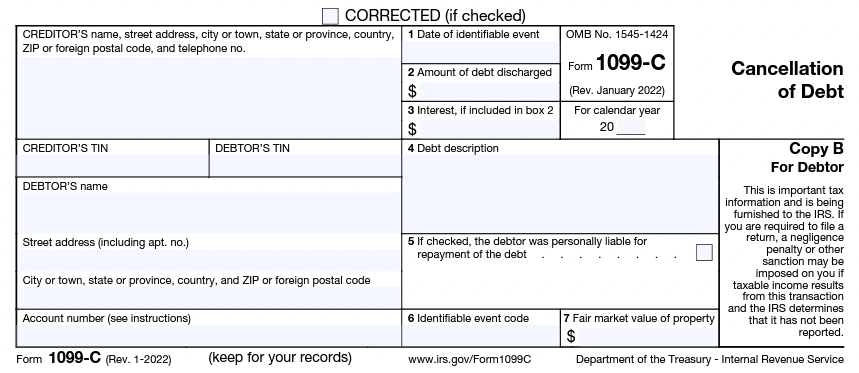

What is Form 1099-C?

Form 1099-C, Cancellation of Debt, is a tax form used in the United States to report canceled or forgiven debts of $600 or more. When a debt is canceled or forgiven, the lender or creditor may be required to file Form 1099-C with the Internal Revenue Service (IRS) and send a copy to the debtor.

The form shows the amount of debt that has been canceled or forgiven and must be reported as income on the debtor's tax return. This is because the IRS considers canceled or forgiven debt to be a form of income, which is subject to taxation.

However, not all canceled or forgiven debts are considered taxable income. Certain circumstances, such as bankruptcy or insolvency, may allow for exclusion from taxation. However, taxpayers will need to file Form 982, Reduction of Tax Attributes Due to Discharge of Indebtedness, along with their tax return to claim these exclusions.

In summary, Form 1099-C is used to report canceled or forgiven debt to the IRS and the debtor, and serves as a record of the amount of canceled debt that may be subject to taxation.

Who needs to file Form 1099-C?

Generally, creditors or lenders who forgive or cancel a debt of $600 or more must file Form 1099-C with the Internal Revenue Service (IRS) and send a copy to the debtor. Here are some additional details on who needs to file Form 1099-C:

-

Financial institutions: Banks, credit unions, and other financial institutions that forgive or cancel a debt of $600 or more must file Form 1099-C.

-

Credit card companies: Credit card companies that forgive or cancel a debt of $600 or more must also file Form 1099-C.

-

Businesses and individuals: If a business or individual lends money or extends credit to someone, even if only in the form of a credit card, and forgives or cancels a debt of $600 or more, they must file Form 1099-C.

-

Government agencies: Government agencies that forgive or cancel debts, such as student loans, must also file Form 1099-C.

-

Exceptions: There are some exceptions to the requirement to file Form 1099-C. For example, if the debt was discharged in a bankruptcy case, if the debtor was insolvent at the time the debt was canceled, or if the debt was a qualified principal residence indebtedness, the creditor may not be required to file Form 1099-C. Visit the IRS’s Taxpayer Advocate Service for more information.

Note that the debtor may still need to report the canceled debt as income on their tax return even if the creditor does not file Form 1099-C. If you do not receive a form 1099-C, you can contact the creditor to inquire about it and request a copy of the form.

Who is not required to file Form 1099-C?

While many creditors and lenders are required to file Form 1099-C to report canceled or forgiven debts, there are some circumstances in which the requirement to file Form 1099-C does not apply. Here are some examples:

-

Debts under $600: Creditors are not required to file Form 1099-C for debts that were canceled or forgiven if the amount of the debt is less than $600.

-

Gifts: If a creditor forgives a debt as a gift or for no consideration, they are not required to file Form 1099-C.

-

Non-profit organizations: Non-profit organizations, including charities and religious institutions, are generally not required to file Form 1099-C for canceled debts.

-

Business debts: If a business cancels a debt owed to them by another business, they are not required to file Form 1099-C.

-

Loans to family members: If a loan was made to a family member and the debt is canceled, the creditor may not be required to file Form 1099-C.

-

Interest: Creditors are not required to report the forgiveness of interest on debt. If they do choose to forgive and report interest on Form 1099-C, they should include the canceled debt in box 2 and the interest in box 3.

-

Nonprincipal Amounts: If the creditor forgives fees, penalties, fines, and/or administrative costs related to the debt, they do not need to report these amounts on Form 1099-C.

Even if a creditor is not required to file Form 1099-C, the debtor may still need to report the canceled debt as income on their tax return, depending on the circumstances of the cancellation. It's always a good idea to consult with a tax professional to determine the tax implications of canceled or forgiven debts. More information can also be found in the Form 1099-C Instructions.

When is the deadline for Form 1099-C?

The deadline for filing Form 1099-C with the Internal Revenue Service (IRS) is January 31st of the year following the year in which the debt was canceled or forgiven. This means that if a creditor forgave or canceled a debt in 2022, they should have filed Form 1099-C with the IRS and sent a copy to the debtor by January 31, 2023. If debt is forgiven in calendar year 2023, the creditor should file and send the form by January 31st, 2024.

Failure to file Form 1099-C on time or failure to provide a copy to the debtor may result in penalties and fines from the IRS. It's a good idea for creditors to keep accurate records of all canceled or forgiven debts and to file Form 1099-C in a timely manner to avoid any issues with the IRS. This can usually be done using accounting software or by soliciting the help of a tax professional.

Can the deadline for Form 1099-C be extended?

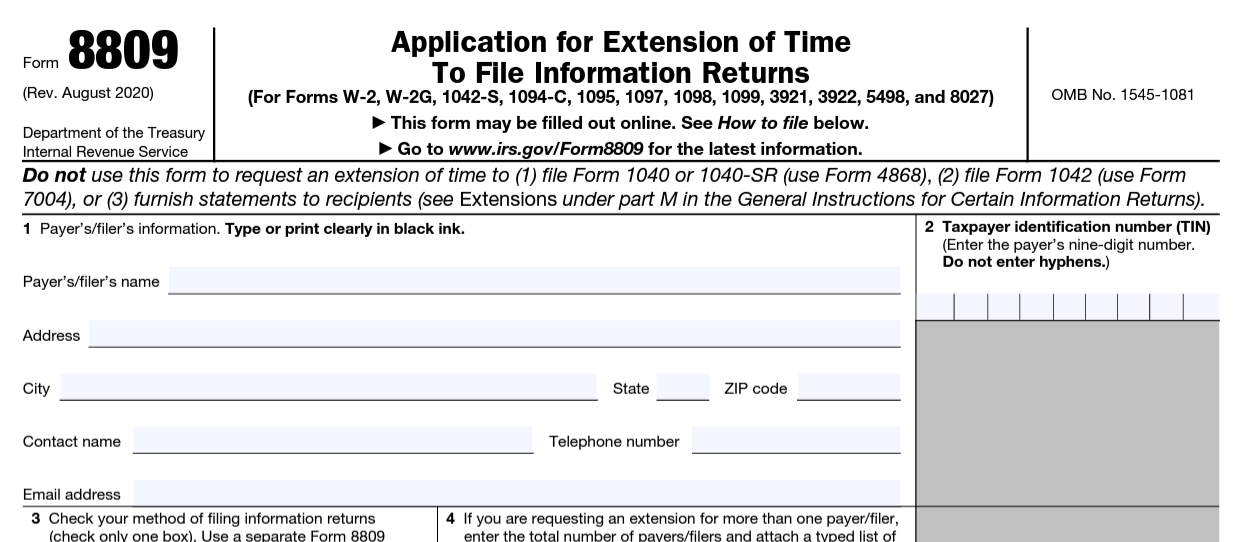

The deadline for filing Form 1099-C with the Internal Revenue Service (IRS) can be extended under certain circumstances. However, the extension is not automatic, and creditors must request an extension by filing Form 8809, Application for Extension of Time to File Information Returns, with the IRS by the original due date of the form (January 31st).

The IRS may grant an extension of up to 30 days to file Form 1099-C, which would extend the deadline to February 28th of the year following the year in which the debt was canceled or forgiven. Additional extensions may be granted for certain hardship situations, such as natural disasters or other unforeseen circumstances. Form 8809 can be filed electronically for free using the IRS’s FIRE system.

While an extension may give creditors more time to file Form 1099-C, it does not extend the deadline for providing a copy of the form to the debtor. Creditors must still provide a copy of the form to the debtor by the original due date, even if they have been granted an extension to file with the IRS.

What is the penalty for late filing of Form 1099-C?

If a creditor fails to file Form 1099-C with the Internal Revenue Service (IRS) on time or provides an incomplete or incorrect form, they may be subject to penalties and fines. The amount of the penalty depends on how late the form is filed and can range from $50 to $550 per form, depending on the length of the delay.

Here are some examples of the penalties that may apply:

-

If the creditor files Form 1099-C no more than 30 days late, the penalty is $50 per form.

-

If the creditor files Form 1099-C more than 30 days late but before August 1st, the penalty is $110 per form.

-

If the creditor files Form 1099-C on or after August 1st or does not file it at all, the penalty is $290 per form.

-

If the creditor intentionally disregards the requirement to file Form 1099-C, the penalty is $580 per form, with no maximum limit.

In addition to these penalties, the IRS may also assess interest on any unpaid penalties or taxes owed as a result of late or incorrect filings.

Creditors must file Form 1099-C accurately and on time to avoid penalties and fines. If a creditor has a reasonable cause for not filing on time, they may be able to request relief from penalties by submitting a written explanation in a letter to the IRS. Information related to penalties for information returns can be found on page 19 of the 2022 General Instructions for Information Returns.

What happens if I don't file Form 1099-C?

If you are a creditor who is required to file Form 1099-C with the Internal Revenue Service (IRS) and you fail to file the form or file it late, you may be subject to penalties and fines. The penalties for failure to file or late filing can be significant, and they can add up quickly if you have multiple forms to file, and even quicker if you intentionally disregard the filing requirement.

In addition to the financial penalties, failure to file Form 1099-C can also result in other consequences. For example:

-

The debtor may not be aware of the canceled debt: By not filing Form 1099-C, the debtor may not be aware of the canceled debt and may not report it as income on their tax return. This can result in additional taxes and penalties for the debtor, which could cause them financial hardship. This can also result in significant administrative costs for the creditor to correct the issue, as well as potential legal action from the debtor as a result of not being notified.

-

The IRS may audit you: If you fail to file Form 1099-C, the IRS may choose to audit your business or organization, which can be time-consuming and expensive.

-

It could harm your business's reputation: Failure to file Form 1099-C accurately and on time can reflect poorly on your business or organization and damage your reputation with customers or other stakeholders.

What supporting documents do I need to file with Form 1099-C?

When filing Form 1099-C with the Internal Revenue Service (IRS), you typically do not need to submit any supporting documents with the form. However, it's important to keep accurate records of the canceled or forgiven debt, as well as any documentation related to the cancellation or forgiveness.

Here are some examples of the types of supporting documents that may be useful to have on hand when filing Form 1099-C:

-

Loan documents: If the canceled debt was related to a loan, it's a good idea to have copies of the loan documents on hand, including the original loan agreement, payment history, and any amendments to the loan.

-

Bank statements: If the canceled debt was related to a credit card or other type of financial account, it may be helpful to have bank statements or other documentation that shows the history of the account.

-

Correspondence with the debtor: If you communicated with the debtor about the canceled debt, it may be helpful to keep copies of any letters, emails, or other correspondence related to the cancellation or forgiveness.

-

Legal documents: If the canceled debt was related to a legal settlement or judgment, it's important to keep any legal documents related to the settlement or judgment, including the court order or settlement agreement.

While you typically do not need to submit these supporting documents with Form 1099-C, having them on hand can be helpful in case of an audit or other inquiry by the IRS. Remember to keep accurate records of all canceled or forgiven debts to ensure that you can file Form 1099-C accurately and on time.

How do I file Form 1099-C?

You can file Form 1099-C either electronically or by mailing the form. To file Form 1099-C with the Internal Revenue Service (IRS), you will need to follow these steps:

-

If filing by mail, obtain Form 1099-C: You can download Form 1099-C from the IRS website, or you can order a paper form by calling the IRS at 1-800-829-3676.

-

Fill out Form 1099-C: Enter the name and contact information of the creditor (the person or organization that canceled the debt) and the debtor (the person who had the debt canceled). Enter the amount of the canceled debt in Box 2 and include any other required information.

-

File Form 1099-C with the IRS:

-

If filing by mail: Mail a copy of Form 1099-C to the IRS by January 31 of the year following the year in which the debt was canceled. The appropriate address is listed on page 7 of the 2022 General Instructions for Information Returns.

-

If filing electronically: You can file the form electronically through the IRS's FIRE (Filing Information Returns Electronically) system.

-

-

Provide a copy of Form 1099-C to the debtor: Send a copy of Form 1099-C to the debtor by January 31 of the year following the year in which the debt was canceled.

-

Keep records: Keep accurate records of all canceled or forgiven debts, as well as any documentation related to the cancellation or forgiveness.

Where should I mail Form 1099-C to?

When you file Form 1099-C with the Internal Revenue Service (IRS), you will need to mail a copy of the form to the appropriate IRS address. The address you use will depend on the state in which you are located and whether you are filing the form electronically or on paper.

Here are the addresses for mailing paper copies of Form 1099-C:

| If your principal business, office or agency, or legal residence in the case of an individual, is located in: | Use the following address: |

| Alabama, Arizona, Arkansas, Delaware, Florida, Georgia, Kentucky, Maine, Massachusetts, Mississippi, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Texas, Vermont, Virginia | Internal Revenue Service Austin Submission Processing Center P.O. Box 149213, Austin, TX 78714 |

| Alaska, Colorado, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Montana, Nebraska, Nevada, North Dakota, Oklahoma, Oregon, South Carolina, South Dakota, Tennessee, Utah, Washington, Wisconsin, Wyoming | Department of the Treasury IRS Submission Processing Center P.O. Box 219256, Kansas City, MO 64121-9256 |

| California, Connecticut, District of Columbia, Louisiana, Maryland, Pennsylvania, Rhode Island, West Virginia | Department of the Treasury IRS Submission Processing Center 1973 North Rulon White Blvd, Ogden, UT 84201 |

It's important to mail the form to the appropriate address to ensure that it is processed correctly and on time. If you are filing Form 1099-C electronically, you will need to use the IRS's FIRE (Filing Information Returns Electronically) system, described below.

Can I file Form 1099-C electronically?

Yes, you can file Form 1099-C electronically with the Internal Revenue Service (IRS) using the FIRE (Filing Information Returns Electronically) system. Filing electronically can be more efficient and can help to ensure that your form is processed quickly and accurately.

To file Form 1099-C electronically, you will need to follow these steps:

-

Register with the IRS: Before you can file Form 1099-C electronically, you will need to register with the IRS through the FIRE system. You can register online at the FIRE website.

-

Prepare your file: Use the IRS's specifications to create a file that contains all of the information required for Form 1099-C.

-

Upload your file: Once you have prepared your file, you can upload it to the FIRE system. The system will validate your file to ensure that it meets the IRS's requirements.

-

Receive confirmation: Once your file has been validated, the FIRE system will provide you with a confirmation number. This number serves as proof that you have filed your Form 1099-C electronically.

If you file Form 1099-C electronically, you do not need to mail a paper copy of the form to the IRS. However, you will still need to provide a copy of the form to the debtor by January 31 of the year following the year in which the debt was canceled.

If you ever need to provide your employees with the monthly payslips, you can try out the online paystub creator.