How Do You Calculate Take Home Pay?

Finding and securing a new job can be hard enough as it is at the moment. What’s even more difficult is trying to navigate what your salary expectations are, what you could be earning and what your take home pay would be if you accept a certain position or role.

When you’re looking for new opportunities, the salaries are often different from what you would actually take home as part of your paycheck. When employers advertise jobs, they often advertise what the gross salary would be, when after your tax deductions are taken out, your pay may be much less than what you expected.

So, how can you tell what your ‘take home pay’ would be? That’s what this guide is all about. But first, what does ‘take home pay’ even mean?

Also read: What Is FUTA Tax - All You Need To Know

What does take home pay mean?

Your take home pay is often different from the advertised, payable salary that employers offer. The take home pay is a term for the amount that you actually receive in your paycheck after all of the deductions such as tax, insurance, benefits and other payments like pension payments or financial deductions. Your take home pay will be the net amount of income that you receive after the deductions have been made from your gross income or gross salary.

What is the gross salary?

Your gross salary is the term used to refer to the full payment an employee receives from the employer before any tax deductions or mandatory contributions and benefits are removed.

The gross pay is often what is advertised by employers for jobseekers, but it does not include all of the withholdings and deductions, so your actual paycheck would be less than the gross salary.

In each state or in different locations, the taxes may slightly vary or differ. For instance, in the state of California, say you are paid $35,000 per year as a gross salary, you would actually take home about $29,000 a year, or about $2,500 a month.

In the most simplest terms, the gross salary is your yearly salary amount before any taxes or deductions, and it is typically much larger than your actual take home pay or salary. So, how do you calculate your take home pay?

Also read: A Full Guide on How to Calculate Income Tax On A Pay Check

How do you calculate take home pay?

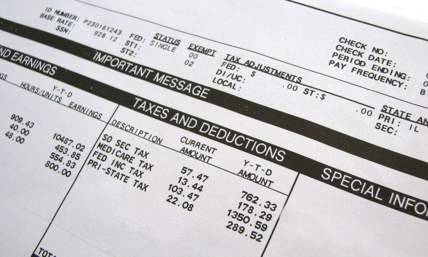

To calculate your take home pay, you will have to know your gross salary amount, and all of your tax deductions or benefit payments. Most of the time, when taxes and deductions are added together, it can take a sizable chunk out of your paycheck. However, on most paychecks, they will list and break down what deductions have been taken out of your pay, and how much these amounts were.

To calculate your take home pay, you will need to estimate how much your tax deductions will be, and how much your contributions to your pension or healthcare insurance is, and take this amount away from your gross salary amount.

What factors could impact your take home pay?

There are many factors that could impact or affect your take home pay, and how much money you pay in taxes and deductions. One of the many things that impacts your take home salary is the state in which you live.

In the US, salaries can vary from state to state as many different states have different laws and different tax amounts. For instance, you could work the same job in one state, be relocated to another, and your paycheck may be slightly different in another state, even for doing the same job at the same company.

You should also pay attention to the minimum wage requirements in your state to ensure that your employer is adhering to the law and paying enough for a good standard of living. In addition to this, you need to find out whether you are classified as exempt or nonexempt when it comes to things such as overtime pay. If you’re exempt, then you could be working lots of extra hours and not being paid anything extra at all, which can seriously impact your take home pay expectations.

Another thing you need to consider is your employer's policies regarding paid time off or paid sick leave. Some employers will pay you for time off due to sickness, holidays, vacation days and personal days, whereas others may not. This can affect your take home pay if you have a few sick days and your employer does not pay for them. This is why it is important to take a look into your employee benefits when applying for a job.

You may also need to think about whether you are considered a full time employee or a part time employee as this can impact the amount of your pay or eligibility for benefits, which will in turn affect your salary after taxes.

In a similar way, you should also confirm with your employer whether you are salaried or paid hourly. This can really impact your pay, as if you are salaried, then your paycheck should be about the same every single month, whereas if you are paid by the hour, then your take home pay may be different from month to month depending on how many hours you worked.

How do I calculate my salary after taxes?

Once you take all of these factors into consideration, you can start to calculate your salary after taxes. These personal deductions could be:

-

Your tax payments (federal, state and local)

-

Personal exemptions if applicable

-

Tax filing status

-

Contributions towards FICA (Federal Insurance Contributions Act)

-

Retirement savings

-

Life/health insurance contributions

When you start a new role, your employer should give you a W-4 form to fill in. It is vital that you fill this in correctly, as this document will tell your employer how much federal income tax they need to withhold from your pay.

This form can also help calculate what allowances you have such as childcare expenses or other benefits that you can claim, so that your take home pay is correct and as expected. By filling out the W-4 form correctly, you can prevent yourself from being stuck with a tax bill unexpectedly.

You can check with the IRS which tax withholdings you would have to pay here: https://www.irs.gov/individuals/tax-withholding-estimator . Once you have worked out your tax deductions and exemptions, you can deduct these from your gross pay to work out your take home salary!

Also read: Mandatory Deductions From Your Paycheck

Take home pay calculator

For a quick and easy solution, and a general idea of what your take home salary or pay would be, you can use a Take Home Pay Calculator such as: https://salaryaftertax.com/us/salary-calculator

With this tool, you can input your state or location, enter your gross salary, and use the calculator to find out what your average take home pay would be.

Also read: What Qualifies As Proof Of Income?

Summary

To summarize, trying to work out your take home pay when applying for jobs or starting a new job can be confusing. Jobs are often advertised with gross salaries, which may not necessarily reflect the actual amount of money you will take home each month. This is why calculating and estimating your take home pay is so important, as you can budget and plan and ensure you are financially stable in your job. Using your pay stubs you will be able to see these deductions a lot clearer. The online pay stub generator on our website makes creating these pay stubs a simple task.