How To Use Your Pay Stubs To Build A Monthly Budget

In today’s economy, knowing how to handle money properly is a crucial skill to have. Although you shouldn’t be miserly to the point of compromising your quality of living, you must also be prudent in your spending.

Gen Xers, or those aged between 40 and 55, have the highest average debt of more than USD$135,000 among the age groups. Coming in second and third are baby boomers (56 to 74 years old) with nearly USD$97,000 and millennials (24 to 39 years old) with USD$78,000, respectively.

Mortgage and home equity lines of credit (HELOCs) comprise a significant chunk of consumer debt. Meanwhile, other types of consumer debt that burden Americans are student and auto loans, as well as credit card purchases.

While the figures might seem daunting, there isn’t any problem if your income is higher than your expenses. However, if the opposite is true, and your spending goes over your take-home pay, then you should be careful about biting off more than you can chew financially.

Fortunately, to avoid going into debt, you just need to be mindful of how much pay you bring home each week or month, along with your expenses. For your income, it’s best to have a copy of your pay stubs.

What are paystubs?

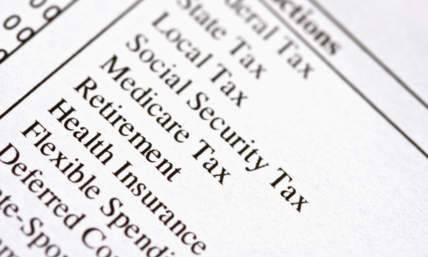

Pay stubs, also known as payslips, are work documents that provide your payment information. It includes details on how much your gross and net salary, along with voluntary and involuntary deductions, such as taxes, 401(k)s, and other contributions.

If you’re a regular worker, then your wages are relatively stable and pretty straightforward. You’re compensated for the number of hours or days you rendered in service of the company. Your pay stubs should reflect that and give you information on how much you’ve earned for a particular pay period. Additionally, it must also display how much you’ve been taxed as well as other contributions to date.

Take note, though, that businesses aren’t mandated by federal law to distribute pay stubs to their employees. While companies have to keep records of how much they’re paying their workers, some states don’t require them to give employees access to this document.

Alabama, Arkansas, Florida, Georgia, Louisiana, Mississippi, Ohio, South Dakota, and Tennessee are the states that don’t have any paystub distribution laws. Meanwhile, other states, like Arizona, Illinois, Michigan, Nevada, New York, Oklahoma, and Wisconsin, among others, require businesses to give their employees access to their payslips, but it can be electronic, so they don’t need to print the file.

You’re lucky if you work in California, Colorado, Connecticut, Iowa, Maine, Massachusetts, New Mexico, North Carolina, Texas, Vermont, and Washington. In these states, you won’t need to print your own pay stubs since your employers are required by local laws to do so.

However, if you fall under the states that don’t require employers to distribute physical or electronic stubs, you might be wondering how to get pay stubs. Conveniently, you can create one using an online paystub generator. All you have to do is provide your payment details, and the tool will do the rest.

Along with freelancers, you have to know how to create pay stubs so you’ll have your pay information on file. This document is useful when you want to take out loans or just keep track of how much you’re earning and how much you’re actually bringing home.

How to build a monthly budget

It’s crucial to set a monthly budget because it allows you to achieve your long-term goals by setting you on the right financial route. Determining a set of criteria on where and how to spend helps you live within your means and, in turn, avoid spending more than you can afford.

At the same time, a budget helps you save for large-ticket expenses, like a home, car, or even a grand family vacation. Typically, you need to pay a significant amount upfront for these purchases, and having a budget lets you save up for them properly.

If you don’t have a monthly budget yet, it’s time to create one. These are the steps to achieve it:

1. Collate your financial documents

Before anything else, you need to determine your income and expenses. To do so, you must collect your financial documents to ensure that your calculations are accurate. The more precise you are, the better your budgeting will be.

As mentioned earlier, you should keep a record of your pay stubs since this type of file contains details on your gross and net pay. This way, you get a comprehensive idea of your income and how much you can spend without putting a dent in your finances.

Aside from paystubs, these are other documents that you need to gather:

-

Government forms - Government forms, like the W2 and 1099, also contain your earnings information. The W2 records an employee’s total income as well as the taxes that are withheld from their paychecks, which are separated into federal and Social Security tax contributions, among others. Meanwhile, 1099 contains details of your non-employment income, which can come from owning stocks or being an independent contractor.

-

Bank statements - This document summarizes the activity on your bank account. It also reflects the balances for the previous month or quarter. You can use this data to balance your accounts, check your spending and other transactions, as well as detect errors or fraud before they become major financial issues.

-

Investment accounts - Aside from 1099, it also pays to stay on top of your investment accounts by keeping records of these documents. This way, you get an idea of your financial standing through how much your stocks, bonds, exchange-traded funds (ETFs), and mutual funds are earning.

-

Credit card bills - Aside from income, you also need to monitor your expenses through your credit card bills. Reviewing your purchases allows you to see your buying habits and reevaluate your spending. This way, you can work toward eliminating debt and start spending money safely.

-

Loan statements - You may also have loans, such as mortgages, auto loans, and other types of debts. You must also stay on top of these by collecting the statements and knowing when you’ll be able to repay them fully. Moreover, you may also be eligible for consolidating or refinancing your loans, which can give you better interest rates. So, you should check the options you have.

-

Receipts - On top of cashless purchases, you should keep track of your cash expenses as well. Taking note of small purchases, like buying a soda from a convenience store or bus fare, might seem tedious. However, if you’re serious about budgeting, you should develop this habit to ensure the accuracy of your records. You’ll get the hang of it in no time.

Also read: Do You Need Multiple W2 Forms From The Same Employer?

Also read: The Complete Checklist To Prepare For The W2 Form Deadline

2. Determine your income and expenses

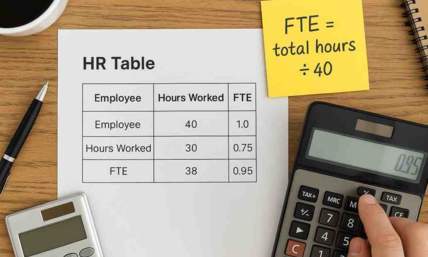

Net income or pay refers to the money that you can bring home. This comes after all the deductions and contributions have been taken out from your gross wages. Again, your paystub can help you determine this figure.

Budgeting is more straightforward when you’re an employee that receives a stable salary per week or month. Often, the income and deductibles are consistent, so you can easily set the threshold for your savings and spending.

It’s more complicated for independent contractors and business owners whose income depends on the number of clients they have for a particular period. If you fall under this category, you should be more thorough in your budgeting and ensure to save up for rainy days.

There are also fixed and variable expenses. The former pertains to expenses that regularly occur each week or month, such as utility costs and groceries. Conversely, variable expenses are those that don’t occur regularly, like vacations and emergencies.

Also read: Payroll Tax Vs Income Tax - The Ultimate Guide

3. Create a budgeting plan

After you’ve determined your income and expenses, you need to have a strategy on how to spend your money wisely. The most common and easiest budgeting plan is the 50-30-20 rule.

With this technique, you spend 50% on essential expenses, such as rent, utilities, groceries, and gas. Then, you can allocate 30% to non-essential purchases, like clothing, dining out, subscriptions, and gym memberships, among others. Lastly, you must set aside 20% of your savings. You can deposit into your savings account and other funds, such as for retirement, emergencies, and your other financial goals.

If this seems complicated, you can start with the 80-20 technique. With this strategy, you allocate 20% of your net income to your savings account and spend 80% in any way you want.

The best way to go about this technique is to set up automatic withdrawals as soon as you receive your pay in your bank account. The funds should be sent right into your savings account so you won’t be tempted to use the money.

Takeaway

Determining your income and exactly how much you can spend without going broke is the first step toward creating a monthly budget. Keeping records of your pay stubs can help you stay on top of your finances.

Once you have an idea of your net pay, you should also take a look at your expenses and see whether you have enough funds. This way, you can figure out which purchases can take a backseat and which ones should be prioritized.