We've Helped Customers Create Their 1099-R Form Using Our Generator

Form 1099-R Generator

What Is Form 1099-R?

Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. is an Internal Revenue Service (IRS) form used to report designated distributions of $10 or more from certain retirement plans, annuities, or insurance contracts. Payments that appear on a Form 1099-R include those made from a profit-sharing or retirement plan, IRA, annuity, pension, insurance contract or survivor income benefit plan, permanent or total disability payment under a life insurance contract, or a charitable gift annuity.

What Is Form 1099-R Used For?

As a payer, trustee, or plan administrator, you should file a Form 1099-R for each person to whom you’ve paid a designated distribution or are treated as having made a distribution of $10 or more from any of the plans above. In general, payments that are subject to withholding of social security and Medicare taxes should not be reported on Form 1099-R. Instead, use Form W-2, Wage and Tax Statement, for these types of payments.

How Do I File Form 1099-R?

You can file Form 1099-R online or send the form through the mail. Here are your options for both methods.

Can I File Form 1099-R Online?

You can file Form 1099-R online through the Filing Information Returns Electronically System (FIRE System). Because the system is secure and processing is quicker when you file online, the IRS suggests you file all 1099 forms online, if possible.

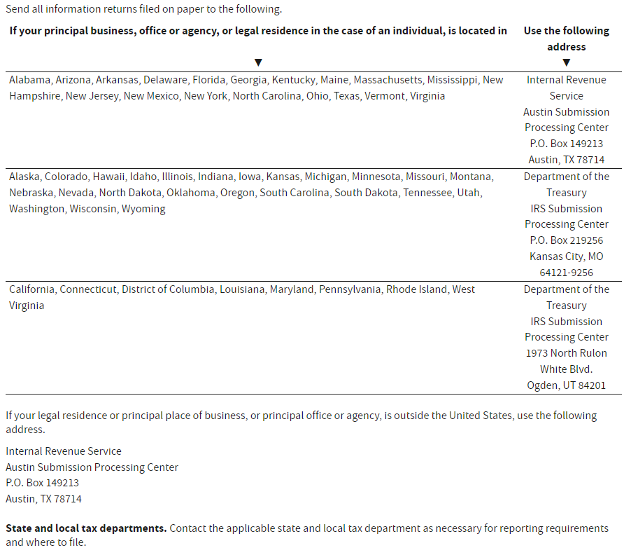

Where Do I Mail Form 1099-R?

Where you need to mail Form 1099-R depends on where your business is located. Here are the IRS mailing locations for informational returns, such as the Form 1099-R, based on your state or country. If you mail the form by its due date, it will be considered timely as long as it is appropriately stamped and postmarked by the due date.

When Is Form 1099-R Due?

Form 1099-R should be furnished to the recipient by January 31 of the year following the year being reported on the form. It is due to the IRS by February 28, if mailed, or March 31, if filed electronically.

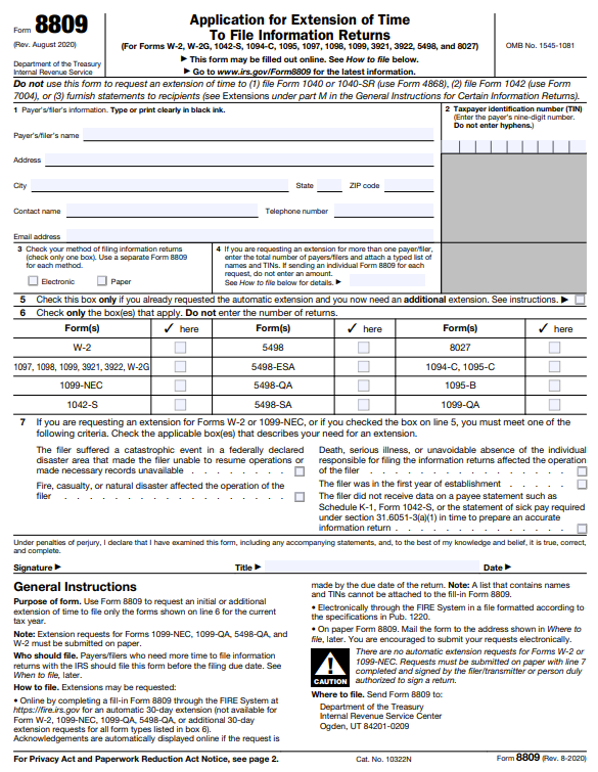

Am I Able To Get An Extension of Time To File?

If you complete Form 8809, Application for Extension of Time To File Information Returns, you can get an automatic extension of 30 days to file. You can complete the form online via the FIRE System or submit it on paper via the mail. However, it must be submitted by the due date of the return to qualify for the 30 day extension.

How Do I Receive A Copy of My Form 1099-R?

Payers are required to furnish a copy of Form 1099-R to recipients by January 31 of the following year. If you have not received a copy by this date– or a few days later if it was mailed– you should contact your plan administrator to request a copy.

What Are Some Examples of Transactions That Might Be Reported On A 1099-R?

There are many kinds of retirement-related transactions that can appear on a Form 1099-R. Here are some of the most common types.

Retirement Payments

Retirement distributions you see on your Form 1099-R may or may not be taxable, depending on the origin of funds. Employer sponsored retirement benefits vary depending on the employer and the specific plan offered by your employer. The most common employer sponsored retirement plans such as 401(k)s and 403(b)s are offered pre-tax– you do not pay taxes on the amount when it is initially deposited into your retirement account. These amounts grow tax-deferred– amounts are taxed at a later date when you withdraw the funds from your retirement account. When you take a distribution in retirement, you will have to pay taxes on funds from your 401(k) or 403(b).

Rollovers

Rollovers occur when retirement money is transferred from one custodian to another. You typically do not have to pay taxes on a rollover, and rollovers are clearly identified on your Form 1099-R using distribution codes. A direct rollover occurs when your previous financial institution directly transfers the payment to another plan or IRA.

An indirect transfer occurs when you have the funds from your first retirement account paid out to you directly. After you receive a payout, you have 60 days to complete the rollover of funds into another retirement plan. You can deposit the entire amount or only a portion, but taxes and penalties may apply to any amount not rolled over into another plan or IRA.

Early Distributions

When you take an early distribution of your retirement funds– typically, any benefits paid out prior to reaching age 59 ½– you will be subject to an additional 10% penalty for early withdrawal. This amount is added to the amount of tax you would have otherwise paid on the distribution if it had been taken at retirement age. There are a few exceptions to the early distribution penalty for disability, death, an IRS levy, military reservists called to active duty, or certain medical expenses exceeding the annual AGI threshold determined by the IRS.

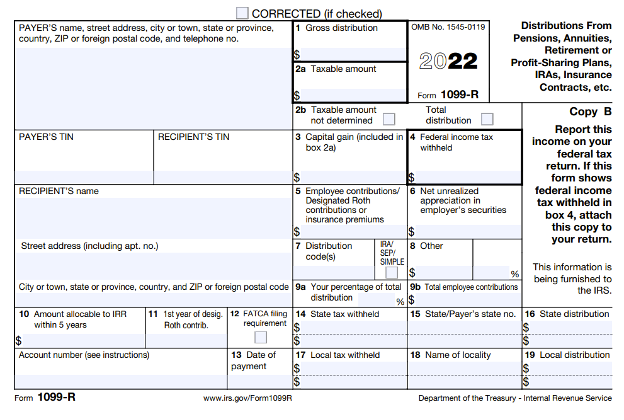

What Information Is Reported On Form 1099-R?

The top left section on the IRS Form 1099-R is where you will find the payer’s name, address, and taxpayer identification number (TIN). As a business, the payer’s TIN is likely to be an employer identification number (EIN). The next section is where you’ll find the recipient’s name, address, and TIN. As an individual, your TIN is likely a social security number (SSN) or individual taxpayer identification number (ITIN). The bottom left box on the form is for an account number. You may or may not see anything in this box. It is an optional box that the payer may use to assign a unique number to the recipient’s account.

Box 1 Gross Distribution shows the total amount distributed during the year. The total may include a direct rollover, a transfer or conversion to a Roth IRA, a recharacterization of IRA contributions, or a distribution paid out to you. This box may include both taxable and nontaxable amounts.

Box 2a Taxable Amount shows the amount out of your total from box 1 that is taxable to you. If there is no amount listed in box 2, the payer may not have enough information to determine your taxable amount.

Box 2b Taxable Amount Not Determined Checkbox should be checked if there is no amount listed in box 2a because the payer is unable to determine the taxable amount for the recipient.

Box 2b Total Distribution Checkbox should be checked if the amount was a distribution that closed out your entire account.

Box 3 Capital Gain shows amounts that can be treated as a capital gain rather than ordinary income for tax purposes. Capital gains are taxed at lower rates, so it is a tax-advantaged option if you qualify. If you received a lump-sum distribution from a qualified plan and were born before January 2, 1936– or you’re the beneficiary of a plan for someone born before that date– you may be able to elect this treatment on Form 4972, Tax on Lump-Sum Distributions.

Box 4 Federal Income Tax Withheld shows any amount you have had withheld throughout the year for federal income taxes. You may or may not have an amount listed in this box. If there is, be sure to include it on your tax return as income tax withheld.

Box 5 Employee Contributions / Designated Roth Contributions or Insurance Premiums shows your basis in a designated Roth account, the part of premiums paid on annuities or insurance contracts recovered tax free, or the employee’s investments (after-tax contributions) in a contract recovered tax free in the year. If the amount listed shows your basis in a designated Roth account, the first year you made contributions will be entered in box 11.

Box 6 Net Unrealized Appreciation in Employer’s Securities shows the increase in value of any securities you have in your employer’s company. It is taxed only when you sell the securities, unless you choose to include it in your income each year you hold onto it.

Box 7 Distribution Codes identify the type of distribution you received. Here are the available distribution code options.

- 1 - Early distribution, no known exception (under age 59 ½)

- 2 - Early distribution, exception applies (under age 59 ½)

- 3 - Disability

- 4 - Death

- 5 - Prohibited transaction

- 6 - Section 1035 exchange (tax-free exchange of life insurance, annuity, qualified long-term car insurance, or endowment contracts)

- 7 - Normal distribution

- 8 - Excess contributions plus earnings / excess deferrals (and/or earnings) that are taxable

- 9 - Cost of current life insurance protection

- A - May be eligible for 10 year tax option

- B - Designated Roth account distribution

- C - Reportable death benefits under 6050Y

- D - Annuity payments from nonqualified annuities that may be subject to tax under section 1411

- E - Distributions under Employee Plans Compliance Resolution System (EPCRS)

- F - Charitable gift annuity

- G - Direct rollover of a distribution to a qualified plan, a section 403(b) plan, a governmental section 457(b) plan, or an IRA

- H - Direct rollover of a designated Roth account distribution to a Roth IRA

- J - Early distribution from a Roth IRA, no known exception (under age 59 ½)

- K - Distribution of traditional IRA assets not having a readily available FMV

- L - Loans treated as distributions

- M - Qualified plan loan offset

- N - Recharacterized IRA contribution made for current year and recharacterized in current year

- P - Excess contributions plus earnings / excess deferrals taxable in prior year

- Q - Qualified distributions from a Roth IRA

- R - Recharacterized IRA contribution made for prior year and recharacterized in current year

- S - Early distribution from a SIMPLE IRA in first two years, no known exception (under age 59 ½)

- T - Roth IRA distribution, exception applies

- U - Dividend distribution from ESOP under section 404(k)

- W - Charges or payments for purchasing qualified long-term care insurance contracts under combined arrangements

Box 7 IRA / SEP / SIMPLE Checkbox should be checked if you received a traditional IRA, SEP, or SIMPLE distribution.

Box 8 Other shows the value of your annuity contract if you received an annuity contract as part of your distribution. It isn’t taxable when you receive the contract, and the amount is not shown in boxes 1 or 2a. When you receive periodic payments out of the annuity contract, the amount is taxable at that time.

Box 9a Your Percentage of Total Distribution shows the percentage you received if a total distribution was made to more than one person.

Box 9b Total Employee Contributions shows the employee’s total investment in a contract for a life annuity from a qualified plan or section 403(b) plan.

Box 10 Amount Allocable to IRR Within 5 Years If you see an amount listed in this box, you should see the instructions for Form 5329 and Publication 575.

Box 11 1st Year of Designated Roth Contributions lists the year you first made designated Roth contributions.

Box 12 FATCA Filing Requirement Checkbox is checked if the payer is reporting on Form 1099-R to satisfy its Internal Revenue Code chapter 4 account reporting requirement under FATCA.

Box 13 Date of Payment shows the date of payment for reportable death benefits under section 6050Y.

Box 14 State Tax Withheld shows any amount you have had withheld throughout the year for state income taxes, if applicable.

Box 15 State / Payer’s State No. shows your state’s number, if applicable.

Box 16 State Distribution shows the amount of the distribution that is reported to your state. You may or may not see an amount listed in this box depending on whether your state has an income tax or taxes the specific retirement funds you received.

Box 17 Local Tax Withheld shows any amount you have had withheld throughout the year for local income taxes, if applicable.

Box 18 Name of Locality shows the name of your local government.

Box 19 Local Distribution shows the amount of the distribution that is reported to your local government. You may or may not see an amount listed in this box depending on whether your local government has an income tax or taxes the specific retirement funds you received.

I Received A Form 1099-R, Does That Mean I Owe Taxes?

If you received a Form 1099-R, it means you received $10 or more in distributions from your retirement plan, insurance plan, or other payer. It does not necessarily mean that your distributions are taxable, but you should report the information from your Form 1099-R on your Form 1040, U.S. Individual Income Tax Return. It is always beneficial to contact a tax adviser if you have questions that are specific to your own tax situation.

If you or your relatives and friends need to produce and print out a pay stub, you can always check out the paystub creator. There are dozens of paystub samples for you to choose from.