We've Helped Customers Create Their 1099-G Form Using Our Generator

What Is Form 1099-G?

Form 1099-G, Certain Government Payments, is an Internal Revenue Service (IRS) form filed by federal, state, or local governments that made payments of unemployment compensation, state or local income tax refunds, credits, or offsets, reemployment trade adjustment assistance (RTTA) payments, taxable grants, or agricultural payments. They should also file the form if they received payments on a Commodity Credit Corporation (CCC) loan.

Form 1099-G is an information return. That means the government payer is providing the payment information to the IRS because there was a reportable transaction with the recipient during the calendar year. It allows the IRS to compare the amount provided by the payer to the amount the recipient taxpayer claims as income on their tax return.

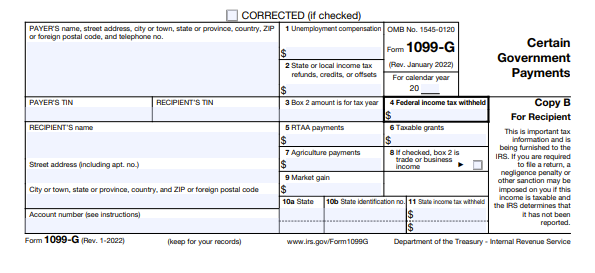

The Form 1099-G has multiple copies that report the same information. Copy A goes to the Internal Revenue service, Copy 1 to the state tax department, Copy B and Copy 2 to the recipient, and Copy C is retained by the payer. The due date to furnish the form to the recipient is earlier than it is for the IRS.

When Will The IRS Release Form 1099-G?

The current version of the Form 1099-G is now available on the IRS website, here. Each year, this same link will point to the most current version of the form. According to the IRS, the form has been updated from an annual revision form to a continuous use format, where the form will only be updated as needed.

Who Must File a Form 1099-G?

You should file Form 1099-G if you are a unit of a federal, state, or local government and have made payments for:

- Unemployment compensation

- State or local income tax refunds, credits, or offsets

- Reemployment Trade Adjustment Assistance (RTAA)

- Taxable grants

- Agriculture

You should also file a Form 1099-G if you have received payments on a Commodity Credit Corporation (CCC) loan. The government employee or officer who controls the CCC loan payments, whether received or made, should file the Form 1099-G.

You should also file Form 1099-G if you withheld federal income tax under backup reporting rules regardless of the amount of the payment.

What Is Not Reportable On Form 1099-G?

Compensation for services, prizes, or incentives are not reportable on Form 1099-G. They may be reportable on Form 1099-MISC, Miscellaneous Information, or Form 1099-NEC, Nonemployee Compensation.

When Is Form 1099-G Due?

Form 1099-G is due to the recipient by January 31. It is due to the IRS by February 28 if filed via mail or March 31 if filed electronically. If the due date falls on a holiday or weekend, the deadline is pushed to the next business day.

Where Is Form 1099-G Filed?

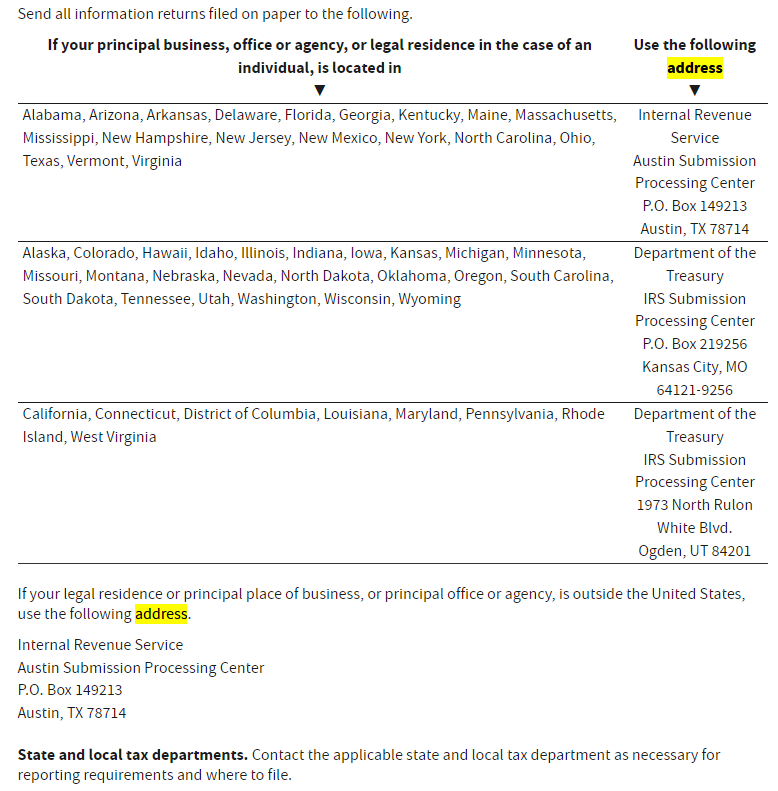

You can file Form 1099-G with the IRS electronically or through the mail. The IRS highly recommends filing electronically, if possible. However, if you choose to mail the form, the address you mail the Form 1099-G to depends on the state or province in which your business is located.

When Do I Get Form 1099-G?

If you are a recipient waiting on your 1099-G, you can usually expect it on or before January 31. The deadline for a payer to furnish an information return to a recipient is January 31 of the year following the year being reported. If the form is properly addressed, postmarked, and mailed by the U.S. postal service or an accepted private delivery service (PDS) by the due date, it will be considered furnished on time. That means as a recipient, you may receive it as late as early February through the mail. The IRS lists its currently accepted PDSs, here.

How To Get Form 1099-G

A recipient may receive the Form 1099-G from the payer either electronically or via the mail. The IRS allows payers to provide the forms to recipients in an electronic format, as long as certain criteria are met. To qualify, the payer must have the consent of the recipient to receive electronic documents, provide notice via mail or an electronic means that the form is published on a website, provide details on how to access the form, and keep the form live on that website until at least October 15 of the same year.

What Information Is Reported On Form 1099-G?

The same information is reported to both the IRS and the recipient of a Form 1099-G, with the following exception. To reduce the risk of identity theft, the IRS allows the payer to truncate the recipient’s taxpayer identification number (TIN) to the final 4 digits of their TIN on the copy furnished to the recipient. Typically, a TIN for a recipient is a social security number (SSN), but it may also be an individual taxpayer identification number (ITIN) or adoption taxpayer identification number (ATIN). The employer identification number (EIN) for the payer cannot be truncated on any copies, and the full TIN of the recipient must be displayed on the copy furnished to the IRS.

Account Number

You may see an account number in this box if you have multiple accounts with a payer or if they have voluntarily assigned you an account number. This box is optional, but highly recommended by the IRS.

2nd TIN Not.

If the IRS has notified the payer twice within 3 calendar years that the recipient taxpayer provided an incorrect TIN, this box may be checked. However, both notices must come in different years and relate to separate years’ information returns. If both of these criteria are not met, the box should not be checked. This box exists because scammers engage in identity theft in order to collect government benefits, like unemployment. If you suspect an identity theft issue, here is a government website that helps you identify and report unemployment identity theft.

Box 1. Unemployment Compensation

Box 1 is where you will find payments made of $10 or more in unemployment compensation. This box includes Railroad Retirement Board payments for unemployment. If you have contributory programs that are deemed to be similar to unemployment benefits, you should file a separate Form 1099-G for each contributory program. Box 1 includes the full amount before any income tax is withheld.

Box 2. State or Local Income Tax Refunds, Credit, or Offsets

Box 2 includes amounts greater than $10 for refunds, credits, or offsets of state or local income tax. This amount may be taxable to the recipient if they previously deducted the state or local income tax paid on Schedule A, Itemized Deductions, of the Form 1040, U.S. Individual Income Tax Return.

The amount is still taxable to the recipient even if the recipient did not directly receive the refund. For example, the amount shown may have been credited to the recipient’s state or local estimated tax, offset against their federal or state debts, offset against their other offsets, or donated as a charitable contribution.

Box 2 includes refunds or carryforward credits of overpayments of tax due to refundable state tax credits and incentive payments that are paid under an existing state tax law. For example, filmmaker incentive credits, home improvement credits paid in low-income areas, and solar panel installation credits may be included in Box 2. Refunds, credits, or offsets of a tax on dividends, tax on net gain from sale or exchange of a capital asset, and tax on net taxable income of an unincorporated business should also be included in Box 2.

The payer should also furnish the recipient with a Form 1099-INT for any interest that accumulated on the refunded amount. If the amount is less than $600, the payer may have the option to appropriately label and include the amount in the blank box next to Box 9 on Form 1099-G. Interest on any refund, credit, or offset reported to the recipient is included in their interest income for federal income tax purposes.

Box 3. Box 2 Amount Is For Tax Year

If the refund, credit, or offset is for the current tax year, box 3 will remain blank. If it is for another tax year, box 3 will display the year in which the refund, credit, or offset was made. If the amounts cover multiple years, each year should be reported on its own separate Form 1099-G.

Box 4. Federal Income Tax Withholding

Box 4 is where you will see federal income tax withheld by the payer. It may be for voluntary withholding or backup withholding. Voluntary withholding is any amount withheld at the request of the recipient. Please note, voluntary withholding is not allowed on RTTA payments.

Backup withholding on payments reported in box 5, 6, or 7 should also be included in box 4. The payer must use a backup withholding rate of 24% if the recipient does not furnish a TIN or if the payer is notified by the IRS that the TIN provided is incorrect.

Box 5. RTAA Payments

Box 5 displays RTAA payments of $600 or more that were paid to an eligible individual under the Reemployment Trade Adjustment Assistance program.

Box 6. Taxable Grant

Box 6 includes any amounts for taxable grants administered by a federal, state, or local government for subsidized energy financing or grants for projects designed to conserve or produce energy. It only applies to energy property or dwelling units located within the United States. It also includes taxable grants administered by an Indian tribal government.

Box 6 also includes amounts related to other grants, if the amount exceeds $600. State and local grants are typically taxable at the federal level. A federal grant is typically taxable unless stated otherwise in the legislation authorizing the grant. Scholarship and fellowship grants should not be reported on Form 1099-G. Instead, see Form 1099-MISC or 1099-NEC.

Box 7. Agriculture Payments

Box 7 reports USDA agricultural subsidy payments made during the year. It includes market facilitation program payments. The Form 1099-G should be filed to the actual owner of the payments, even if a nominee received subsidy payments for another person.

Box 8. Trade or Business Income (Checkbox)

If the refund, credit, or offset from box 2 relates to income from a trade or business and is not a tax of general application, there will be an X in this checkbox.

Box 9. Market Gain

Box 9 reports any market gain associated with the repayment of a CCC loan.

Box 10a, 10b, and 11 State Information

Boxes 10a, 10b, and 11 may be completed if the payer participates in the Combined Federal/State Filing Program. The IRS does not use information from these boxes. If the state tax department requires a paper copy of the Form 1099-G, the payer should use Copy 1 to provide information to the state department. Copy 2 should be given to the recipient to include with their income tax filing to the state department.

I Received A Form 1099-G In Error, What Should I Do?

The IRS has noticed an increase in recent years in identity theft related to unemployment benefits. Specifically, during 2020 and later when many Americans were affected by job loss or reduced work hours, there was a significant increase in the number of people applying for unemployment benefits. Scammers took advantage of the situation by filing fraudulent unemployment claims with identities stolen from individuals who had not filed any claims. In these situations, the scammer received the payment for the unemployment benefits rather than the true owner of the TIN listed on the form.

If you received a Form 1099-G reporting unemployment benefits that you did not receive, you should contact your appropriate state agency to request a corrected form. After you show that you did not receive the benefits, you should receive a Form 1099-G showing zero benefits. Even if you have not received the corrected form from your state agency by the time you file your tax return, you should file your tax return with accurate information. You should only include income you did receive. Per IRS guidance, if you were previously identified as a victim of identity theft, you should not receive a Form 1099-G.

Should you require paystubs to print out for historical records, do not hesitate to check out the instant paystub maker supplemented with dozens of printable paystub samples.