What's on a Pay Stub?

A pay stub is like an ultimate document for employees. However, it begs to ask, "Do you understand what’s on a pay stub? A pay stub is very important. Both employees and employers should understand all pay stub details.

This involves knowing how to read them and comprehending why their pay stub is so important. This article discusses what's on a pay stub, your pay stub details, and how to understand this document.

What Is a Pay Stub?

A pay stub shows an employee's total earnings, taxes deducted, and net pay. A pay stub may be given to employees as a printed slip along with your paycheck, or you can access it online. This depends on your employer's method of issuing employee pay stubs.

Pay stubs show your salary, wages, pay rate, work hours, and other important job details. Individuals must understand their pay stub details. This helps them manage their finances well.

They'll also need to be updated and compliant based on state and federal requirements. Apart from pay stubs, this is also necessary when preparing tax documents like W-2s or 1099s.

Although federal law doesn't require employers to issue pay stubs, some states require employers to provide a written breakdown of employee earnings. Not all states are expected to do this, but the FLSA still requires employers to keep accurate records of their employee pay stub details.

Pay Stub Details: What’s on a Pay Stub?

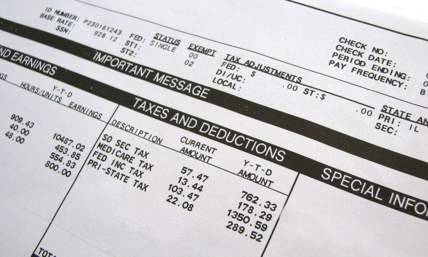

On a pay stub, different sections break down various parts of your work information. You'll need to fully understand each part of your pay stub and what each pay stub details mean. This helps keep your work records and know your earnings. Pay stub details include:

Employee Details

One of the first things you'll find on a pay stub is the employee's personal information. It includes details such as your name, address, and an EIN. Since this is your personal information, you must make sure that you give the right details. If you spot any wrong information, let HR know right away. This would help you avoid any issues later.

Pay Period

This refers to the pay period that you usually work for. Your pay period can be weekly, bi-weekly, or monthly.

Total Earnings/Gross Pay

This is the total income you earn for a pay period before your taxes are removed. It includes regular hours, overtime, bonuses, and other earnings.

Deductions & Withholdings

This section shows the taxes, deductions, and benefits that are usually removed from your paycheck. They include the taxes paid at the federal, state, and local levels. They also cover Social Security and Medicare taxes, contributions, and health insurance. These deductions determine how much you receive in your final paycheck. You should definitely double-check them regularly.

Net Pay

Net pay is also called take-home pay. It is the amount that you're left with after all taxes and deductions have been removed. This amount is what employees receive in their bank account as their final pay. The net pay is what people use to budget their monthly expenses.

Year-to-Date (YTD) Totals

A YTD is the total of your earnings and deductions for the whole year. It helps you keep track of income, taxes, and contributions or benefit plans all year.

Why Are Pay Stubs Important?

A pay stub is an essential document for both employees and employers. It monitors your taxes withheld, deductions, and contributions from your earnings. This helps budget your finances properly and ensure the right amounts are deducted.

Your pay stubs serve as a proof of income. You could use it as evidence since it acts as a record of your earnings and employment information. This is when you need to apply for loans, mortgages, or even an issue with your wages.

Landlords, lenders, and banks always require your proof of income before approving your application. They must confirm that you're earning enough money to repay or keep up.

Sometimes, there might be issues with your paycheck. This includes, for example, missing deposits or the wrong amount in your earnings or deductions. You'll have to use your pay stub to re-check or confirm the details. Your pay stub helps you verify exactly what you were paid for. With the document, you can spot errors easily and resolve them immediately.

Creating an Employee Pay Stub

Create an employee pay stub of your choice. You can either generate your pay stub manually, digitally, or by using payroll software. Manually creating your pay stub can be difficult, and it usually requires the most effort. It involves formatting the document yourself using Word or Excel. Next, you'll enter all your pay stub details. This includes important employee and payment information. There is a high chance of making mistakes while manually inputting the needed information.

Another method is to use a pay stub generator. These online tools help make the process of creating a pay stub easier. You'll need to choose a reliable pay stub generator and fill in your pay stub details. Using a pay stub generator, you still need to be careful when filling in your details.

Payroll software is the best way to generate an accurate pay stub. Payroll software handles everything in this process for you. You will be able to generate and calculate your pay and deductions automatically. This payroll software lets employees access their pay stubs online. This makes distribution easier. A payroll system protects employees' data and is a professional tool.

Final Thoughts

Knowing how important a pay stub is, you'll need to make it a habit to check your pay stubs regularly. This helps you discover mistakes early enough. You might even notice small errors that you can fix immediately. Also, with your pay stub, you'll know exactly what you earn, and you can be able to verify your deductions. Finally, you can plan and understand your finances better.

Our free pay stub generator is all you need to provide accurate employee pay stubs. It allows you to view your pay stubs easily. This includes your salary, wages, pay rate, work hours, and all other key pay stub details—without errors! Our tool is what you've been looking for; get started with us now.