What Is Form 1099-MISC?

Form 1099-MISC, Miscellaneous Income, is an

Internal Revenue Service (IRS) form filed by an individual or business who has paid more than $600 in

miscellaneous income–

such as rents, prizes or awards, medical and healthcare payments, crop insurance proceeds, cash payments for

fish, payments to an attorney, fishing boat proceeds, or other miscellaneous income payments– to an

individual during the tax year.

It should also be filed by anyone who paid more than $10 in royalties or broker payments in lieu of dividends or

tax-exempt interest to an individual during the tax year. Finally, Form 1099-MISC should be filed by anyone who

made direct sales of $5,000 or more in consumer products to a buyer for resale anywhere other than in a

permanent retail establishment.

What Is Form 1099-MISC Used For?

Form 1099-MISC is used to report miscellaneous payments you have made to a taxpayer who will need to report the

income on his or her tax return. It is an information

return that allows the IRS to compare the payment information the payer submits to them with the income

details reported on the recipient taxpayer’s tax

return.

If you need to create paystubs as proof of income, you can check out the check stub maker. There

are plenty of paystub samples for you to browse and choose from.

When Is A Form 1099-MISC Required To Be Issued?

You will have to issue a Form 1099-MISC if you have made any of the following payments to at least one individual

in the course of your business:

- $10 or more in royalties

- $10 or more in broker payments in lieu of dividends or tax-exempt interest

- $600 or more in rent

- $600 or more in prizes and awards

- $600 or more in other income payments

- $600 or more in cash paid from a notional principal contract to an individual, partnership, or estate

- $600 or more in fishing boat proceeds

- $600 or more in medical and health care payments

- $600 or more in crop insurance proceeds

- $600 or more in gross proceeds paid to an attorney

- $600 or more in Section 409A deferrals

- $600 or more in nonqualified deferred compensation

- $5,000 or more in sales of consumer products to a person on a buy-sell, deposit-commission, or other

commission basis for resale (or you can report this information on Form 1099-NEC in box 2)

You must also file a Form 1099-MISC for any individual whom you have withheld federal income tax under

backup withholding rules, even if the payment amount is less than the above threshold.

Exceptions To Form 1099-MISC Filing Requirements

Generally, Form 1099-MISC is only issued to individuals. However, you can issue a 1099-MISC if you have

reportable payments to a corporation, such as:

- Cash payments for the purchase of fish for resale

- Medical and health care payments

- Substitute payments in lieu of dividends or tax-exempt interest

- Gross proceeds paid to an attorney

Other situations you may encounter that do not require you to furnish a Form 1099-MISC, even if it is taxable to

the recipient, include:

- Payments not made in the course of your trade or business– personal payments

- Most payments to corporations– except the situations outlined above

- Payments for merchandise, phone, freight, storage, etc.

- Payments of rent to real estate agents or property

managers

- Wages to employees

- Military differential wage payments made while they are on active duty in the U.S. Armed Forces or other

uniformed services

- Business travel allowances paid to employees

- Cost of current life insurance

- Payments to a tax-exempt organization

- Payments made to or for homeowners from the HFA Hardest Hit Fund or similar state program

- Compensation for injuries or sickness by the Department of Justice for a public safety officer

- Survivor’s benefits for a public safety officer who died as the direct result of a personal injury

sustained in the line of duty

- Compensation for wrongful incarceration for any criminal offense in which there was a conviction under

federal or state law

When And Where Do I Furnish The Form 1099-MISC?

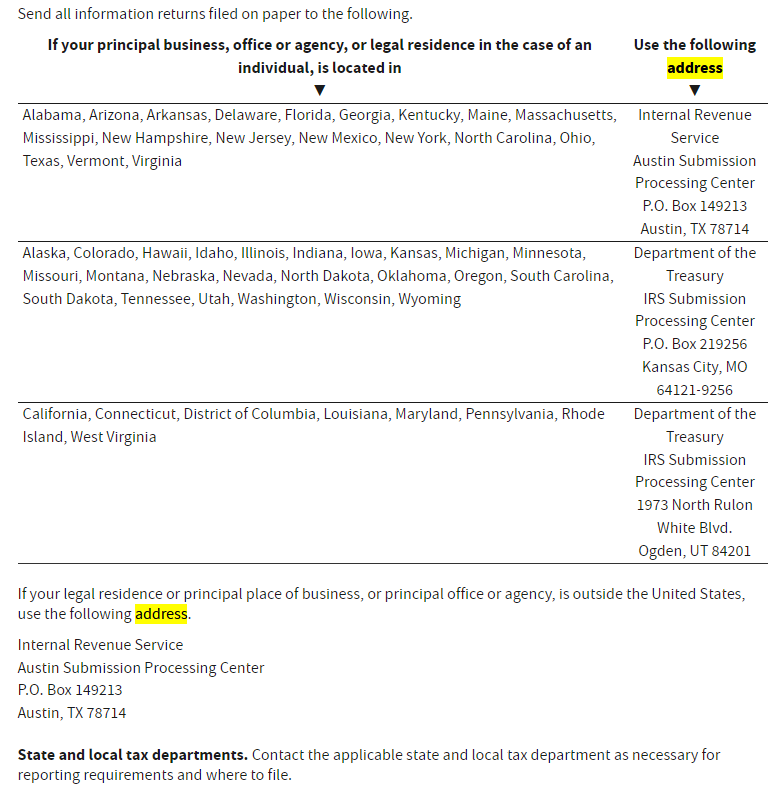

There are multiple copies of the Form 1099-MISC. You must furnish copies of the form to the IRS, your state tax

department, and the recipient. If you file Form 1099-MISC on paper and mail it in, it is due to the IRS by February 28th of the

year following the tax year being reported. If you file electronically, the deadline is March 31st of the year

following the tax year being reported. Beware, if you are required to file Form 1099-MISC, you generally must

furnish the form to the recipient taxpayer by January 31 of the year following the tax year being reported–

even though the deadline for the IRS is later.

You can file Form 1099-MISC with the IRS electronically or

through the mail. The IRS highly suggests you file electronically, if possible. If you mail the Form

1099-MISC, you will meet the due date requirements if the form is properly addressed, postmarked, and mailed

using the U.S. postal service or an accepted private delivery service (PDS) by the due date. The IRS lists its

currently accepted PDSs, here. The

address where you mail your Form 1099-MISC depends on the state or province in which your business is located.

When furnishing the form to a recipient, you are allowed to furnish the Form 1099-MISC electronically as long as

you have met the following criteria:

- You must have the recipient’s consent to electronically receive the form.

- The form must have all the required information and comply with Pub. 1179’s rules about substitute

statements.

- You must post the form on or before the due date, and it should remain available to the recipient on the

website until at least October 15 of the same year.

- You must inform the recipient, electronically or by mail, of the posting and how to access it.

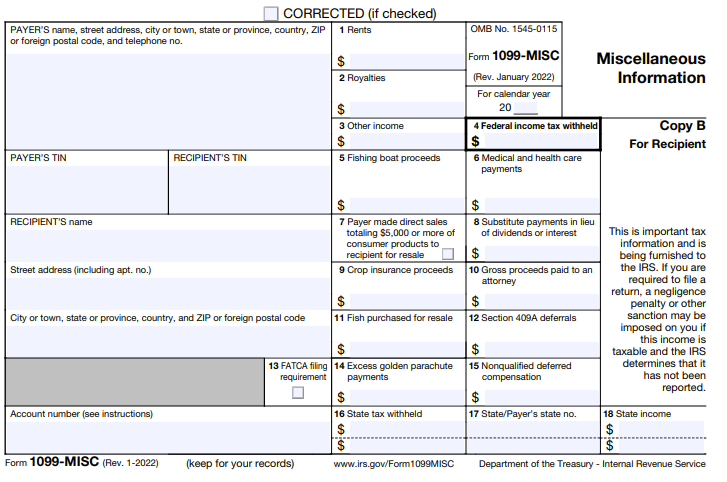

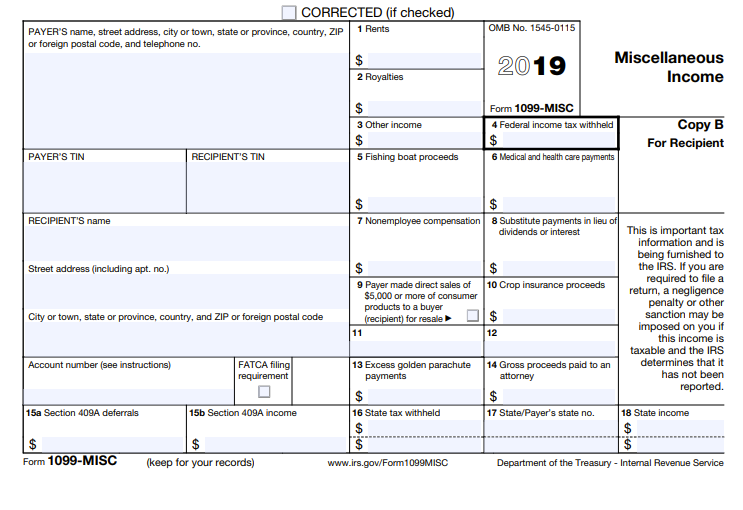

What Information Is Reported On Form 1099-MISC?

Payer and recipient information is on the left-hand side of the Form 1099-MISC. You will need to complete the

boxes for payer’s name and address, payer’s Taxpayer

Identification Number (TIN), recipient’s TIN, and recipient’s name and address. Typically,

the TIN is an Employer Identification Number (EIN) for a business and a Social Security Number (SSN) for an

individual. However, there are exceptions. There is an optional box to enter an account number, if you have a

unique number assigned to the recipient to distinguish the account.

Box 1 Rents

In box 1, you should enter amounts over $600 paid for real estate rentals of your office space, machine rentals,

or pasture rentals. If you paid the amount to a real estate agent or property manager, you do not need to file

Form 1099-MISC, but they will have to file one for amounts paid to the property owner.

Box 2 Royalties

If you paid royalties of $10 or more, enter that amount into box 2. Amounts that may appear in box 2 include

royalties from oil, gas, or other mineral properties. Surface royalties should not appear in box 2, but instead

box 1. Oil or gas payments for a working interest should also not appear in box 2, but instead box 1.

Box 3 Other Income

If an amount you paid must appear on Form

1099-MISC but does not fall into one of the other specific categories, enter it in box 3. This box

includes prizes and awards that you paid, unrelated to services performed. If the winner of a prize chooses an

annuity rather than a lump sum payout, you will file the Form 1099-MISC and include the amount paid in each year

in which the winnings are paid out.

Box 4 Federal Income Tax Withheld

Box 4 is where you will enter backup withholdings and any income tax withheld from payments to members of Indian

tribes from the net revenues of gaming activities conducted by the tribe.

Box 5 Fishing Boat Proceeds

If you operate a fishing boat, enter the amount of your crew member’s share of proceeds over $600 or FMV of

their distribution in kind, into box 5. Also, add to the amount any cash payments of $100 or less per trip that

were contingent on a minimum catch and paid solely for additional duties.

Box 6 Medical and Health Care Payments

In box 6, enter amounts over $600 you have paid in the course of your trade or business to a physician, other

health care provider, or medical supplier.

Box 7 Payer Made Direct Sales Totalling $5,000 or More of Consumer Products to Recipient for Resale

Put an X in the checkbox for box 7 if you had direct sales totalling $5,000 on a buy-sell, deposit-commission, or

other commission basis for resale. You can either use box 7 on Form 1099-MISC or box 2 on Form 1099-NEC to

report these amounts.

Box 8 Substitute Payments In Lieu of Dividends or Interest

In box 8, enter aggregate payments totalling $10 or more by a broker for a customer in lieu of a dividend or

tax-exempt interest. A customer in this instance may be an individual, trust, estate, partnership, association,

company, or corporation.

Box 9 Crop Insurance Proceeds

In box 9, enter crop insurance proceeds of $600 or more paid by an insurance company to a farmer.

Box 10 Gross Proceeds Paid to An Attorney

In box 10, enter gross proceeds of $600 or more paid to an attorney in relation to legal services. The legal

services are not required to have been performed for the payer.

Box 11 Fish Purchased For Resale

If you are in the trade or business of reselling fish, you must report cash payments of $600 or more you made to

any person engaged in the trade or business of catching fish or other aquatic life in box 11.

Box 12 Section 409A Deferrals

In box 12, enter current year nonemployee deferrals under a nonqualified deferred compensation (NQDC)

plan that is subject to the rules of section 409A, plus earnings on current and prior year deferrals.

Box 13 FATCA Filing Requirement

If you have to satisfy account reporting requirements under chapter 4 of the Internal Revenue Code, put an X in

the checkbox for box 13.

Box 14 Excess Golden Parachute Payments

In box 14, enter any excess golden parachute payments– amounts which exceed the average annual compensation

for services includible in the individual’s gross income over the most recent 5 years.

Box 15 Nonqualified Deferred Compensation

In box 15, enter payments to a nonemployee under a NQDC plan that does not qualify under section 409A. Amounts

from box 12 that are taxable should also be included in box 15.

Boxes 16 - 18, State Tax Withheld, State/Payer’s State No., State Income

If you have a state income tax, you may have to report information in boxes 16 to 18.

What Is The Difference Between Form 1099-MISC And 1099-NEC?

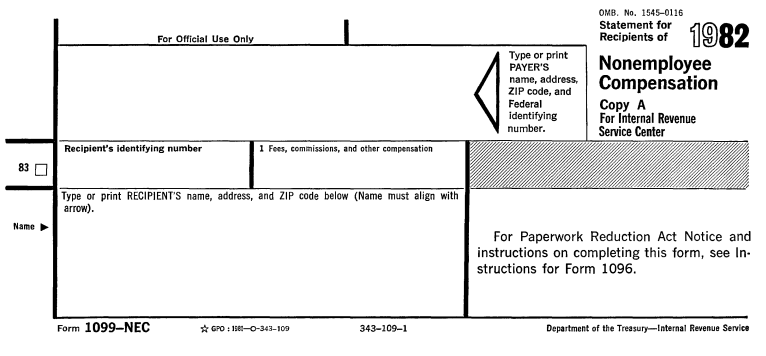

Beginning in tax year 2020, Form 1099-NEC is the form used by businesses to report payments made to independent

contractors, freelancers, sole proprietors, and self-employed individuals– collectively referred to as

nonemployees. Form 1099-NEC was released in 2020 as an update to a form previously discontinued after tax year 1982. It was revamped and

released to solve issues around dual filing deadlines that were causing problems for businesses submitting the

Form 1099-MISC.

Prior to 2020, independent contractor compensation was reported in box 7 of the Form 1099-MISC. The Internal

Revenue Service (IRS) detected

significant fraud relating to individuals falsifying Forms 1099-MISC by reporting small employee

compensation and large withholdings. These individuals filed tax returns requesting sizable refunds, prior to

the Mar. 31 IRS filing deadline for the Form 1099-MISC. The IRS

was unable to match recipient information with the corresponding 1099-MISC.

In order to remedy the issue, the IRS delayed issuing refunds based on the Earned Income

Tax Credit (EITC) until after Feb. 15 and simultaneously pushed back the filing deadline for the

nonemployee compensation portion, box 7, of the 1099-MISC to Jan. 31. All other payment types, and boxes, on the

1099-MISC still had a Mar. 31 due date. Businesses with independent contractors who also made other payments

that were reported on 1099-MISC had two filing deadlines, and it caused significant confusion for the taxpayers.

In 2020, the newly released Form 1099-NEC solved the issue of two filing deadlines for the same form by removing

nonemployee compensation entirely from Form 1099-MISC.