What Is The Difference Between A W-2 And A W-4 Form?

Whatever business you are in, tax forms are part of your job, especially between January and April. People often confuse tax Forms W-2 and W-4, as they relate to one another and their names are similar. One works off the other to report an employee's tax situation. In fact, one of the most common payroll mistakes is incorrectly reporting holdings on the W-4.

If you feel like you are the only one with questions, rest assured, you're not alone! Here's a quick explanation of the differences between the W2 and W4 forms.

The W-2 And W-4 Forms

The Internal Revenue Service (IRS) needs to know what income people earn during the tax year. It also requires employers to withhold money from employees' paychecks to cover employees' end-of-year tax bill. The W2 and W4 Forms apply to employees but not independent contractors. Independent contractors file taxes differently.

Click Here to Create Your Form W-2 in Less Than 2 Minutes

The W-4 Form

The W4 Form is the tax form employers ask their employees to fill out upon hire. An employee must fill out a W-4 form unless they make less than $800 per year. Employers use it to calculate the amount of federal income tax to deduct from an employee's earning. The employee needs to fill in the form according to his or her household earnings.

All these things make up the total number of withholding options (also called allowances) for withholding taxes. Things to consider are, marital status, number of children or other dependents, and employment status. An employee can update the W4 at any time there is a change to his or her personal or financial status.

Employers are not required to request updates. If an employee is unsure about how much pay he or she wants the employer to withhold, he or she can refer to the IRS's Online Withholding Calculator for help.

Also read: Employer-Sponsored Health Insurance On Form W-2

The W-2 Form

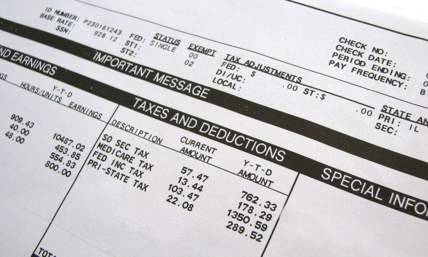

The W2 Form is a tax form that employers issue their employees at the end of each year. The W-2 form includes the total amount of wages the employee earned. It also lists the total amount of federal and state taxes the government withheld. Finally, it lists the contributions made to Social Security for that tax year.

After receiving the W2 Form from his or her employer, the employee must submit this information in April when paying taxes, with their Form 1040. Employers must provide employees their W2 by January 31 of each year. They are also required to send a copy to the Social Security Administration (SSA) by February 29.

The company keeps a copy on record for a minimum of four years. Employers send three copies to employees for their personal records and tax filings.

Also read: How To Correct A W2 Form Properly

Beyond The Basics Of Tax Forms

As long as there are taxes (and you know what they say about taxes and death), there will always be questions about tax forms.

Let's get you started on your form W-2! If you need to get your own paystub, you can try our paystub maker.

Also read: