How Do I Change My Direct Deposit Information With The IRS?

You've probably heard of Direct Deposit before. This is where you send your paycheck directly into the IRS bank account. The IRS then automatically deposits your tax refund into your checking or savings account.

Direct Deposit is a convenient way to get your taxes paid without having to go through the hassle of filing them. You can also make changes to the information easily when needed. If you don't already have a direct deposit setup, you'll want to check out these steps to set it up.

But we know that not everyone will know how to do this or how to change the information they have given the IRS. Before you know it, you can find yourself overwhelmed and unsure what to do or how to proceed.

So today, we are here to tell you how you can set a direct deposit up and how you can change this information with the IRS with ease. Just keep reading to find out more.

Also read: Is Rent Tax-Deductible?

Steps To Set Up A Direct Deposit

Follow our steps below to set up a direct deposit with the IRS.

1) Open A New Bank Account At A Financial Institution That Accepts Direct Deposits

The first step in setting up a direct deposit is opening a new bank account with a financial institution that will accept direct deposits. Most banks offer this service for free, but some charge fees for it.

2) Contact Your Employer And Ask Them To Add You To Their Payroll System

After you've opened an account with a financial institution, you'll need to talk to your employer about adding you to their payroll system, so they can initiate a direct deposit. There are two ways to do this.

Option 1 - Use An Online Payroll Service

If you're using an online payroll service such as Intuit's QuickBooks Online, you can simply log on to your business's website and click "Add Employee" under the Employees tab. From there, you'll be able to choose whether you want to use automatic deduction (direct deposit), manual deduction, or both.

Option 2 - Send In A Form W-4V

If you're not using a payroll service, you'll need to fill out a form called a W-4V. This is a U.S. Department of Labor form that allows employers to withhold certain amounts from each employee's paychecks. It lets your employer know how much money to deduct from your paychecks.

3) Tell The IRS That You Want Your Refund Via Direct Deposit

Once you've added yourself to your employer's payroll system, you'll need to let the IRS know that you want your refund deposited into your bank account rather than mailed to you.

To do this, you'll need to call the IRS at 800-829-1040. They'll give you information about how to request a direct deposit.

Also read: Tax strategies for high-income earners

How Do I Change My Direct Deposit Information With The IRS?

The first thing to mention is that if you have already filed your tax returns you will be unable to change your information.

This means you will need to wait until your return is accepted or rejected by the IRS, this usually happens on January 31st when the IRS typically opens their efile system.

If your return is accepted, you will not be able to make changes.

You will also not be able to file an amended return unless you have a good reason why you should amend your return.

If your return was rejected, you may still be able to make changes to your direct deposit information.

However, you may only be able to make one change per year. If you wish to make another change after the deadline has passed, you must submit a new application.

To apply to change your direct deposit information, you will need to go through the same process as filing a new tax return.

First, you will need to open a new bank account.

Next, you will need to contact your employer and ask them to add you to their payroll system.

Finally, you will need to tell the IRS that you want your refund sent directly to your new bank account.

Conclusion

The IRS is very strict about making sure people comply with the law and follow all rules.

They even offer free help if you are having problems understanding the forms and instructions.

It's important to understand the requirements before submitting your returns so that you don't miss anything.

If you're in any doubt it's always a good idea to contact the IRS directly on 800-829-1040.

Remember, the sooner you file your return, the less likely you are to owe money to the government.

Also read: Is College Tuition Tax Deductible?

Frequently Asked Questions

Can I Change My Bank Account With IRS Online?

Once the IRS has accepted your e-filed tax return, there is no way to change your bank account information.

How Can I File Amended Returns?

Amendments are allowed for several reasons:

1) When you forgot to include something in your original return.

2) When you made a mistake on your original return.

3) When you found out that you were eligible for more credits or deductions than you originally thought.

4) To correct errors that were made on your original return.

Also read: Budget For A Small Business

How Do I Make Changes To My Tax Return After Filing?

After the IRS accepts your return, you can't make any changes to it.

You can, however, file an amended return with the IRS.

How Long Does It Take For An IRS Audit To Be Resolved?

An audit takes anywhere between 4 and 6 months to resolve.

Also read: Is Health Insurance Tax Deductible?

What Is A W-4 Form, And How Do I Use It?

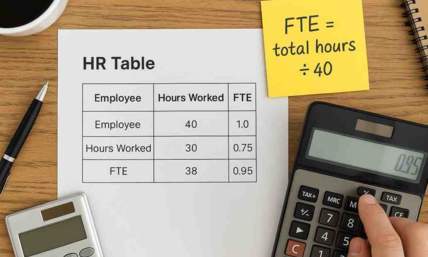

A W-4 form is used to determine how much federal income tax withholding is applied to your paycheck. It tells your employer how much they should take off of your pay each week.

A W-4 form is required every year, but you don’t always use it.

When you get paid biweekly (every two weeks), you don’t need to fill out a W-4 form.

When you work for a company that doesn’t withhold taxes from your paycheck, you won’t need to complete a W-4 form either.

Your employer will automatically deduct the amount withheld from your check.

Your employer will send you a 1099 form at the end of the year showing what they deducted from your paycheck.

Our pay stub generator allows you to create pay stubs in a simple and easy-to-use manner.