We've Helped Customers Create Their 1099-G Form Using Our Generator

What Is Form SS-4?

Form SS-4, Application for Employer Identification Number (EIN), is an Internal Revenue Service (IRS) form used to apply for an employer identification number (EIN). It is used by an employer, sole proprietor, corporation, partnership, estate, trust, or another individual or entity that requires an EIN for tax filing and reporting purposes.

What Is An EIN?

An EIN, or employer identification number, is a 9-digit taxpayer identification number (TIN) used by the IRS to uniquely identify certain entities for tax filing and reporting purposes. Although it has the same number of digits as a social security number (SSN), EINs are formatted in the following manner: XX-XXXXXXX. While a SSN is issued by the Social Security Administration, the IRS issues all other types of TINs, including EINs.

What Is Form SS-4 Used For?

You should use the Form SS-4 to apply for an EIN if you do not already have an EIN and are required to have an EIN for tax filing or reporting purposes. Typically, EINs are used by employers. However, there may be instances when other individuals or entities are required to obtain an EIN.

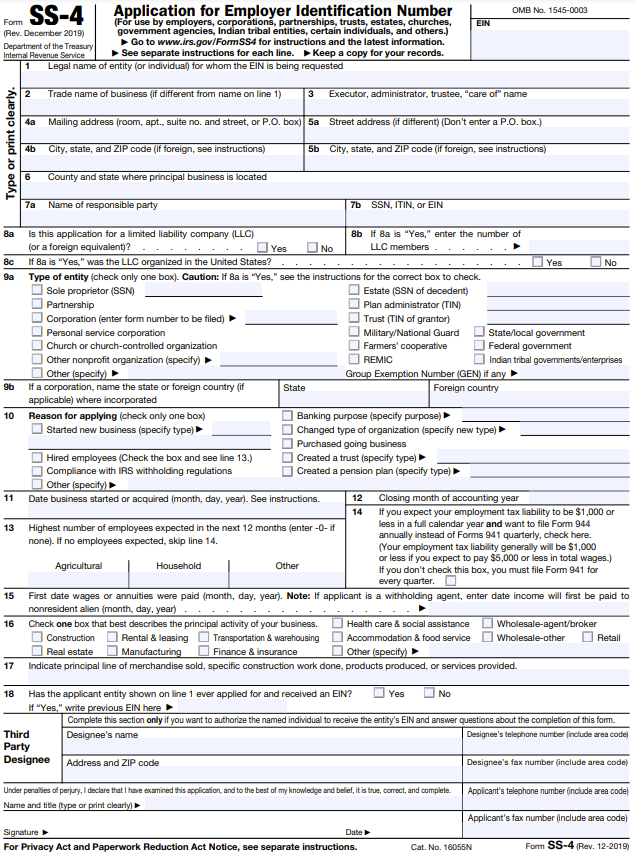

What Information Is Reported On Form SS-4?

The top of Form SS-4 is where you will need to enter identifying details about the individual or entity for whom the EIN is being requested. Lines 1 through 7b are the legal name, trade name or “doing business as” DBA name, administrator name, mailing address, street address, county and state, name of responsible party, and taxpayer identification number of the responsible party.

Your responsible party is the person who ultimately owns or has effective control over the entity. Unless you are applying as a government entity, the responsible party should be an individual rather than an entity.

Line 8a asks if the application is for a limited liability company (LLC). If you answer “yes” to line 8a, then line 8b asks for the number of members in the LLC and line 8c asks if your LLC was organized in the United States.

By default, a domestic single member LLC is treated by the IRS as a disregarded entity. That means the owner of the LLC must report all income and expenses on their own tax return, on Schedule C, Profit or Loss from Business, of the Form 1040, U.S. Individual Income Tax Return. Also, by default, a domestic LLC with two or more members is treated as a partnership. You may file Form 8832 to elect to have your LLC taxed as a corporation. If you and your spouse are the sole owners of the LLC and you wish to have the entity treated as a disregarded entity for taxation purposes, enter “1” in line 8b for the number of members.

Line 9a is where you check the organization type for your entity. The options are:

- Sole proprietor (SSN required)- if you will be filing Schedule C or Schedule F, Profit or Loss from Farming, of the Form 1040

- Partnership- annual information return, Form 1065, U.S. Return of Partnership Income must be filed

- Corporation (Enter form number to be filed)- for any corporation other than a personal service corporation

- Personal service corporation- if the principal activity of the entity for testing period of the tax year is personal services provided by employee-owners and the employee-owners own at least 10% of the fair market value (FMV) of outstanding stock on the last day of the testing period– for example, accounting, engineering, or law firms

- Church or church-controlled organization- a church, convention or association of churches, or an elementary or secondary school controlled by a church or a convention of churches

- Other nonprofit organization (Specify)- if you are covered by a group exemption letter, enter the four-digit group exemption number (GEN) in the final box of this section

- Other (Specify)- common “other” classifications include a household employer, qualified subchapter S subsidiary (QSub), and withholding agent

- Estate (SSN of deceased)- a legal entity set up after a person’s death

- Plan administrator (TIN required)- the person who has the responsibility for running the plan

- Trust (TIN of grantor)- typically, a relationship where one person holds title to property for the benefit of another

- Military / National Guard- when a tax ID number is required on federal tax forms

- Farmer’s Cooperative- when a tax ID number is required on federal tax forms

- REMIC- if your entity has elected to be treated as a real estate mortgage investment conduit

- State / Local Government- if your entity has the characteristics of a government, such as powers of taxation, law enforcement, etc.

- Federal Government- part of the Executive, Legislative, or Judicial branches, as well as other federal agencies

- Indian Tribal Governments / Enterprises- the IRS has the Office of Indian Tribal Governments, which is set up specifically to answer tax questions regarding tribal governments, here

If you checked “corporation” in line 9a, then line 9b asks for the state or foreign country where it was incorporated.

Line 10 is where you check the reason for your application. Lines 11 and 12 ask for the start date of your business and the closing month of the entity’s accounting year. Line 13 is where you enter the number of expected employees in the next 12 months. If you entered anything but zero in line 13, and you don’t expect to exceed the $1,000 annual employment tax liability allowed for Form 944, Employer’s Annual Federal Tax Return, you can check the box in line 14 to request to file Form 944 rather than Forms 941, Employer’s Quarterly Federal Tax Returns. Enter the first date you paid or will pay wages in line 15.

If you need to provide pay stubs for your employees, you can print them out by using this paystub creator. There are also plenty of paystub samples available ready for your choosing.

In line 16, check the box for the activity that most closely represents your business’s primary activity. In line 17, give a description of your primary business activity. In line 18, check the box for whether or not your entity has applied for and received an EIN before. If yes, then enter the previous EIN.

The next section on the Form SS-4 is the third party designee box. It should only be completed if you want to authorize someone to receive the entity’s EIN and answer questions on behalf of your entity. If you have a designee, enter their name, address, telephone number, and fax number. Finally, sign and date the form.

Who Needs To Fill Out Form SS-4?

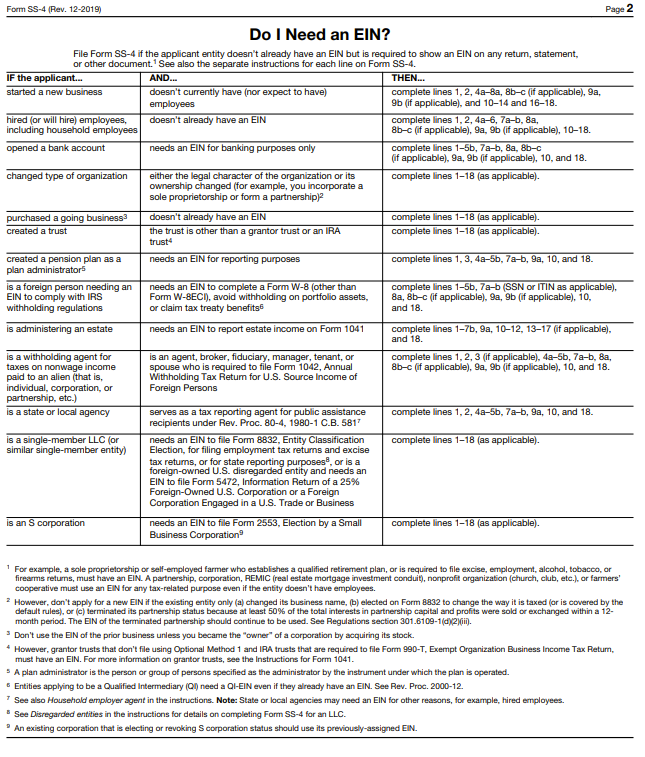

You can determine if you need an EIN based on the flowchart provided on the second page of the Form SS-4. Depending on your business formation and need for an EIN, you will have to fill out specific lines of the Form SS-4.

How To Fill Out Form SS-4 For A New Business

If you have started a new business and do not plan to have employees, you should complete lines 1, 2, 4a through 8a, 8b and 8c (if applicable), 9b (if applicable), 10 through 14, and 16 to 18.

How To Fill Out Form SS-4 To Hire Employees

If you have hired or plan to hire employees, including household employees, you should complete lines 1, 2, 4a through 6, 7a and 7b, 8a, 8b and 8c (if applicable), and 16 to 18.

How To Fill Out Form SS-4 To Open A Bank Account

If you need an EIN for banking purposes only, you should complete lines 1 through 5b, 7a and 7b, 8a, 8b and 8c (if applicable), 10, and 18.

How To Fill Out Form SS-4 to Change An Organization Type

If you change the legal character of your business– such as going from a sole proprietorship to a partnership– you should complete lines 1 to 18, as applicable.

How To Fill Out Form SS-4 to Purchase A Going Business

If you purchased a going business that does not already have an EIN, you should complete lines 1 to 18, as applicable.

How To Fill Out Form SS-4 For A Trust

If you created a trust– other than a grantor trust or an IRA trust– you should complete lines 1 to 18, as applicable.

How To Fill Out Form SS-4 As A Plan Administrator For A Pension

If you are an administrator on a pension plan and need an EIN for reporting purposes, you should complete lines 1, 3, 4a through 5b, 7a and 7b, 9a, 10, and 18.

How To Fill Out Form SS-4 As A Foreign Person Who Must Comply With IRS Withholding Rules

If you are a foregin person who must have an EIN to comply with IRS withholding regulations– to complete a Form W-8, avoid withholding on portfolio assets, or to claim tax treaty benefits– you should complete lines 1 through 5b, 7a and 7b, 8a, 8b and 8c (if applicable), 10, and 18.

How To Fill Out Form SS-4 For An Estate

If you administer an estate and you need an EIN to report estate income on Form 1041, you should complete lines 1 through 7b, 9a, 10 through 12, 13 through 17 (if applicable), and 18.

How To Fill Out Form SS-4 As A Withholding Agent For Taxes On Non Wage Income Paid To An Alien

If you are a withholding agent who is required to file Form 1042, Annual Withholding Tax Return for U.S. Source Income of Foreign Persons, you should complete lines 1, 2, 3 (if applicable), 4a through 5b, 7a and 7b, 8a, 8b and 8c (if applicable), 10, and 18.

How To Fill Out Form SS-4 As A State Or Local Agency

If you are a state or local agency that services as a tax reporting agent for public assistance recipients under Rev. Proc. 80-4, 1980-1 C.B. 581, you should complete lines 1, 2, 4a through 5b, 7a and 7b, 9a, 10, and 18.

How To Fill Out Form SS-4 As A Single Member LLC

If you are a single member LLC and need an EIN for one of the following reasons:

- To file form 8832, Entity Classification Election

- For filing employment tax returns and excise tax returns

- For state reporting purposes

- As a foreign-owned U.S. disregarded entity who must file Form 5472, Information Return of a 25% Foreign-Owned U.S. Corporation or a Foreign Corporation Engaged in a U.S. Trade or Business

You should complete lines 1 through 18, as applicable.

How To Fill Out Form SS-4 As An S Corporation

If you are an S Corporation that needs to file Form 2553, Election by a Small Business Corporation, you should complete lines 1 through 18, as applicable.

When Should I File Form SS-4?

You should complete Form SS-4 at least 4 to 5 weeks prior to the date you need an EIN if you plan to file via the mail. Fax is quicker, with a typical turnaround time of 4 business days. The quickest option— and IRS recommended– is to apply for an EIN online. You will receive your EIN immediately upon completion of all your validations.

Where Do I Submit Form SS-4?

The easiest way to apply for an EIN is on the IRS website, here. The application walks you through a series of questions that mirror details on the Form SS-4. If you do not qualify to file online or otherwise prefer the paper form, you can fax or mail Form SS-4.

International applicants are able to apply via the telephone. This is not an option for anyone with a U.S. or U.S. possession-based legal residence or principal place of business. If you qualify, you can call 267-941-1099 between 6:00a.m. to 11:00p.m., Monday through Friday, to obtain an EIN. You will be asked certain questions that will answer line items from the Form SS-4. It is recommended for you to complete the Form SS-4 prior to calling the IRS, as it will help to establish your account and assign your EIN.

Where To Fax Form SS-4

If your principal place of business or legal residence is in one of the fifty states or the District of Columbia, you should fax your Form SS-4 to 855-641-6935. If your principal place of business or legal residence is outside of the fifty states or District of Columbia, you should fax your Form SS-4 to 855-215-1627 from within the United States or 304-707-9471 from outside the United States. If you fax in your form, you will receive a fax back when your EIN is issued. The typical turnaround time is four business days.

Where To Mail Form SS-4

If your principal place of business or legal residence is in one of the fifty states or the District of Columbia, you should mail your Form SS-4 to:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

If your principal place of business or legal residence is outside of the fifty states or District of Columbia, you should mail your Form SS-4 to:

Internal Revenue Service

Attn: EIN International Operation

Cincinnati, OH 45999

If you mail your Form SS-4, you can expect to receive your EIN in the mail in four to five weeks. You can call the IRS at 800-829-4933 to ask about the status of your mailed application.