Easily Create Any Type Of 1099 Tax Form

Generate any type of Form 1099 in an instant. Fast, easy to use and eliminates errors. We have all the form types to choose from.

1099 Form Types

The IRS Form 1099 is a series of documents that the Internal Revenue Service (IRS) refers to as "information returns."

Form 1099-MISC: Miscellaneous Income

Reports miscellaneous income, such as rents, prizes, awards, or other types of income not reported on other 1099 forms.

-

Easy to use

-

30-days money back guarantee

-

Accurate

-

Satisfaction Guaranteed

-

Secured

-

24/7 Customer Service

Form 1099-NEC: Nonemployee Compensation

Reports nonemployee compensation, such as fees, commissions, or other forms of payment for services rendered by independent contractors.

-

Easy to use

-

30-days money back guarantee

-

Accurate

-

Satisfaction Guaranteed

-

Secured

-

24/7 Customer Service

Form 1099-G: Certain Government Payments

Reports certain payments made by federal, state, or local governments, such as unemployment compensation, state and local income tax refunds, or agricultural payments.

-

Easy to use

-

30-days money back guarantee

-

Accurate

-

Satisfaction Guaranteed

-

Secured

-

24/7 Customer Service

Form 1099-R: Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.

Reports distributions from retirement plans, pensions, annuities, IRAs, and other similar accounts.

-

Easy to use

-

30-days money back guarantee

-

Accurate

-

Satisfaction Guaranteed

-

Secured

-

24/7 Customer Service

Form 1099-INT: Interest Income

Reports interest income paid by financial institutions, such as banks or credit unions.

-

Easy to use

-

30-days money back guarantee

-

Accurate

-

Satisfaction Guaranteed

-

Secured

-

24/7 Customer Service

Form 1099-DIV: Dividends and Distributions

This form is used to report dividend income and capital gains distributions paid to investors by corporations and mutual funds.

-

Easy to use

-

30-days money back guarantee

-

Accurate

-

Satisfaction Guaranteed

-

Secured

-

24/7 Customer Service

Form 1099-OID: Original Issue Discount

This form is used to report taxable interest income from bonds or other debt instruments that were issued at a discount to their maturity value.

-

Easy to use

-

30-days money back guarantee

-

Accurate

-

Satisfaction Guaranteed

-

Secured

-

24/7 Customer Service

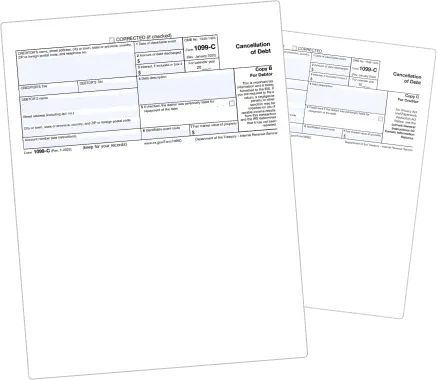

Form 1099-C: Cancellation of Debt

This form is used by financial institutions to report the cancellation of a debt that the debtor is no longer legally required to pay.

-

Easy to use

-

30-days money back guarantee

-

Accurate

-

Satisfaction Guaranteed

-

Secured

-

24/7 Customer Service

Benefits of using our 1099 Forms

Filling out forms can be repetitive and can also take up a lot of valuable time. Our 1099 generator can dramatically reduce the time it takes to fill out the form itself. Imagine what you could accomplish with all that free time on your hands. Our agents are available 24/7 via chat, phone and e-mail, and they will answer all kinds of questions and inquiries you might have.

Ease of Access

Quickly locate and download the form you need from our comprehensive directory

Up-to-date Forms

We ensure that you have the most current version of each form

Detailed Instructions

We provide user-friendly instructions for each form, helping you avoid mistakes and understand your tax obligations

Secure Handling of Information

our data is safe with us—we adhere to strict privacy standards

Reliable Support

Our team of tax professionals is ready to assist you with any queriesHow It Works

A step-by-step guide on using the platform for 1099 forms:

Select the 1099 form Type

you need

Fill in the required

information

Review and confirm

the details

Generate and download

your form