What is Form 1099-OID?

When a bond or debt instrument is issued at a price lower than its face value (also known as its maturity value), the difference between the issue price and the face value is referred to as an original issue discount (OID). The OID represents a form of built-in interest, as the bondholder (the buyer) is effectively lending money to the bond issuer (the seller) at a discount and receiving more back at maturity. This interest income is taxable, and the bond issuer is responsible for reporting the amount of OID to the bondholder and the IRS on Form 1099-OID.

Not all bonds or debt instruments have OID, and not all interest income is reported on Form 1099-OID. For example, traditional bonds that are issued at or above face value do not have OID, and the interest income they generate is reported on Form 1099-INT.

If you receive a Form 1099-OID, you must report the amount of OID shown on the form as taxable interest income on your tax return. Depending on the amount of OID income you received, this could have a significant impact on your taxable income. It's important to understand the rules surrounding OID, do your own research, and consult with a tax professional if you have any questions.

Who needs to file Form 1099-OID?

The issuer of a bond or debt instrument that has an OID is responsible for filing Form 1099-OID. This includes corporations, government entities, and other organizations that issue debt instruments.

Like other Form 1099 information returns, the issuer is required to file a Form 1099-OID for each bondholder or investor who received OID income during the year. The form must be sent to the bondholder and to the IRS by January 31st of the year following the year in which the OID was paid.

Issuers need to file accurate and complete Forms 1099-OID, as failure to do so could result in both penalties from the IRS and issues for the bondholder. Bondholders should also keep accurate records of their OID income, as they are responsible for reporting this income on their tax return.

Who is not required to file Form 1099-OID?

Not all issuers of bonds or debt instruments are required to file Form 1099-OID. The following types of issuers are not required to file the form:

-

Issuers of bonds or debt instruments that do not have OID. For example, traditional bonds that are issued at or above face value do not have OID, and the interest income they generate is reported on Form 1099-INT.

-

Issuers that are exempt from tax under the Internal Revenue Code, such as some government entities.

-

Issuers of bonds or debt instruments that are issued in registered form and are traded on a recognized securities market.

-

Issuers of bonds or debt instruments that are issued to tax-exempt organizations, such as charitable organizations or educational institutions.

-

Bonds where the gross (total) OID income is less than $10 so not need to file or send Form 1099-OID for these bonds. However, if you withheld federal income tax from these bonds, you will still need to file Form 1099-OID.

Even if an issuer is not required to file Form 1099-OID, the bondholder is still responsible for reporting any OID income they receive on their tax return. They may still receive a Form 1099-OID from the issuer, but if not, they should keep accurate records of their OID income so that they can report it correctly on their tax return.

When is the deadline for Form 1099-OID?

The deadline for filing Form 1099-OID is January 31st of the year following the year in which the OID was paid. For example, if OID was paid in 2022, the Form 1099-OID should have been filed by January 31, 2023. If the OID is paid in 2023, the deadline is January 31, 2024.

The form must be filed by the issuer of the bond or debt instrument. The issuer must send a copy of the form to each bondholder and to the IRS.

The deadline for filing Form 1099-OID is a hard deadline, which means that there are no extensions or exceptions. If the form is not filed by January 31st, the issuer may be subject to penalties from the IRS.

The bondholder is also responsible for reporting their OID income on their tax return. They should keep accurate records of their OID income, even if they do not receive a Form 1099-OID from the issuer.

Both issuers and bondholders have to understand the rules surrounding Form 1099-OID and to take the necessary steps to ensure that the form is filed accurately and on time. If you have any questions or concerns, it's a good idea to consult with a tax professional.

Can the deadline for Form 1099-OID be extended?

No, the deadline for filing Form 1099-OID cannot be extended. The deadline is January 31st of the year following the year in which the OID was paid, and it is a hard deadline with no exceptions or extensions.

The issuer of the bond or debt instrument is responsible for filing the form and must send a copy of the form to each bondholder and to the IRS by the deadline. If the form is not filed by January 31st, the issuer may be subject to penalties from the IRS.

Issuers must plan ahead and ensure that they have the necessary information and resources to file accurate and complete Forms 1099-OID by the deadline. This can include records of bond agreements and bond payment terms, records of OID amounts, bond payment records, and finding the appropriate Form 1099 filing software ahead of the deadline. They can also contact a tax professional to file the Forms 1099-OID on their behalf.

What is the penalty for late filing of Form 1099-OID?

The penalty for late filing of Form 1099-OID can be significant. The IRS imposes penalties on issuers who fail to file the form on time or who file an incorrect or incomplete form. The amount of the penalty depends on the circumstances, but it can be substantial.

Here are the IRS imposed penalties for late filing of information returns, including Form 1099-OID. These penalties apply to each Form 1099-OID that is not filed, so penalties can add up quickly.

Here are the factors that determine the amount of the penalty:

-

The length of the delay: The longer the delay in filing, the higher the penalty.

-

The number of Forms 1099-OID: The penalty increases for each form that is filed late or filed incorrectly.

-

Intentional disregard: If the issuer is found to have intentionally disregarded filing the form, the penalty can be even higher.

The exact amount of the penalty can vary, but in some cases, it can be as high as $580 per form. The total penalty can quickly add up if multiple forms are filed late or filed incorrectly.

What happens if I don't file Form 1099-OID?

If you are the issuer of a bond or debt instrument with OID and you fail to file Form 1099-OID, there can be serious consequences. Here are some of the potential consequences of failing to file the form:

-

Penalties from the IRS: The IRS imposes penalties on issuers who fail to file the form on time or who file an incorrect or incomplete form. The amount of the penalty depends on the circumstances, but it can be substantial.

-

Bondholder underreporting: If the bondholder does not receive a Form 1099-OID from the issuer, they may underreport their OID income on their tax return. This can result in additional taxes and interest, as well as penalties for underreporting. The bondholder may attempt to hold the issuer responsible for additional taxes, penalties, and interest.

-

IRS enforcement action: If the IRS determines that the issuer has failed to file the form, it may take enforcement action, including fines and penalties. In severe cases, the IRS may even perform an audit or pursue criminal charges.

-

Damage to reputation: Failing to file Form 1099-OID can damage the issuer's reputation and make it more difficult to attract investors in the future.

What supporting documents do I need to file with Form 1099-OID?

While you generally do not need to file supporting documentation alongside Form 1099-OID, you should consider keeping the following information in your records:

-

Bond or debt instrument information: The issuer will need to retain information about the bond or debt instrument, including its face value, issue price, and OID.

-

Bondholder information: The issuer should maintain accurate information about the bondholder, including their name, address, and taxpayer identification number (TIN).

-

Interest payment records: The issuer will need to have records of all OID payments made to the bondholder during the year.

-

Backup withholding documentation: If backup withholding was taken from the bondholder's OID income, the issuer should keep documentation to support this.

-

Electronic filing documentation: If the issuer is required to file Form 1099-OID electronically, they will need to have a valid electronic filing identification number (EFIN) and may need to use specialized software, a third-party service, or a tax professional to file the form(s).

These are just some of the supporting documents that may be required when filing Form 1099-OID. The exact requirements may vary depending on the circumstances.

How do I file Form 1099-OID?

Form 1099-OID can be filed either electronically or on paper. Here are the steps for filing Form 1099-OID:

-

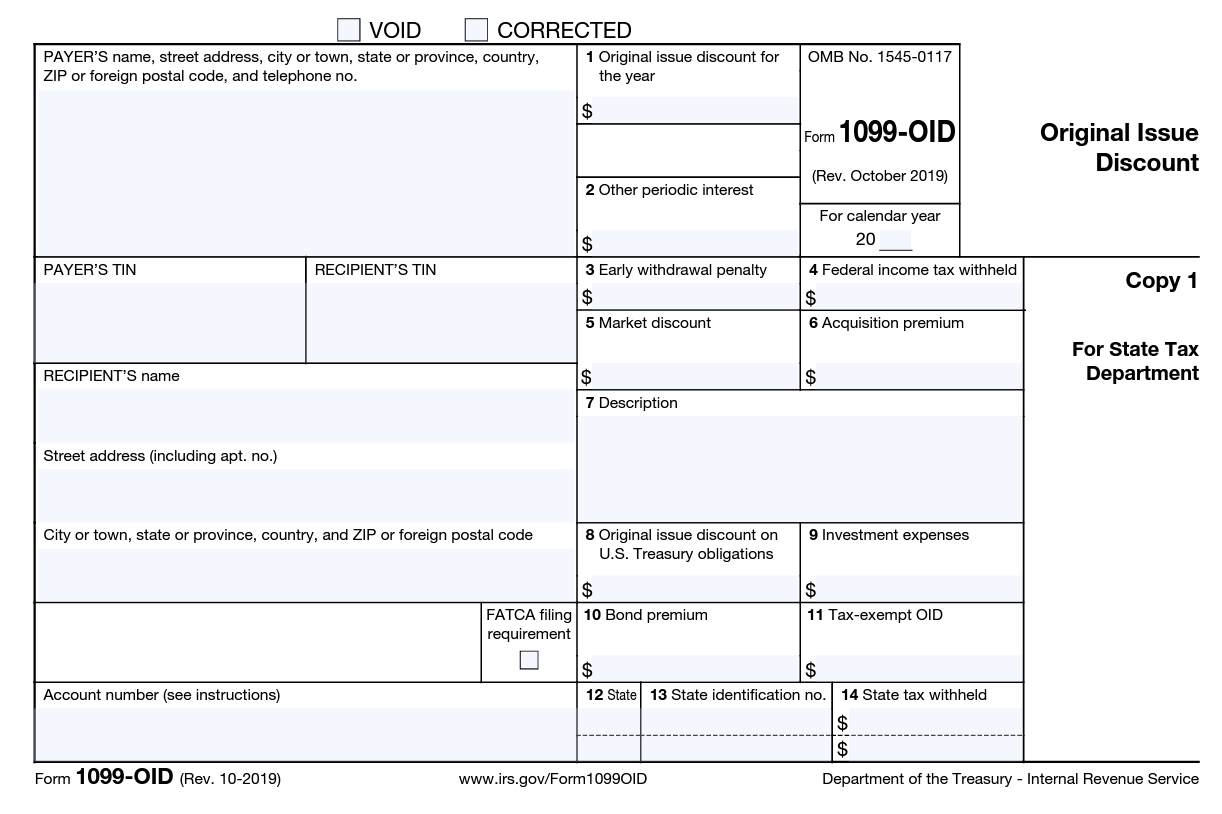

Gather information: The issuer will need to gather all relevant information related to the bond or debt instrument, including its face value, issue price, OID, and any tax withholdings, as well as accurate information about the bondholder, including their name, address, and taxpayer identification number (TIN).

-

Choose a filing method: The issuer can choose to file Form 1099-OID electronically or on paper. If the issuer is required to file 250 or more Forms 1099-OID, they must file electronically. For smaller issuers, paper filing is an option, but electronic filing is highly recommended as it reduces the risk of errors and increases the speed and accuracy of processing by the IRS.

-

If filing by mail: Mail a copy of Form 1099-OID to the IRS by January 31 of the year following the year in which the debt was canceled. The appropriate address is listed on page 7 of the 2022 General Instructions for Information Returns.

-

If filing electronically: You can file the form electronically through the IRS's FIRE (Filing Information Returns Electronically) system.

-

-

Prepare the form: The issuer will need to complete the form, including all relevant information about the bond or debt instrument and the bondholder. The form should be accurate and complete, and any backup withholding documentation should be included if applicable.

-

File the form: If filing electronically, the issuer will need to use specialized software or a third-party service to file the form. If filing on paper, the form should be sent to the IRS and to each bondholder by January 31st of the year following the year in which the OID was paid.

Where should I mail Form 1099-OID to?

The issuer of a bond or debt instrument with OID must send a copy of Form 1099-OID to both the IRS and to each bondholder. The Internal Revenue Service (IRS) address you should use will depend on the state in which you are located.

Here are the IRS’s addresses for mailing paper copies of information returns such as Form 1099-OID:

| If your principal business, office or agency, or legal residence in the case of an individual, is located in: | Use the following address: |

| Alabama, Arizona, Arkansas, Delaware, Florida, Georgia, Kentucky, Maine, Massachusetts, Mississippi, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Texas, Vermont, Virginia | Internal Revenue Service Austin Submission Processing Center P.O. Box 149213, Austin, TX 78714 |

| Alaska, Colorado, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Montana, Nebraska, Nevada, North Dakota, Oklahoma, Oregon, South Carolina, South Dakota, Tennessee, Utah, Washington, Wisconsin, Wyoming | Department of the Treasury IRS Submission Processing Center P.O. Box 219256, Kansas City, MO 64121-9256 |

| California, Connecticut, District of Columbia, Louisiana, Maryland, Pennsylvania, Rhode Island, West Virginia | Department of the Treasury IRS Submission Processing Center 1973 North Rulon White Blvd, Ogden, UT 84201 |

It's important to mail the form to the appropriate address to ensure that it is processed correctly and on time. If you are filing Form 1099-OID electronically, you will need to use the IRS's FIRE (Filing Information Returns Electronically) system, described below.

Can I file Form 1099-OID electronically?

Yes, you can file Form 1099-OID electronically with the Internal Revenue Service (IRS) using the FIRE (Filing Information Returns Electronically) system. Electronic filing is the recommended method of filing Form 1099-OID by the IRS, as it is faster and more accurate than filing paper forms. Issuers who are required to file 250 or more Forms 1099-OID are required to file electronically. For smaller issuers, paper filing is still an option, but electronic filing is still recommended.

To file electronically, the issuer will need to use either the IRS’s FIRE system, specialized software, the assistance of a tax professional, or a third-party service that is approved by the IRS. There are a number of different software and service options available, and the issuer should choose one that meets their needs and budget, including the quantity of Forms 1099-OID they need to file.

The software or service will guide the issuer through the process of preparing the form and transmitting it to the IRS. The issuer will need to enter information about the bond or debt instrument and the bondholder, and the software or service will generate the form based on this information.

Additionally, the issuer must still send a copy of the form to each bondholder, even if they file electronically.

Electronic filing offers several advantages over paper filing, including faster processing, reduced risk of errors, and more efficient handling of corrections and adjustments.

If you ever wonder how to create paystubs for your employees, you can do so by using the instant paystubs generator online.