.

Finally, if the IRS determines that you have willfully failed to file Schedule E, you may be subject to criminal charges for tax evasion. This is a serious offense that can result in fines, imprisonment, and a criminal record.

Failing to file Form 1040 Schedule E can result in significant consequences, including penalties, fines, and interest charges, as well as the possibility of criminal charges for tax evasion. To avoid these consequences, it's recommended that you file your tax return and Schedule E by the April 15th deadline, or request an extension of time to file using Form 4868 if you're unable to do so.

What supporting documents do I need to file with Form 1040 Schedule E?

While you generally do not need to attach supporting documentation to Schedule E when you file it, it is recommended that you keep supporting documents in your records, as it’s possible that the IRS could contact you to request evidence supporting the information reported on Schedule E. The specific supporting materials that you should maintain will depend on the type of passive income you're reporting on Schedule E.

For example, if you're reporting rental real estate income on Schedule E, you should keep records of documentation such as:

-

Rental agreements: A copy of each rental agreement for each property you own.

-

Expense records: Records of expenses related to each rental property, such as mortgage interest, property taxes, insurance, repairs and maintenance, and utilities.

-

Bank statements: Bank statements that show any rental income received, and credit or debit card statements showing rental expenses.

If you're reporting income from a partnership or S corporation on Schedule E, you'll need to keep records of:

-

Form K-1: A Schedule K-1 from each partnership or S corporation that shows your share of the entity's income, deductions, and credits.

If you're reporting income from a trust or estate on Schedule E, you'll need to keep records of:

-

Form K-1: A Schedule K-1 from each trust or estate that shows your share of the entity's income, deductions, and credits.

If you're reporting royalty income on Schedule E, you'll need to keep records of:

-

Royalty statements: Statements from the party that pays you the royalty income, showing the amount of the royalty payment and any deductions taken.

These are just examples, and the specific supporting documents you'll need to maintain will depend on your specific tax situation. If you're unsure what supporting documents you'll need to maintain related to your Schedule E, it's recommended that you consult with a tax professional for guidance. If you need to submit and produce your payslips, you can check out the instant paystub generator.

How do I file Form 1040 Schedule E?

Form 1040 Schedule E can be filed either electronically or by mail. Here's a general overview of the steps involved in filing Schedule E:

-

Gather required information: Before you start filing, you'll need to gather all the information and supporting documentation required to complete Schedule E. This includes information such as rental income, partnership income (Form 1065 Schedule K-1), trust and estate income (Form 1041 Schedule K-1), and royalty income, as well as documentation of expenses related to these sources of income.

-

Complete Schedule E: Schedule E is used to report various types of passive income, such as rental real estate income, income from partnerships and S corporations, income from trusts and estates, and royalty income. You'll need to complete the form by entering the required information, such as your name, address, and Social Security number. You'll also need to enter the details of your passive income and any related expenses.

-

File electronically or by mail: Once you've completed Schedule E, you can file the form either electronically or by mail. If you're filing electronically, you can use IRS e-file, which, another tax filing software (like Turbotax, H&R Block, Tax Slayer, etc), or you can hire a tax professional to file your return on your behalf. If you decide to file by mail, you'll need to print a copy of the completed form and mail it to the address indicated on the form.

Where should I mail Form 1040 Schedule E to?

The mailing address for Form 1040, Schedule E will depend on your state of residence and the type of form you are filing. The mailing addresses for Form 1040 and its schedules are listed on the IRS website, and you can find the correct address for your situation by using the IRS "Where to File" tool.

Here are the various IRS processing centers as of March 2023:

| If you live in... | And you are not enclosing a payment, use this address | and you are enclosing a payment, use this address |

| Arkansas ,Connecticut, Delaware, District of Columbia, Illinois, Indiana, Iowa, Kentucky, Maine, Maryland, Massachusetts, Minnesota, Missouri, New Hampshire, New Jersey, New York, Oklahoma, Rhode Island, Vermont, Virginia, West Virginia, Wisconsin | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0002 | Internal Revenue Service P.O. Box 931000 Louisville, KY 40293-1000 |

| Pennsylvania | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0002 | Internal Revenue Service P. O. Box 802501 Cincinnati, OH 45280-2501 |

| Florida, Louisiana, Mississippi, Texas | Department of the Treasury Internal Revenue Service Austin, TX 73301-0002 | Internal Revenue Service P.O. Box 1214 Charlotte, NC 28201-1214 |

| Alabama, Georgia, North Carolina, South Carolina, Tennessee | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0002 | Internal Revenue Service P O Box 1214, Charlotte, NC 28201-1214 |

| Arizona, New Mexico

| Department of the Treasury Internal Revenue Service Austin, TX 73301-0002 | Internal Revenue Service P.O. Box 802501, Cincinnati, OH 45280-2501 |

| Alaska, California, Colorado, Hawaii, Idaho, Kansas, Michigan, Montana, Nebraska, Nevada, Ohio, Oregon, North Dakota, South Dakota, Utah, Washington, Wyoming | Department of the Treasury Internal Revenue Service Ogden, UT 84201-0002 | Internal Revenue Service P.O. Box 80250, Cincinnati, OH 45280-2501 |

Always be sure to check the IRS website for the most recently updated mailing addresses, as well as for any special instructions related to mailing your return. It's also important to note that if you owe taxes and you're mailing your return, you should send your payment (via check, not cash) along with your tax return to the appropriate address.

The mailing addresses listed above are for taxpayers who are mailing a paper copy of their return. If you are filing your return electronically, you do not need to mail a paper copy of your return to the IRS.

Can I file Form 1040 Schedule E electronically?

Yes, you can file Form 1040 Schedule E electronically. The Internal Revenue Service (IRS) offers several options for individuals to file their tax returns electronically, including the IRS E-File system.

IRS e-file is a convenient and secure way to file your tax return and Schedule E. Alternatively, you can use another tax filing software (like Turbotax, H&R Block, Tax Slayer, etc), or you can hire a tax professional to file your return on your behalf.

When you file electronically, you'll need to provide information similar to what you would provide if you were filing a paper return. You'll need to provide information such as your name, address, Social Security number (SSN) or Taxpayer Identification Number (TIN), and information about your income and expenses.

Filing electronically has several benefits, including:

-

Faster processing: The IRS processes electronic returns more quickly than paper returns, so you can receive your refund more quickly.

-

Increased accuracy: Electronic filing reduces the risk of errors, as the tax preparation software will automatically check for errors and omissions.

-

Convenient and secure: You can file your tax return from the comfort of your own home, and your personal information will be transmitted securely to the IRS.