What is Form 1065?

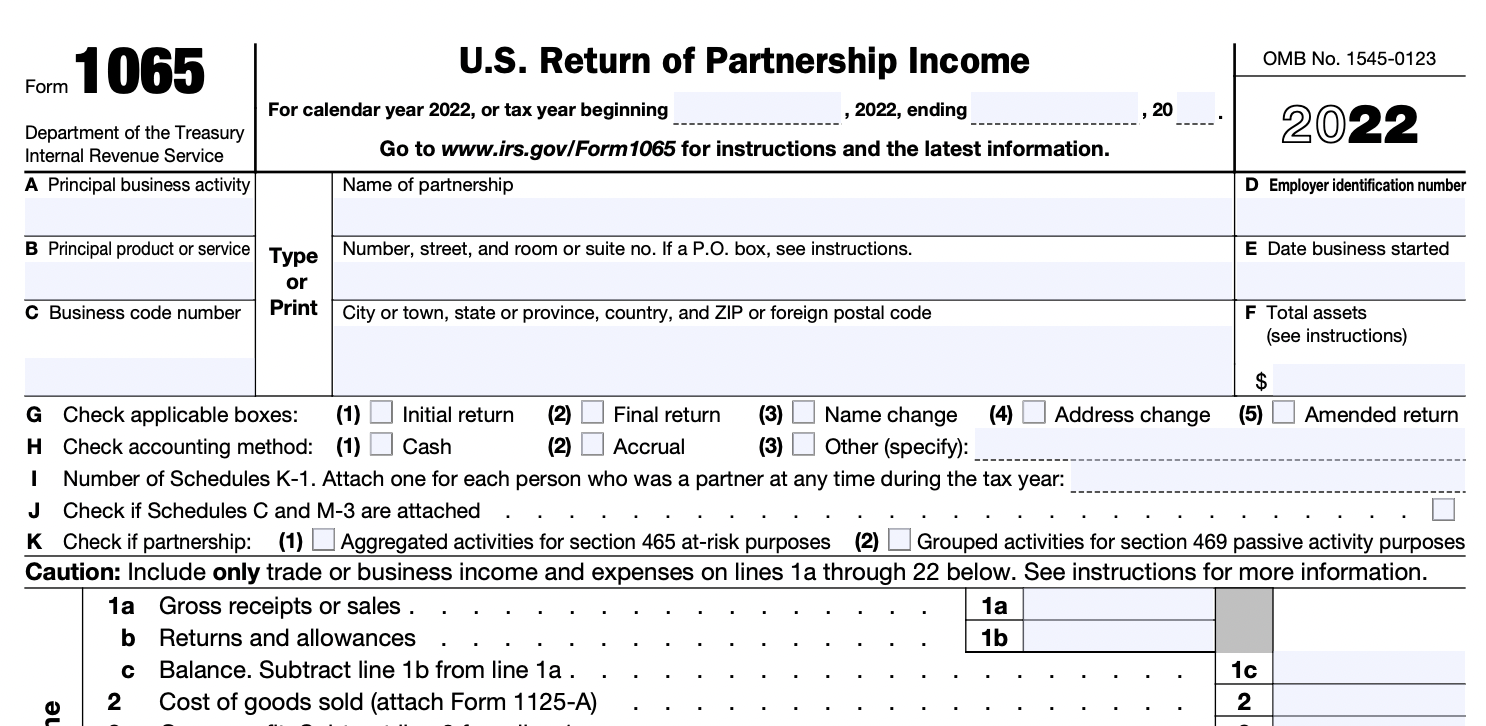

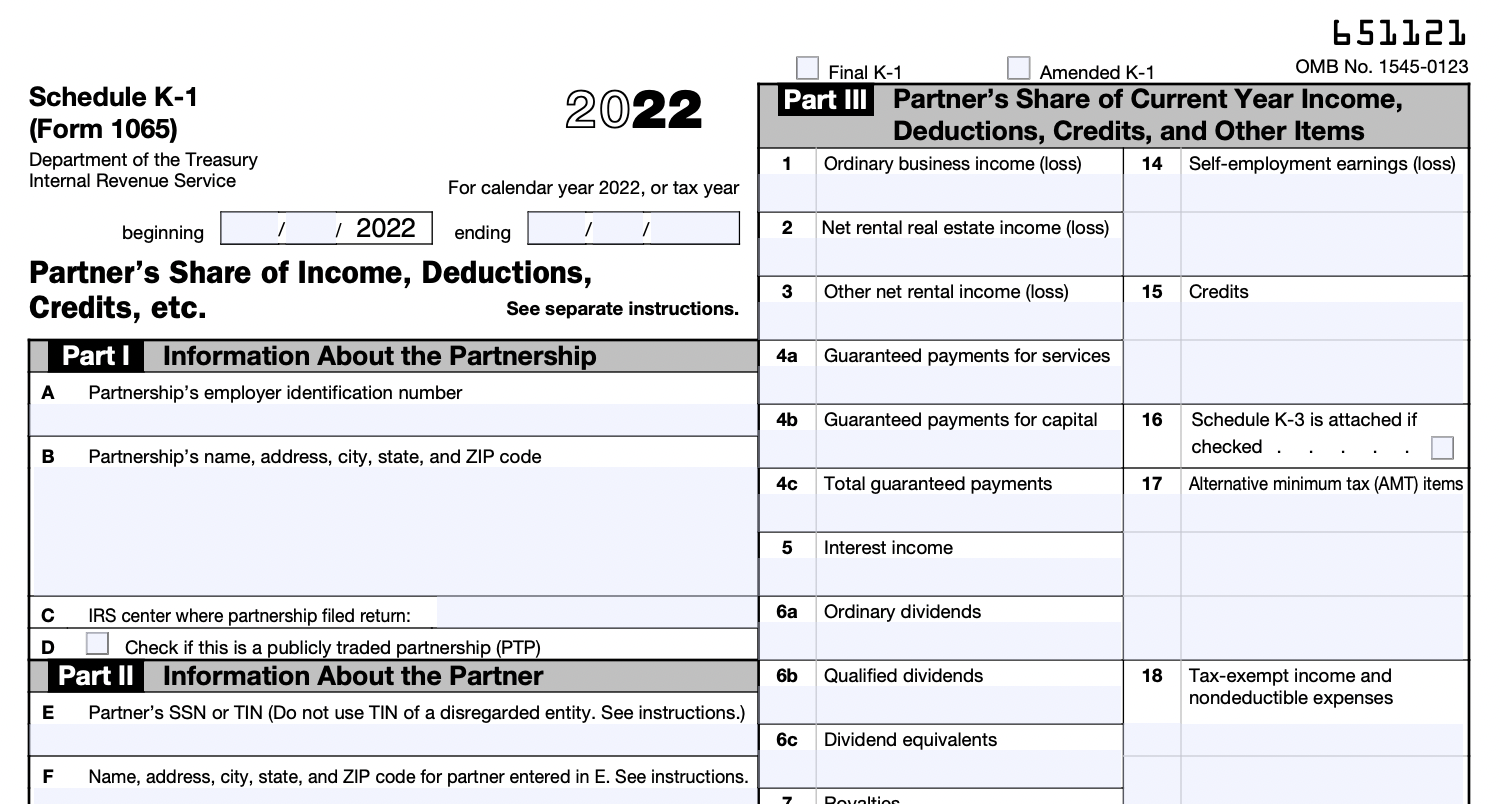

Form 1065, U.S. Return of Partnership Income, is an information return filed by partnerships, which are business entities with two or more owners. The form requires partnerships to report their income, expenses, deductions, credits, and other tax-related information to the IRS. Partnerships are “passthrough entities”, which means they are not taxed on their income at the entity level. Instead, profits and losses are passed through to each individual partner on Schedule K-1, and they are responsible for paying taxes on their share of the partnership's income.

When Form 1065 is filed, a Schedule K-1 is sent to each partner. Schedule K-1 reports each partner’s share of the partnership's income, deductions, and credits. Partners use this information to report their share of the partnership's income or loss on their individual tax returns, where it is ultimately taxed.

Who needs to file Form 1065?

Any partnership that conducts trade or business in the United States, or receives income from U.S. sources, is required to file Form 1065 annually with the Internal Revenue Service (IRS).

A partnership is defined as a business entity where two or more individuals or entities join together to carry on a trade or business and share in the profits and losses. Partnerships can include general partnerships, limited partnerships, limited liability partnerships, and joint ventures.

If you need to produce pay stubs for your employees at the end of the month, you can check out the instant pay stubs generator. There are nice selections of pay stubs templates for you to choose from as well.

Partnerships are required to file Form 1065 regardless of whether they made a profit or a loss during the tax year. Additionally, partnerships with foreign partners or income from foreign sources may have additional reporting requirements, such as filing Form 8865 or Form 5471.

Failure to file Form 1065, or filing it late, can result in penalties from the IRS. Therefore, it's important for partnerships to ensure that they file Form 1065 in a timely and accurate manner. The due date is generally March 15th after the end of each tax year.

Who is not required to file Form 1065?

There are a few situations in which a partnership may not be required to file Form 1065. These can include the following:

-

No Income or Expenses: if a partnership did not conduct any business activities, did not receive any income, and did not have any expenses during the tax year, it may not be required to file Form 1065. However, if the partnership has any assets, such as bank accounts or property, it may still need to file Form 1065 or other tax forms to report this information (including depreciation expense for any depreciable assets.

-

Gross Receipts of Less than $1,000: if a partnership had gross receipts (i.e., total income) of less than $1,000 during the tax year, it may not be required to file Form 1065. However, if the partnership had any deductions, such as startup costs or organizational expenses, it may still need to file the form.

-

Investment Income Only: if a partnership only had investment income during the tax year, such as interest, dividends, or capital gains, and did not engage in any business activity, it may not be required to file Form 1065. However, the partnership may still need to file other tax forms, such as Form 1040 or Form 1065-B, depending on the type of investment income and the partnership's specific circumstances.

-

Single-Member LLC: if a partnership is a single-member LLC that is disregarded for tax purposes, it may not be required to file Form 1065. Instead, the single member reports the income and expenses on their individual tax return using Schedule C, Profit or Loss From Business.

When is the deadline for Form 1065?

The deadline for filing Form 1065 with the Internal Revenue Service (IRS) is typically the 15th day of the third month after the end of the partnership's tax year. This date may be extended if it falls on a weekend or holiday. For most partnerships, which operate on a calendar year basis (i.e., January 1 to December 31), the deadline for filing Form 1065 is March 15 of the following year.

However, if the partnership needs more time to file its tax return, it can request an automatic six-month extension by filing Form 7004, Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns, with the IRS. Form 7004 provides a six month extension of time to file, and it must be requested by the original due date of the return, which is March 15 for most partnerships.

While an extension gives the partnership more time to file its tax return, it does not extend the deadline for paying any taxes owed. If the partnership owes taxes, it must estimate and pay the tax by the original due date of the return, which is March 15 for most partnerships, to avoid late-payment penalties and interest.

Can the deadline for Form 1065 be extended?

Yes, the deadline for filing Form 1065 with the Internal Revenue Service (IRS) can be extended. Partnerships that need more time to file their tax return can request an automatic six-month extension by filing Form 7004, Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns, with the IRS.

To request an extension, the partnership must file Form 7004 by the original due date of the return, which is the 15th day of the third month after the end of the partnership's tax year. For most partnerships, this is March 15 of the year following the tax year in question. The extension will give the partnership an extra six months after the original due date to file its tax return.

While an extension gives the partnership more time to file its tax return, it does not extend the deadline for paying any taxes owed. If the partnership owes taxes, it must estimate and pay the tax by the original due date of the return, which is March 15 for most partnerships, to avoid late-payment penalties and interest.

Additionally, partnerships with foreign partners or income from foreign sources may have different filing deadlines and extension rules, so it's important to check with the IRS or a tax professional to determine the specific requirements.

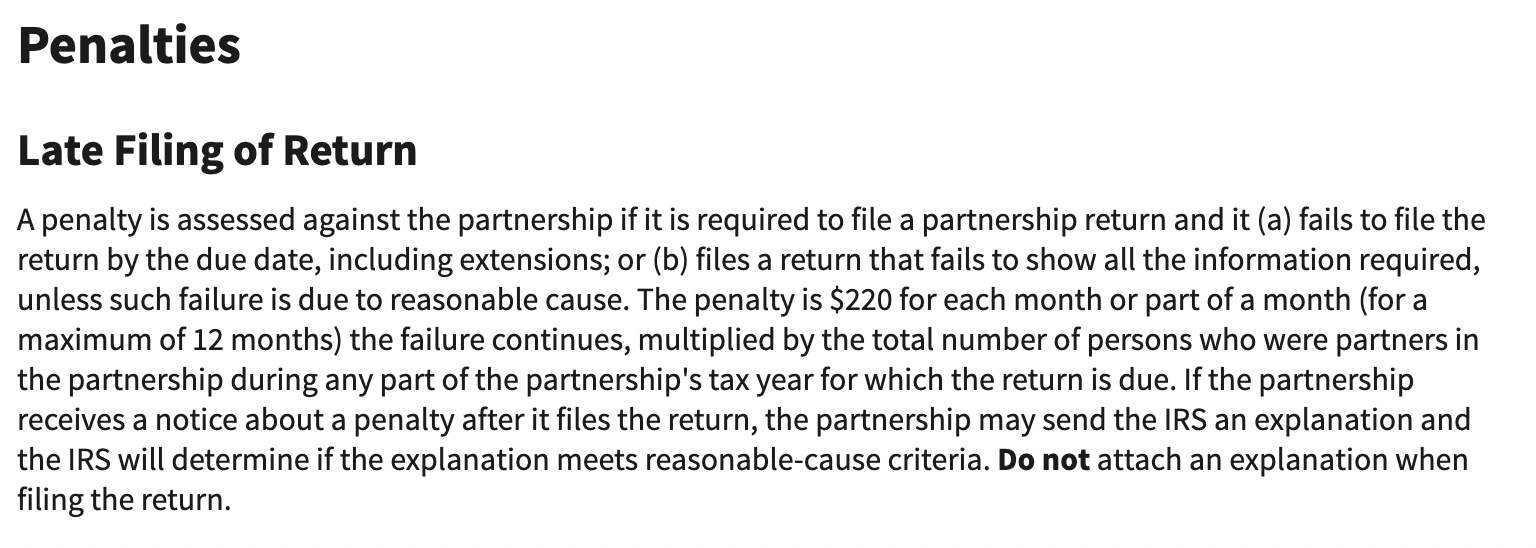

What is the penalty for late filing of Form 1065?

If a partnership fails to file Form 1065 by the due date (including extensions), the Internal Revenue Service (IRS) may assess late filing penalties which can be significant. The penalty is based on the number of months the return is late and the number of partners in the partnership during any part of the tax year.

For tax year 2022, the penalty for late filing of Form 1065 is $220 per month, per partner, for up to 12 months. For example, if a partnership has three partners and the return is two months late, the penalty would be $1,320 ($220 x 2 months x 3 partners).

However, if the partnership can show that the failure to file on time was due to reasonable cause and not willful neglect, the IRS may waive or reduce the penalty. To request a penalty abatement, the partnership must submit a written explanation with the tax return or after receiving the penalty notice.

What happens if I don't file Form 1065?

If you are required to file Form 1065, but you either file it late or don't file it at all, you may face penalties and interest charges from the Internal Revenue Service (IRS).

The penalty for failing to file Form 1065 on time is $220 per month, per partner, for up to 12 months or a maximum of $2,640 per partner. Additionally, the IRS may assess a penalty for failing to furnish Schedules K-1 to the partners, which is $290 per partner, per year as of 2022.

If taxes are owed on partnership income, but the partnership neglects to file Form 1065 or furnish Schedules K-1 to partners on time, then that income may be subject to failure-to-pay penalties on the partner’s Form 1040 Individual Income Tax Returns. The penalty is typically 0.5% of the unpaid tax for each month or part of a month the tax remains unpaid, up to a maximum of 25% of the unpaid tax.

In addition to penalties, the IRS may also charge interest on any taxes owed, starting from the original due date of the return.

If you fail to file Form 1065, the IRS may also take further enforcement action, such as filing a substitute return on your behalf, which may not include all of the deductions and credits that you are entitled to. This could result in a higher tax liability than if you had filed the return yourself, and may require you to contact the IRS and file an amended Form 1065 to fix the issues.

If you are unable to pay the full amount of taxes owed by the due date, it's still important to file the return or extension on time and pay as much as possible to minimize the amount of interest and penalties that may accrue. It’s also important that you contact the IRS to set up a payment plan that works for you.

What supporting documents do I need to file with Form 1065?

When filing Form 1065, partnerships must include various supporting documents to provide additional information about the partnership's income, deductions, and other tax-related items. Some of the key supporting documents that may be required when filing Form 1065 include:

-

Schedules K-1: Each partner's share of income, deductions, credits, and other items must be reported on a Schedule K-1. Partnerships must provide a copy of Schedule K-1 to each partner and also attach a copy to Form 1065 for the IRS.

-

Form 4562: Any depreciation and amortization must be reported on Form 4562, Depreciation and Amortization. This form includes a description of the property, the date it was placed in service, the cost or basis of the property, and the method and amount of depreciation or amortization.

-

Form 8825: If the partnership received rental income, it must file Form 8825, Rental Real Estate Income and Expenses of a Partnership or an S Corporation. This form includes a description of the rental property, the amount of rental income received, and the expenses associated with the property.

-

Form 8990: If the partnership is subject to the section 163(j) limitation on business interest expense, it must file Form 8990, Limitation on Business Interest Expense Under Section 163(j). This form calculates the amount of business interest expense that can be deducted and any amounts that must be carried over to future years.

-

Other documents: Depending on the partnership's activities, it may need to include other supporting documents, such as Forms 1099-MISC for contractors, Forms W-2 for employees, or Forms 1095-C, as well as other schedules or forms that report additional information.

It's important to carefully review the instructions for Form 1065 and any applicable schedules or forms to determine the specific requirements for your partnership. Additionally, it's a good idea to consult with a tax professional if you have any questions or need assistance with filing your tax return.

How do I file Form 1065?

Partnerships can file Form 1065 either electronically or by mail. Here are the steps to file Form 1065:

-

Gather information: Before you begin to prepare Form 1065, gather all the necessary information, including the partnership's tax identification number, income and expense records, partner information, and any other documents or schedules that may be required.

-

Choose a method of filing: Partnerships can file Form 1065 electronically, using tax preparation software, or by mailing a paper copy to the IRS. A tax professional can also file Form 1065 on behalf of the taxpayer.

-

Complete Form 1065: Use the information you have gathered to complete Form 1065, including all applicable schedules and forms.

-

Attach schedules and forms: Attach all required schedules and forms to Form 1065. If you choose to file electronically or use a tax professional, they will do this for you.

-

Sign and date the return: The partnership's authorized person must sign and date the return prior to filing.

-

File the return: If filing electronically, sign the return electronically and submit it using your e-file provider. If filing by mail, sign the paper Form 1065 and send it, along with any required tax payments, to the address listed in the instructions for Form 1065.

-

Keep a copy: Keep a copy of the completed return and all supporting documentation for your records. We recommend using an asterisk (*) in place of any sensitive information, such as social security numbers, on any saved tax returns.

Where should I mail Form 1065?

The mailing address for Form 1065 depends on the state in which the partnership is located and whether or not the partnership includes a payment with the return. The instructions for Form 1065 includes a list of mailing addresses for each state, based on whether or not a payment is being included.

If a payment is being included, the mailing address will be different than if no payment is included. It's important to check the instructions for Form 1065 to ensure that you are mailing the return to the correct address.

Partnerships that are filing electronically do not need to mail a paper copy of the return, unless specifically requested to do so by the IRS.

The appropriate addresses for tax year 2022 are included here:

| If the partnership's principal business, office, or agency is located in: | And the total assets at the end of the tax year (Form 1065, page 1, item F) are: | Use the following address: |

| Connecticut, Delaware, District of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, Wisconsin | Less than $10 million and Schedule M-3 isn't filed | Department of the Treasury Internal Revenue Service Center Kansas City, MO 64999-0011 |

| Connecticut, Delaware, District of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, Wisconsin | $10 million or more or less than $10 million and Schedule M-3 is filed | Department of the Treasury Internal Revenue Service Center Ogden, UT 84201-0011 |

| Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, Wyoming | Any amount | Department of the Treasury Internal Revenue Service Center Ogden, UT 84201-0011 |

| A foreign country or U.S. possession | Any amount | Internal Revenue Service P.O. Box 409101 Ogden, UT 84409 |

Partnerships that are sending a payment with the return should use the address listed in the instructions for Form 1065 (also included above) that corresponds to their state.

Can I file Form 1065 electronically?

Yes, partnerships can file Form 1065 electronically. The IRS encourages electronic filing, and it offers several options for partnerships to file their tax returns electronically, including:

-

IRS e-file: Partnerships can use IRS e-file to file Form 1065 electronically. This service is available to partnerships with less than 100 partners. To use this service, the partnership must apply for an electronic filing PIN from the IRS.

-

Authorized e-file provider: Partnerships can also file Form 1065 electronically through an authorized e-file provider. The IRS maintains a list of authorized e-file providers on its website.

-

Third-party software: Partnerships can use third-party tax preparation software to file Form 1065 electronically. Many tax preparation software programs include the ability to e-file tax returns with the IRS.

Electronic filing offers several benefits, including faster processing times, more accurate returns, and fewer errors. Additionally, partnerships that file electronically will receive confirmation that their return was received and accepted by the IRS.